DealStats (formerly Pratt's Stats) Frequently Asked Questions (FAQs)

Thank you for visiting the FAQ page for DealStats (formerly Pratt's Stats). If you're unable to find the answer you are looking for, please contact us at 1-503-479-8200 or customerservice@bvresources.com and we are happy to help.

- Download the DealStats Companion Guide >>

- View DealStats video tutorials >>

- DealStats Mapping file (Excel) >>

Q: What is the legend for DealStats source and company data?

Source and Company Data

| Term | Definition |

Contributor Name/Firm | The name of the business broker or business intermediary that was involved with the sale of the business, as well as its company name. This intermediary provided the sale details to DealStats. |

Acquirer Name | The name of the acquiring company. |

Acquirer Type | Denotes whether the acquirer was a private company or individual or whether the acquirer was a public company. |

Target Name | The name of the acquired business. |

Target Type | Denotes whether the target was a private company or individual or whether the target was a public company. |

Target Business Description | The description of the acquired business. |

Franchise | A yes/no field specifying whether the acquired company was a franchise or independent. |

Development Stage Company | A yes/no field specifying whether the acquired company was focused on early-stage business activities, such as research and development. Companies marked as “yes” generally have no or little revenue. |

CIK | The Central Index Key (CIK) is a unique SEC identifier for the public acquiring company. |

8-K Date | The date of the public buyer’s Current Report discussing the acquisition. |

8-K/A Date | The date of the public buyer’s Amended Current Report discussing the acquisition. |

Other Filing Type | Type of other SEC filing that reports information regarding the acquisition. |

Other Filing Date | The date of the other filing type. |

Contributor Company | The name of the firm with which the business broker or business intermediary works. This is not the name of the acquirer. |

SIC 1 | The primary four-digit Standard Industrial Classification (SIC) code associated with the description of the acquired business. Go to www.osha.gov/pls/imis/sicsearch.html to search for an SIC code. |

SIC 2 and SIC 3 | The secondary and tertiary SIC codes for the acquired business based on additional services/products that generate less revenue than the primary SIC code. |

NAICS 1 | The primary North American Industry Classification System (NAICS) code associated with the description of the acquired business. Go to www.census.gov/eos/www/naics/ to search for a NAICS code. |

NAICS 2 and NAICS 3 | The secondary and tertiary NAICS codes associated with the acquired business based on additional services/products that generate less revenue than the primary NAICS code. |

Sale Location | The geographic location of the acquired business. |

Target Region | The region of the acquired business. The list of state/region associations are as follows:

|

Years in Business | The number of years the acquired business has been in operation. |

Number of Employees | The number of full-time equivalent employees working in the acquired business. This amount does not include the owner or owners. |

E-Commerce | Specifies whether the target’s sales channel is solely e-commerce or primarily e-commerce. |

Q: What is the legend for DealStats income data?

Income Statement Data

All dollar figures are in whole numbers, not thousands or millions.

| Term | Definition |

Data Are “Latest Full Year” Reported | Indicates that the income data reflect the latest reported full-year financial statement. |

Data Are Restated | Indicates that, for broker submitted transactions (see “Source Data” section on detailed transaction report to determine whether the transaction was submitted by a broker or retrieved from SEC filings), the income data have been recast in order to normalize the financial statement. This may include adjustments such as bringing owner’s compensation or rent payments to reasonable levels. For transactions collected from the SEC website, this indicates that certain items have been corrected or changed as they may have been misstated in the prior publishing of the financial statement. The DealStats “Notes” field may contain further details pertaining to the restatements. Please note that the contributing business intermediary may still submit recasted EBITDA and Discretionary Earnings (SDE) values even though the provided income statement/P&L is not recasted. This occurs in the majority of the intermediary contributed deals. Please see EBITDA and Discretionary Earnings below for more information. |

Income Statement Date | Date of the last filed income statement. |

| Income Statement Type | This value describes the type of income data the business buyer had access to, and/or the type of income data the business seller provided to the buyer, during the business transaction negotiation. The available income statement types are Tax Return/P&L, Owner to Prove, and Owner Estimate. The Tax Return/P&L type (accounting for 98.4% of all types as of August 2018) means that the buyer and seller had access to tax returns and/or profit and loss statements. The Owner to Prove generally applies to businesses where the owner had a lot of unreported cash sales, and the owner planned on proving the sales to the buyer to justify the business’s selling price (instead of providing a tax return, which would show lower earnings). The Owner Estimate type generally applies to income statements where the owner did not keep detailed records and, as a result, estimated his or her sales and expenses to the best of his or her ability. |

Net Sales | Annual gross sales, net of returns and discounts allowed, if any. |

Cost of Goods Sold | The cost of the inventory items sold during the year. Net of any discounts, returns, or write-offs. |

Gross Profit | Net Sales - Cost of Goods Sold |

Yearly Rent | Annual cost of occupying all space necessary for operation of the business. |

Owner’s Compensation | Annual income, salary, or wage paid to one business owner. |

Other Operating | All selling and general and administrative expenses, excluding Rent, Owner’s Compensation, and Depreciation/Amortization. |

Depreciation/ | Annual decrease in value due to wear and tear, decay, or decline in the price of a tangible and/or intangible fixed asset. |

Total Operating Expenses | Rent + Owner’s Compensation + Depreciation/Amortization + Other Operating Expenses |

Operating Profit | Gross Profit - Total Operating Expenses |

Interest Expense | Cost of borrowing expressed as an annual dollar amount. (Does not include interest earnings. If the company had interest earnings, you will find that value in the “Interest Income” field.) |

Interest Income | Interest revenue, expressed as an annual dollar amount, from any investments the entity makes or on debt it owns. |

Other Non-Operating Expenses | Any losses from sources not related to the typical activities of the business or organization. |

