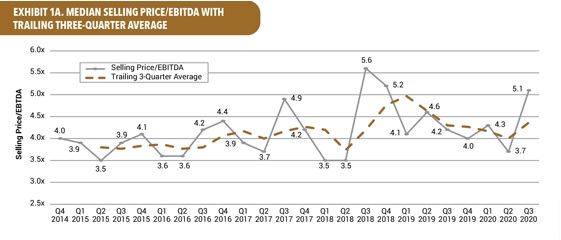

After a drop in 2Q20, EBITDA multiples (median selling price/EBITDA) across all industries increased to 5.1x in the third quarter of 2020, the highest level since 2018, according to BVR’s DealStats Value Index (DVI) report. In 2Q20, the multiple had dropped to 3.7x as deal activity “nearly came to a standstill,” says the report. In addition, the trailing three-month average for multiples has increased in 3Q20 after dropping in the prior quarter (see graph). “As the economy, and in particular, the M&A transaction portion, continues to recover, DealStats will continue to monitor the trends in the EBITDA multiple,” says the report.

The DealStats Value Index (DVI) summarizes valuation multiples and profit margins for private companies that were sold over the past several quarters. The DVI is a quarterly newsletter and is complementary with a subscription to DealStats.

Extra: For transactions occurring during the pandemic, a little more investigation may be required as to why the deal took place. For example, bargain hunters may be looking for owners forced to sell. Call the broker—they’re named in the DealStats transactions and you can find their contact info from the Find an Intermediary database at data.bvresources.com/brokerfind.asp.