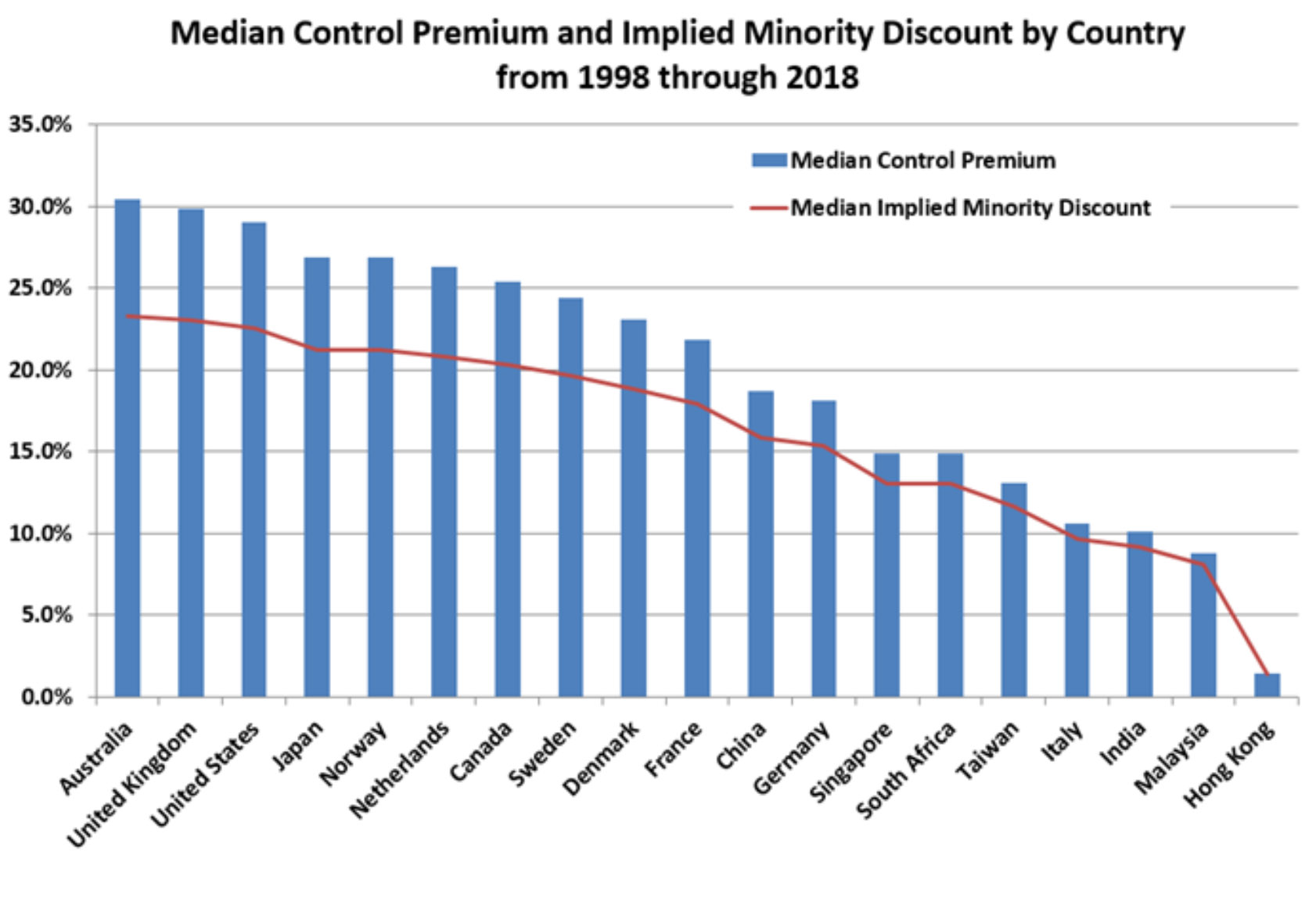

Quite a bit, it turns out—30%. Current data (including Q1 2019 updates)

from the

FactSet Mergerstat/BVR Control Premium Study

(CPS) show that UK buyers value the future benefits of controlling interests

higher than nearly anywhere else in the world (the graph below compares

acquisition premiums and the related implied minority discounts from the

leading economies). The premium is measured as the percent difference

between the target’s prior trading price and the per-share takeover price

in the acquisition. The implied minority discount is the inverse of this—it

is the percentage difference between the per-share takeover price in the

acquisition compared with the target’s prior trading price. Business

valuers use these premia to benchmark the value of private assets where

control changes hands.

CPS contains nearly 12,000 public company transactions from companies traded on every major world exchange and details up to 57 data points and up to five valuation multiples for each transaction. Most transactions are mergers and acquisitions with 100% shares acquired and include controlling takeovers and buyouts.