Other Non-Operating Income | Any gains from sources not related to the typical activities of the business or organization. |

Earnings Before Taxes | Operating Profit - Interest Expense + Interest Income - Other Non-Operating Expenses + Other Non-Operating Income |

Tax Expense | Annual value of tax expense. This figure only includes income taxes and does not include sales taxes, property taxes, payroll taxes, etc. (Does not include an income tax benefit. If the company had a tax benefit, you will find that value in the “Tax Benefit” field.) |

Tax Benefit | Annual value of tax benefit. |

Net Income | Earnings Before Taxes - Tax Expense + Tax Benefit |

EBITDA | Operating Profit + Depreciation/Amortization If the contributor provided BVR with the recasted value for EBITDA, this value will be given preference and displayed in the EBITDA field instead of the above calculation. The provided EBITDA value will also be used in other calculations that use EBITDA, such as MVIC/EBITDA and EBITDA Margin. If the contributor provided BVR with the recasted value for SDE and the value for Owner’s Compensation, but not the recasted value for EBITDA, the EBITDA displayed will be the recasted value of SDE minus the value for Owner’s Compensation. |

Discretionary Earnings (also referred to as Seller's Discretionary Earnings or SDE) | Operating Profit + Depreciation/Amortization + Owner’s Compensation If the contributor provided BVR with the recasted value for Discretionary Earnings, which is common, this value will be given preference and displayed in the Discretionary Earnings field instead of the above calculation. The provided Discretionary Earnings value will also be used in other calculations that use Discretionary Earnings, such as MVIC/SDE and SDE Margin. |

Gross Cash Flow | Net Income + Depreciation/Amortization |

| Net Sales FY+1 | Projected net sales for the first fiscal year after the most recent fiscal year. This figure is forecasted by the business owner and the business broker/M&A advisor. |

| Net Sales FY-1, Net Sales FY-2, Net Sales FY-3, Net Sales FY-4 | Net sales for the fiscal years prior to most recent full fiscal year |

| SDE FY+1 | Projected Seller's Discretionary Earnings for the first fiscal year after the most recent fiscal year. This figure is forecasted by the business owner and the business broker/M&A advisor. |

| SDE FY-1, SDE FY-2 | Seller's Discretionary Earnings for the fiscal years prior to the most recent full fiscal year. |

| EBITDA FY+1 | Projected EBITDA for the first fiscal year after the most recent fiscal year. This figure is forecasted by the business owner and the business broker/M&A advisor. |

| EBITDA FY-1, EBITDA FY-2, EBITDA FY-3, EBITDA FY-4 | EBITDA for the fiscal years prior to the most recent full fiscal year. |

| EBITDAR | Operating Profit + Depreciation & Amortization + Rent |

Q: What is the legend for DealStats asset data?

Balance Sheet Data

All dollar figures are in whole numbers, not thousands or millions.

| Term | Definition |

Balance Sheet Date | Date of most recent balance sheet reported. |

Cash and Equivalents | All cash, marketable securities, and other near-cash items. Excludes sinking funds. Cash equivalents (NOW accounts and money market funds) must be available upon demand in order to justify inclusion. |

Trade Receivables | All accounts from trade, net of allowance for doubtful accounts, that will result in the collection of cash. |

Inventory | Anything constituting inventory for the firm including raw material, work in progress, and finished goods. Those items of tangible property that are held for sale in the normal course of business, are in the process of being produced for such purposes, or are to be used in the production of such items. |

Other Current Assets | Any other current assets, excluding Cash and Equivalents, Trade Receivables, and Inventory. |

Total Current Assets | Cash and Equivalents + Trade Receivables + Inventory + Other Current Assets |

Fixed Assets | Equipment and leasehold improvements, net of accumulated depreciation. DealStats does not include the value of buildings and real estate in the “Fixed Assets” field (this value is captured in the “Real Estate” field). Some of the larger transactions that are captured from the Securities and Exchange Commission website may not provide information that separates the value of buildings and real estate from fixed assets, and in these instances DealStats is unable to determine and separate their values. |

Real Estate | Dollar value placed on any real estate associated with the sale of the business. The real estate value is not included in the MVIC. |

Intangibles | Assets with uncertain or hard-to-measure benefits, such as brand names, trademarks, patents or copyrights, a trained workforce, special know-how, and customer or supplier relationships, that make the company a viable competitor and give it earning power. These values are net of accumulated amortization. |

Other Non-Current Assets | Any other noncurrent asset, excluding Real Estate, Fixed Assets, Intangibles, a Noncompete Agreement, and an Employment/Consulting Agreement. |

Total Assets | Total Current Assets + Real Estate + Fixed Assets + Total Intangibles + Other Non-Current Assets |

Current Liabilities | Any monies owed that are payable on demand within one year. Includes the current portion of long-term debt. |

Long-Term Liabilities | Any monies owed that are not payable on demand within one year. The current portion of long-term debt is a current liability, as distinguished from a long-term liability. |

Total Liabilities | Current Liabilities + Long-Term Liabilities |

Stockholder’s Equity | Paid-in capital, donated capital, and retained earnings less the liabilities of the company. Stockholder’s Equity = Total Assets - Total Liabilities |

Q: What is the legend for DealStats purchase price allocation data?

