Fairness Opinion Research Service

CONTACT BVR TO REQUEST MORE INFORMATION >>

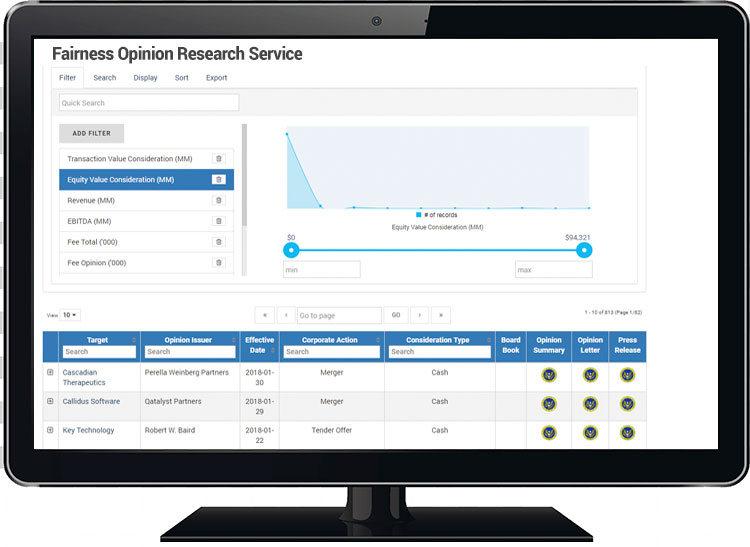

With the absence of regulation surrounding the issuance of fairness opinions, market practices have become de facto standards. BVR's new "Fairness Opinion Research Service" (FORS) is a breakthrough resource that provides immediate and full access to hundreds of filed fairness opinions and enables professionals to easily know “what’s market” as well as benchmark their work against hundreds of board books, opinion summaries, and opinion letters filed at the SEC over the last five years. Nowhere else will you find the opinions as easily!

Bypass the SEC's filing maze and know “what’s market” with this robust resource

The FORS intuitive interface lets you screen fairness opinions using up to 68 criteria options. Ensure your analyses falls within what's market and enjoy the rare competitive advantage of benchmarking your fairness opinion against the best work in the business.Plus, score the advantage by discovering firms' fee strategies.

Additional Product Details

- Easily find board books and key benchmarks in seconds with direct links to all SEC source documents

- Save countless hours with FORS’ customizable interface – screen by 68 criteria and efficiently filter information-rich documents

- Score the advantage – compare fees, deal structures and financing, valuation methods, and more

- Boost your credibility by including the most relevant and most current financial ratios, growth metrics, and other benchmarks

- Ensure your methods and conclusions meet the highest standards - choose the best comparables by pulling straight from actual filed fairness opinions prepared by expert analysts from the top investment banks, advisory, and valuation firms

- Exponentially improve your research – with FORS you can find comparable fairness opinion reports from around the world by searching:

- Cost of Capital and WACC conclusions

- GPC and M&A multiples

- Forecasted earnings and growth

- Consideration type

- Corporate action

- Industry classifications (SICS, NAICS)

- Target company description

- Participants: Bidder, Counsel, Opinion issuer

- Opinion issuance date