Purchase Price Allocation Data

All dollar figures are in whole numbers, not thousands or millions.

| Term | Definition |

Purchase Price Allocation Date | Date for which the purchase price allocation was reported. |

Cash and Equivalents PPA | All cash, marketable securities, and other near-cash items acquired. Excludes sinking funds. Cash equivalents (NOW accounts and money market funds) must be available upon demand in order to justify inclusion. |

Accounts Receivable | All accounts from trade, net of allowance for doubtful accounts, that were acquired. |

Inventory PPA | Anything constituting inventory for the firm including raw material, work in progress, and finished goods that were acquired. Those items of tangible property that are held for sale in the normal course of business, are in the process of being produced for such purposes, or are to be used in the production of such items. |

Other Current Assets PPA | Any other current assets that were acquired, excluding Cash and Equivalents PPA, Trade Receivables PPA, and Inventory PPA. |

Total Current Assets | Cash and Equivalents PPA + Trade Receivables PPA + Inventory PPA + Other Current Assets PPA |

Fixed Assets PPA | All equipment and leasehold improvements acquired, net of accumulated depreciation. Some of the larger transactions that are captured from the SEC website may not provide information that separates the value of buildings and real estate from the acquired fixed assets, and in these instances DealStats is unable to determine and separate their values. |

Real Estate PPA | The value placed on any real estate acquired in the sale of the business. The real estate value is not included in the MVIC price. |

Customer Relationships Lists PPA | The value attributed to any customer relationships or customer list acquired as part of the acquisition. |

Backlog PPA | Any acquired purchase orders or booked sales on orders that have not been fully completed. |

Developed/Existing Technology PPA | Any acquired developed/completed technology, core technology, and/or acquired or purchased technology. Technology that is in the process of being developed is included in in-process R&D. |

In-Process R&D PPA | Intangible assets acquired relating to any uncompleted/in-process research and development. |

Trade Names/ Trademarks PPA | The value of acquired trademarks/service marks to identify and/or differentiate goods and services or business trade names. |

Noncompete Agreements PPA | The value placed on an agreement with the selling party not to compete with the purchaser, usually for a certain period and usually in a specified geographic area. |

Other Intangibles PPA | Any other intangible asset acquired that is not listed in the preceding fields. |

Total Identifiable Intangibles PPA | The sum of all the identifiable intangible assets acquired. |

Goodwill PPA | Represents the excess of the aggregate purchase price over the fair value of net assets of the acquired business. |

Total Intangibles PPA | Total Identifiable Intangible Assets PPA + Goodwill PPA |

Other Non-Current Assets PPA | All other noncurrent assets acquired not already identified and included in the preceding purchase price allocation fields. |

Total Assets PPA | The value of all assets acquired, both tangible and intangible. |

Interest-Bearing | The value of all interest-bearing liabilities assumed. In addition to long-term debt, includes the current portion of long-term debt, as well as any other current liabilities bearing interest. |

Total Liabilities PPA | The sum of all the seller’s liabilities the buyer assumed. |

Useful Life Fields | When available, the useful lives will be populated for the identifiable intangible assets. An intangible asset with a finite useful life is amortized, and its life will be provided in years (e.g., 6.5). An intangible asset with an indefinite useful life is not amortized and will be labeled as “Indefinite.” |

Q: What is the legend for DealStats transaction and other data?

Transaction and Other Data

All dollar figures are in whole numbers, not thousands or millions.

| Term | Definition |

Date Sale Initiated | Date business was listed for sale. |

Date of Sale | Date sale of business was closed. |

Days to Sell | The number of days it took the business to sell. The difference between Date Sale Initiated and Date of Sale. |

Asking Price | The price the seller desired at time of listing the business for sale. |

MVIC Price (Market Value of Invested Capital) | Also known as the selling price, MVIC is the total consideration paid to the seller and includes any cash, notes, and/or securities that were used as a form of payment plus any interest-bearing liabilities the buyer assumed. The MVIC price includes the noncompete value and the assumption of interest-bearing liabilities and excludes: (1) the real estate value; (2) any earnouts (because they have not yet been earned and they may not be earned); and (3) the employment/consulting agreement values. In a Stock Sale, all assets and liabilities are typically transferred. In an Asset Sale, inventory, fixed assets, and intangibles/goodwill are typically transferred. In an Asset Sale, cash and accounts receivable are rarely transferred and liabilities are generally not assumed. Transactions with information in the “Purchase Price Allocation” section will provide definitive information as to what was included in the asset sale. An appraiser can also look to the “Additional Notes” field to see whether a purchase price allocation is presented there. If no purchase price allocation is available for the transactions, the appraiser will need to use his or her experience and knowledge in the field and the buyer’s/seller’s knowledge and experience with his or her business to determine what is customarily transferred in an asset sale in that industry. |

Debt Assumed | Those interest-bearing financial liabilities that the buyer assumes upon the purchase of the company. Includes the current portion of long-term debt. |

Amount Down | Dollar value of consideration given as a down payment. |

Down Payment Percentage | Percentage of the consideration that was paid in cash and/or unrestricted publicly traded common stock. |

Employment/Consulting Agreement Value | Dollar value placed on an agreement between the buyer and seller for the seller’s personal services to be provided to the buyer either as an employee or consultant after the sale of the business. The Employment/Consulting Agreement is not included in the MVIC. |

Transaction Costs | This applies to deals documented from the SEC, not those contributed by members of BVR’s Contributor Network. Transaction Costs are the reported amount of costs the acquiring company incurred with the acquisition. The amount reported typically includes the cost of advisory fees, legal fees, accounting fees, and other costs that were directly associated with the acquisition. |

Employment/Consulting Agreement Description | The description of the seller’s agreement to provide services or training to the acquirer or acquiring company. |

Amount Seller Financed | The value of the seller financing, if any. Often referred to as a “promissory note” or “seller note,” this is the amount the buyer will need to pay the seller over time. The terms of seller financing, when available, will be included in the “Deal Terms” field. |

Seller Financing Percentage | Percentage of the consideration that was seller financed. |

| Acquirer Note Paid | A yes/no field specifying whether the seller financed a portion, or all, of the selling price |

| Acquirer Personal Guarantee | A yes/no field specifying whether the buyer personally guaranteed the seller note. If yes, then the note was secured by the buyer's personal assets and not solely the acquired business. |

Deal Terms | The detailed consideration information that specifies what, and how, the buyer paid the seller for the equity or assets of the business. |

SBA or Bank Loan | Indicates whether the acquirer used an SBA or other bank loan to finance the cash portion of the purchase price. |

SBA/Bank Loan Amount | The amount of the SBA or other bank loan used to finance the cash portion of the purchase price. |

SBA or Bank Loan % of Amount Down | The percentage of the SBA or other bank loan used to finance the cash portion of the purchase price relative to the total cash consideration paid to the seller. |

Transaction Type | Specifies whether the acquirer purchased the stock or assets of the business. |

Percentage Acquired | The percentage of sold business purchased by the buyer. In stock sale transactions, this represents the ownership interest purchased. DealStats collects information on 100% and less than 100% stock sale transactions, but currently only makes available 100% ownership purchases. |

| Earn-Out Fair Value | The fair value of any additional payment or payments to the seller, contingent on the achievement of a pre-determined future performance measure or occurrence of some future event. The earn-out fair value is not included in the MVIC. |

| Earn-Out Full Value | The full value of any additional payment or payments to the seller, contingent on the achievement of a pre-determined future performance measure or occurrence of some future event. The earn-out full value is not included in the MVIC. |

| Assumed Lease | A yes/no field specifying if the buyer assumed the seller’s lease in conjunction with the business purchase. |

| Renewal Option | A yes/no field specifying if the assumed lease has options for lease renewal. |

| Lease Length | The current length of the assumed lease, reported in months (excludes any renewal options). |

| Lease Terms | The terms of the lease assumed, such as square footage and monthly rent. |

| Real Estate Acquired | A yes/no field specifying if real estate was acquired in the transaction. The value of real estate is removed from the MVIC. |

Noncompete Agreement Value | Dollar value placed on an agreement with the selling party not to compete with the purchaser, usually for a certain period and usually in a specified geographic area. The Noncompete Agreement value is included in the MVIC. |

Noncompete Agreement Length | The duration, presented in months, that the seller has agreed not to compete with the acquirer or acquiring company. |

Noncompete Description | The specific geographic area that the seller has agreed not to compete with the acquirer or acquiring company. |

Live Date | The date the transaction was entered into DealStats internal data management system. For broker contributed deals, this would represent the date the broker contributed the deal information to DealStats. For internally documented deals BVR captures from the Securities and Exchange Commission, it would represent the date a BVR analyst documented the transaction. |

Q: What is the legend for DealStats company structure data?

Company Structure Data

| Term | Definition |

C Corporation | A corporation acting as a separate taxpaying entity for income tax purposes. The profit of a C corporation is taxed to the corporation when earned and then is taxed to the shareholders when distributed as dividends. |

S Corporation | A corporation with restrictions on equity ownership. S corporations pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. |

Partnership | A business comprised of two partners, either created as a general partnership or limited partnership. A partnership files an annual information return to report the income, deductions, gains, losses, etc. to the IRS, but it does not pay income tax. Instead, it passes through any profits or losses to its partners. |

Sole Proprietorship | A sole proprietor is someone who owns an unincorporated business by himself or herself. The business pays no income taxes . The sole proprietor pays personal income tax on the profits generated. A sole proprietor reports all business income or losses on his or her personal income tax return. |

LLC | A Limited Liability Company (LLC) is a structure where the members have limited legal liability and may participate in the management of the organization. A single-member LLC is taxed as a sole proprietorship or corporation. An LLC that has more than one member pays income tax as a partnership or as a corporation. |

Q: What is the legend for the DealStats valuation multiples and financial ratios calculations?

Valuation Multiples

| Valuation Multiple | Database Calculation |

MVIC/Net Sales | MVIC/Net Sales |

MVIC/Gross Profit | MVIC/Gross Profit |

MVIC/EBITDA | MVIC/(Operating Profit + Depreciation/Amortization) |

MVIC/EBIT | MVIC/Operating Profit |

MVIC/SDE (Seller's Discretionary Earnings) | MVIC/(Operating Profit + Owner’s Compensation + Depreciation/Amortization) |

MVIC/BVIC (Book Value of Invested Capital) | MVIC/[(Total Assets - Total Liabilities) + Long-Term Liabilities] |

Financial Ratios

| Financial Ratio | Database Calculation |

Net Profit Margin | Net Income/Net Sales |

Operating Profit Margin | Operating Profit/Net Sales |

Gross Profit Margin | Gross Profit/Net Sales |

| EBITDA Margin FY+1 | EBITDA FY+1/Net Sales FY+1 |

EBITDA Margin | EBITDA/Net Sales |

| EBITDA Margin FY-1 | EBITDA FY-1/Net Sales FY-1 |

| EBITDA Margin FY-2 | EBITDA FY-2/Net Sales FY-2 |

| EBITDA Margin FY-3 | EBITDA FY-3/Net Sales FY-3 |

| EBITDA Margin FY-4 | EBITDA FY-4/Net Sales FY-4 |

| SDE Margin FY+1 | Discretionary Earnings FY+1/Net Sales FY+1 |

SDE Margin | Discretionary Earnings/Net Sales |

| SDE Margin FY-1 | Discretionary Earnings FY-1/Net Sales FY-1 |

| SDE Margin FY-2 | Discretionary Earnings FY-2/Net Sales FY-2 |

Return on Assets | Net Income/Total Assets |

Return on Equity | Net Income/(Total Assets - Total Liabilities) |

Fixed Charge Coverage | Operating Profit/Interest Expense |

Long-Term Liabilities to Assets | Long-Term Liabilities/Total Assets |

Long-Term Liabilities to Equity | Long-Term Liabilities/(Total Assets - Total Liabilities) |

Current Ratio | Total Current Assets/(Total Liabilities - Long-Term Liabilities) |

Quick Ratio | (Total Current Assets - Inventory/(Total Liabilities - Long-Term Liabilities) |

Total Asset Turnover | Sales/Total Assets |

Fixed Asset Turnover | Sales/Fixed Assets |

Inventory Turnover | Sales/Inventory |

| Rent/EBITDAR | Rent/(Operating Profit + Depreciation & Amortization + Rent) |

| Rent/Sales | Rent/Net Sales |

| Sales Per Square Foot | Net Sales/Square feet of operating space |

| Sales Growth FY+1 | [(Net Sales FY+1) – (Net Sales Current)]/Net Sales Current |

Sales Growth (Current) | [(Net Sales Current) – (Net Sales FY-1)]/Net Sales FY-1 |

| Sales Growth FY-1 | [(Net Sales FY-1) – (Net Sales FY-2)]/Net Sales FY-2 |

| Sales Growth FY-2 | [(Net Sales FY-2) – (Net Sales FY-3)]/Net Sales FY-3 |

| Sales Growth FY-3 | [(Net Sales FY-3) – (Net Sales FY-4)]/Net Sales FY-4 |

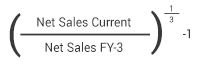

Net Sales 2Y CAGR | Compound Annual Growth Rate Y3 =  |

Q: How often is the DealStats database updated with new transactions?

A: The platform is updated daily with new transactions.

Q: Are there any limitations that come with a subscription to DealStats?

A: Both subscribers and day pass purchasers receive access to the full DealStats platform, including unlimited searches, comparable company statistics, summarized results, transaction reports, and PDF exports. Subscribers, but not day pass buyers, receive access to all current and historical issues of the DealStats Value Index (a quarterly publication analyzing private-company acquisitions from the DealStats database).

Subscribers to the database are limited to 500 unique transactions that can be exported to Excel in a day and 1,000 unique transactions that can be exported to Excel in a month. Day pass purchasers are limited to 200 unique transactions that can be exported to Excel in a day.

Only unique exported transactions within a 24-hour period will be deducted from the daily limit, and only unique exported transactions during the month will be deducted from the monthly limit. In other words, once a particular transaction is exported to Excel, exporting that same transaction again during the 24-hour period will not count against the daily export total, and exporting that same transaction again any time during the month will not count against the monthly export total.

If you are a subscriber and would like to increase your daily and/or monthly export limits, there are several upgrade options. For more information, please contact us at: 503-479-8200 ext. 2 or sales@bvresources.com.

Q: Are there any limits on exporting transaction data from DealStats?

A: When using the “Only Displayed Fields” and “All Available Fields” selections, the export limit is 500 transactions. When using the “Analysis Tabs” export selection (which contains the Statistics, Summary, and other tabs), there is no export limit.

Q: Where does DealStats get its data and how are the data verified?

A: DealStats obtains transactions for the database via three tracks: (1) the BVR Contributor Network; (2) BVR personnel perform research at the Security and Exchange Commission's (SEC) website and collect details on acquisitions; and (3) BVR personnel perform research at the System for Electronic Document Analysis and Retrieval (SEDAR) website and collect details on acquisitions. The BVR Contributor Network consists of business brokers, M&A advisors, and other business transaction specialists who have been involved in business transfers and who contribute details on their closed deals to DealStats.

The transactions DealStats receives from business brokers are typically private-company "Main Street" business transactions, and the private-company acquisitions collected from the SEC website, SEDAR website, or from M&A advisors are typically private-company merger and acquisitions (M&A) transactions.

Many of the contributing business brokers are members of the International Business Brokers Association (IBBA) and hold their Certified Business Intermediary (CBI) certification or are members of M&A Source and hold their Merger & Acquisition Master Intermediary (M&AMI) certification. In every possible circumstance, BVR relies on audited financial information conforming to U.S. generally accepted accounting principles (GAAP). BVR personnel carefully review each transaction before it is included in DealStats.

When a transaction is included in DealStats, information on the source is disclosed. If the deal was sourced from SEC filings or SEDAR filings, there will be information documenting which filings were used as well as a link to view the filings. If a business broker or M&A advisor contributed the deal, the transaction will list the contributor's name and firm and will provide a link to contact the contributor (unless the contributor asks that its information remain confidential).

Q: Do BVR staff review the transactions the BVR Contributor Network submits? If so, what is the screening process for submitted transactions?

A: Yes, BVR financial analysts carefully review every transaction that is submitted to BVR for inclusion within DealStats. Each transaction is thoroughly reviewed for required inclusion and exclusion criteria and is formatted for consistency (please see the FAQ question, "What, if any, inclusion criteria and exclusion criteria does DealStats use in its data collection process?" for more information about the DealStats inclusion criteria and exclusion criteria). If necessary, BVR personnel will contact the submitting business intermediary with any follow-up questions. When any necessary questions have been answered and all of the inclusion criteria have been met, the transaction is then ready for inclusion within DealStats. Unless the intermediary specified it wanted its personal information to remain confidential, each submitted transaction will contain the business intermediary's name and firm name, along with a link to contact the business intermediary.

Because of the comprehensive screening criteria, BVR has built strong relationships with its contributing business intermediaries.

Q: If I am a business intermediary who would like to contribute to DealStats, how do I do so?

A: Please visit our Contributor Network Page to learn about the benefits of the BVR Contributor Network and see how you can get involved.

Q: What does it mean when the "Contributor Name" field is left blank on the DealStats transaction report?

A: For confidentiality reasons, some brokers ask that their name be left off the DealStats transaction report. In these cases, we are unable to report or provide the contributor’s name to users. Though, should you have a question, you can contact us at dataquestions@bvresources.com, and we will contact the contributor directly with your question.

Q: What, if any, inclusion criteria and exclusion criteria does DealStats use in its data collection process?

A: The inclusion criteria for DealStats transactions are as follows:

- Date of sale must be disclosed;

- The selling price has to be clear (i.e., if restricted stock is part of the consideration, the value of the restricted stock issued in the transaction must be given, etc.);

- Earnouts (or contingency payments) cannot be included in the selling price; if the earnouts cannot be removed from the given selling price, then the transaction will not be included (please note that DealStats provides the value of earnouts, should the user choose to add their value to the reported selling price);

- Product/service description of the seller must be disclosed;

- The income statement must cover 12 months of operations and cannot be a pro forma or annualized;

- Company type must be disclosed (C or S corp, LLC, LLP, sole prop. etc.);

- The type of transaction must be disclosed, either a stock or asset sale;

- The transaction must not be a reverse acquisition, reorganization, recapitalization, etc.;

- The transaction must be 100% acquisition (no partial transactions); and

- If any transaction includes the value of real estate and buildings as part of the selling price and BVR can determine their value, BVR will deduct the real estate value from the selling price

Q: What should I do if I notice duplicate transactions in DealStats?

A: While BVR staff does its best to review and eliminate duplicates, it’s possible that some duplicate transactions make their way into the database. If you notice a duplicate transaction, please let us know by contacting dataquestions@bvresources.com.

Please keep in mind that the same business can sell twice (or three times) in a relatively short period. As a result, the two (or three) transactions may have similar information, such as the same income statement, business description, location, etc., but may have a different sale date, sale initiation date, and sale price.

Q: Can I print more than one transaction report at a time?

A: To print a group of transaction reports, utilize the icon that looks like an orange piece of paper in the upper-left section of the “Data” tab—it is labeled “Batch Transaction Report.” When printing more than a couple of detailed transaction reports, this will save you time by printing all of your selected transaction reports.

Q: I have questions about the “Save” feature. Can you explain that more to me?

A: The “Save” feature allows you to save your work for future use. The “Save” feature will save anything you have done within that session of DealStats, including any search criteria utilized on the “Quick Search” tab and “Search” tab, any fields you have selected or rearranged using the “Display” tab, any sort preferences you have made on the “Sort” tab, and any transactions you have deselected (unchecked) on the “Data” tab.

If you want to save just the view of certain fields and their order, enter DealStats, make your modifications on the “Display” tab, and select “Save.”

If you want to save just your search criteria, enter DealStats, specify your search criteria on the “Quick Search” tab and/or “Search” tab, and select “Save.”

Saving your search criteria, then revisiting it later, will return all new transactions that meet your search criteria. If you only want to see transactions that were available as of your initial search, navigate to the “Search” tab, select the “Live Date” field, choose the operator “Less or Equal,” then specify the date of your search.

All saved information is account-specific (an individual user only has access to his or her own saved displays and searches). If you would like to save a display, field layout, or other customization to be accessible firmwide, we can set your firm up with a portal. Please contact BVR at sales@bvresources.com or 1-503-479-8200, ext. 2.

There is no limit on the amount of saved items you can have, nor do they expire.

You can retrieve a saved search and change any criteria you like, then save the search again using the same name (which saves over the previous saved search), or you can give it a new name (which saves it as a new search). Think of it like an Excel file—you can open, make changes, and then save it, or you can save it with a new name, which saves it as a new file (and leaves your previous file intact).

Q: On the “Search” tab, does the “and” and “or” logic apply to all pieces of criteria specified?

A: Yes. All pieces of criteria on the “Search” tab will be applied using either “and” or “or” criteria, depending on what you select. Regardless of your selection for the specific criteria within the “Search” tab, the criteria between the “Quick Search” tab and the “Search” tab will be applied using “and” logic.

Q: Does DealStats contain private/public acquirers and private/public targets? Can I search by private/public acquirers and private/public targets?

A: DealStats contains transactions where the purchased company was private, and the buyer was either an individual or private company, or was a public company.

DealStats also contains transactions where the purchased company was public, and the buyer was either a private company (such as a private equity company) or was company management, or was a public company.

To search by acquirer type, select the “Acquirer Type” field on either the “Quick Search” tab or the “Search” tab, and choose either “Private” or “Public.”

Please note that the “Search” tab defaults to “Private” for the “Target Type.” If you would like to search for acquired public companies, go to the “Search” tab and change “Private” to “Public.” To search for all target types, click the trashcan icon on the “Target Type” field.

You can search by any combination of “Acquirer Type” and “Target Type” you choose.

Q: Where can I view my accumulated filters (the various selection/filter criteria I have made)?

A: You can view your entire search/filter criteria on the “Summary” tab in DealStats. The information on the “Summary” tab can be downloaded using the “Download” tab (click the “Analysis Tabs” options), or you can use the “Copy” feature at the top-right of the “Summary” tab to copy and paste all your information into a Word document or Excel file.

Q: Do you get different transactions if you search by SIC versus NAICS, or does the database “recognize” when you put in an SIC code the associated NAICS codes and includes them as well in your search?

A: Each transaction in DealStats has both a SIC and corresponding NAICS associated with it. So, you should be able to search by either and receive the same transactions (e.g., if you’re looking for software companies, you could search by SIC 7372 or NAICS 511210 and receive the same transactions).

The one potential exception to this is where the relationship of SIC to NAICS is not one to one (where one SIC could correspond to two NAICS codes or more). In those situations, since the SIC is more general, you will receive more transactions when searching by the SIC code then by the NAICS code, since the NAICS is more specific.

Each transaction has up to three SIC codes and up to three NAICS codes assigned to the target company, depending on the products/services the target business offers. You can choose to search by primary SIC/NAICS only, or by primary, secondary, and tertiary SIC/NAICS.

Q: What are the assumptions for DealStats data with regards to blank fields and values of $0?

A: The assumptions for DealStats data are:

- A blank field indicates that the data in question were not available;

- A dollar value of zero has been expressly specified as zero; and

- If whether any reported debt was assumed cannot be definitively determined, the assumption is made that either zero debt was assumed or that insignificant debt was assumed such that it would not make a material difference in the calculation of an MVIC price.

Q: Is there a way to know whether the income data in DealStats are based upon tax return data or internally generated financial statements?

A: If the data were collected from a member of the BVR Contributor Network, it can be either internally generated financial statements or income data from a tax return, though the majority of the time the income data comes from internally generated financial statements. If the data were collected from the SEC website, the income data will typically be audited internally generated financial statements. If you look at the "Source Data" section of the transaction report, you can verify whether the deal was collected from a member of the BVR Contributor Network or from the SEC website.

Q: In DealStats, when you research SEC documents where public companies purchase private companies, are you capturing all of the deals, or are you unable to capture some?

A: In certain instances, the registrant is not required to include the financial statements for the acquisition, so these transactions are not captured in DealStats. Without financial statements, DealStats cannot compute valuation multiples. If the acquisition is not considered "significant," as defined in the Securities and Exchange Commission's Regulation S-X 11.01 (b) of Regulation S-X, it is not mandatory for financial statements to be included in the buyer's filings. The SEC determines a "significant" business disposition as one that meets the requirements and conditions of a significant subsidiary in 210.1-02 (w). In an acquisition, the acquired (or to be acquired) business must be considered a significant subsidiary when the financial statements of the seller and registrant are compared. A significant subsidiary is determined under the conditions specified in 210.1-02 (w), substituting 20% for each place 10% appears.

Q: How does DealStats report financial statements for banks and bank holding companies?

A: On the income statement, DealStats reports the value of interest income, dividend income, and other income in the “Net Sales” field. Interest expense is reported in the “Cost of Goods Sold” field, and net interest income (net sales minus cost of goods sold) is reported in the “Gross Profit” field. On the balance sheet, DealStats reports net loans in the “Accounts Receivable” field.

Q: Can I use public company data to value a private company?

A: Yes, sale details on publicly traded companies (valuation multiples for publicly traded companies can be found in DealStats) can be used to value a private company. The indicated value utilizing the sale of an entire public company will result in a control value. It normally would not be appropriate to add a control premium. One or more discounts may be appropriate, depending on the valuation assignment. For more details, see The Market Approach to Valuing Businesses by Shannon Pratt (New York: John Wiley & Sons, 2001. p. 39).

Q: Are the transactions sourced? What are the sources of your transactions?

A: Yes. Each transaction provides the source, which will either be the Securities and Exchange Commission (SEC), System for Electronic Document Analysis and Retrieval (SEDAR), or the BVR Contributor Network.

If the transaction came from the SEC, the acquirer name, CIK number, filings used (e.g., 8-K, 8-K/A, 10-Q, 10-K, etc.), and a link to the buyer’s filings are provided.

If the transaction came from the SEDAR, the acquirer’s name will be provided, along with a link to the buyer’s filings.

If the transaction came from a member of the BVR Contributor Network, the contributor’s name and firm name are provided (and you can look up the contact information using the BVR Contributor Network database). Some contributors choose to keep their name and firm name confidential. For these transactions, you will see that the source is from the BVR Contributor Network, but you will not see the contributor’s name and firm name.

Q: When conducting a search in DealStats, can I specify that I want only SEC-sourced deals or SEDAR-sourced deals? In other words, can I search by only those transactions where the acquirer was a public buyer that were sourced from the SEC or SEDAR?

A: Yes. On the DealStats “Search” tab, select "SEC" or “SEDAR” from the "Source" field. This will retrieve the SEC or SEDAR sourced deals. These transactions also have links to the public buyers' filing pages with the SEC's EDGAR database or SEDAR database, so a user can verify the information contained in DealStats transaction reports or search for additional information. As of July 2018, approximately 30% of all transactions in the DealStats database were sourced from the SEC or SEDAR (as opposed to being collected from the BVR Contributor Network). These transactions provide extensive, verifiable information well-suited for litigation work.

Q: Which filings does DealStats use to capture the income statement data, balance sheet data, purchase price allocation data, and transaction data for deals sourced from the Securities and Exchange Commission (SEC) website?

A: While other filings may be used, DealStats commonly uses the following filings: 8-K, 8-K/A, 10-Q, 10-K, and S-1. The filings used, as well as the dates they were filed with the SEC, are included in the “Source” section for each transaction documented from the SEC website. DealStats uses the most recently available transaction and purchase price allocation data as of the date DealStats staff documented the deal. Sometimes, after the deal has been closed and is documented by DealStats staff, the acquirer may make changes to the purchase price allocation based on revaluations of the assets acquired and liabilities assumed. While DealStats does not monitor every future modification to the various deals' purchase price allocations, appraisers, if they wish to, can use the “Source” section of each deal to find the public-company buyer's main SEC filing page in order to locate changes to purchase price allocations that occurred at a date after DealStats documented the deal.

Q: I see that you show the harmonic mean (labeled as “H Mean” in the DealStats Statistics tab and Summary tab) for the valuation multiples. What is the harmonic mean?”

A: On the Statistics tab and the Summary tab, DealStats presents medians, averages, coefficients of variation, harmonic means, and other statistics, depending on the data. When price is the numerator, many practitioners and academics believe the harmonic mean is a better measure of central tendency for valuation multiples than the mean (the arithmetic average).

Shannon P. Pratt writes on page 140 of his 2nd edition of The Market Approach to Valuing Businesses:

Although the harmonic mean is not used frequently, probably because it is unfamiliar to most readers of valuation reports, it is conceptually a very attractive alternative measure to central tendency.

In addition, Gilbert Matthews, CFA, chairman emeritus of the Business Valuation Update and a senior managing director of Sutter Securities Inc., wrote an article in the April 2021 issue of Business Valuation Update that explains what the harmonic mean is, why it should be used, and provides a detailed example. Matthews was quoted in the April 2021 Business Valuation Update as follows:

Valuation professionals should not use the arithmetic mean of multiples. It is mathematically incorrect because it gives excessive weight to high multiples. A multiple is an inverted ratio with price in the numerator. Therefore, the harmonic mean should be used as the appropriate measure of central tendency. As a cross-check, the median should also be considered.

Matthews goes on to say:

The median is not useful for small samples; with a limited number of guideline companies, the harmonic mean is the only useful measure of central tendency. The harmonic mean is superior to the median in another respect--because the median uses only one datapoint, it does not give any consideration to skewness in the data.

Q: I see that you show the weighted harmonic mean (labeled as “WH Mean” in the DealStats Statistics tab and Summary tab) for the valuation multiples. What is the weighted harmonic mean?”

A: The weighted harmonic mean is often used in finance to average multiples. Quoting Wikipedia:

The weighted harmonic mean is the preferable method for averaging multiples, such as the price–earnings ratio (P/E), in which price is in the numerator. If these ratios are averaged using a weighted arithmetic mean (a common error), high data points are given greater weights than low data points. The weighted harmonic mean, on the other hand, gives equal weight to each data point. The simple weighted arithmetic mean when applied to non-price normalized ratios such as the P/E is biased upwards and cannot be numerically justified, since it is based on equalized earnings; just as vehicles speeds cannot be averaged for a roundtrip journey.

Quoting Investopedia:

The harmonic mean helps to find multiplicative or divisor relationships between fractions without worrying about common denominators. Harmonic means are often used in averaging things like rates (e.g., the average travel speed given a duration of several trips).

The weighted harmonic mean is used in finance to average multiples like the price-earnings ratio because it gives equal weight to each data point. Using a weighted arithmetic mean to average these ratios would give greater weight to high data points than low data points because price-earnings ratios aren't price-normalized while the earnings are equalized.

Some practitioners, including Toby Tatum, have stated that that weighted harmonic mean is the appropriate averaging formula when all of the numerators and denominators in an array of ratios are different.

Q: Can you provide an example of computing the average (mean), harmonic mean, and weighted harmonic mean?

A: Below is an example of computing the mean, harmonic mean, and weighted harmonic mean using a set of comparable companies:

Comps | Selling Price | Cash Flow | SP/CF Multiple | |||

A | $365,842 | $136,508 | 2.7 | |||

B | $258,951 | $159,876 | 1.6 | |||

C | $753,159 | $258,963 | 2.9 | |||

D | $589,122 | $101,698 | 5.8 | |||

Average (mean) = (2.7 + 1.6 + 2.9 + 5.8) ÷ 4 = 3.3 | ||||||

Excel function is =AVERAGE | ||||||

Harmonic mean = 4 ÷ ((1 ÷ 2.7) + (1 ÷ 1.6) + (1 ÷ 2.9) + (1 ÷ 5.8)) = 2.7 | ||||||

Excel function is =HARMEAN | ||||||

Weighted harmonic mean = ($365,842 + $258,951 + $753,159 + $589,122) ÷ (($365,842 ÷ 2.7) + ($258,951 ÷ 1.6) + ($753,159 ÷ 2.9) + ($589,122 ÷ 5.8) = 3.0 | ||||||

There is no Excel function | ||||||

Now, let’s take a look at another example and see how the averages change if our fourth company, Company D, becomes a greater outlier:

Comps | Selling Price | Cash Flow | SP/CF Multiple | ||

A | $365,842 | $136,508 | 2.7 | ||

B | $258,951 | $159,876 | 1.6 | ||

C | $753,159 | $258,963 | 2.9 | ||

D | $589,122 | $55,698 | 10.6 | ||

Average (mean) = (2.7 + 1.6 + 2.9 + 10.6) ÷ 4 = 4.4 | |||||

Harmonic mean = 4 ÷ ((1 ÷ 2.7) + (1 ÷ 1.6) + (1 ÷ 2.9) + (1 ÷ 10.6)) = 2.8 | |||||

Weighted harmonic mean = ($365,842 + $258,951 + $753,159 + $589,122) ÷ (($365,842 ÷ 2.7) + ($258,951 ÷ 1.6) + ($753,159 ÷ 2.9) + ($589,122 ÷ 10.6) = 3.2 | |||||

Q: Can you provide another example of the arithmetic average (mean), harmonic mean, and weighted harmonic mean?

A: The below paraphrases examples provided by Toward Data Science and The Chemical Statistician.

Consider taking car trip where you drive for 240 miles at 2 different speeds:

- 60 miles/hour for 120 miles

- 40 miles/hour for another 120 miles

You may intuitively apply the arithmetic average for this trip and conclude the average speed is 50 miles/hour: (60 mph + 40 mph) ÷ 2 = 50.

But consider again: because you travelled faster in one direction, you covered those 120 miles quicker and spent less time overall traveling at that speed, so your average rate of travel across your entire trip’s duration is not the middle point between 60 mph and 40 mph, it should be closer to 40 mph because you spent longer traveling at that speed.

The average speed for your trip (the harmonic mean) is:

Average speed = 2 ÷ ((1 ÷ 60) + (1 ÷ 40)) = 48 miles/hour

otice that the speed for your 2 trips has equal weight in the calculation of the harmonic mean – this is valid because of the equal distance travelled at the 2 speeds. If the distances you traveled were not equal, you would then use a weighted harmonic mean instead.

Now, consider you take a car trip where you drive 240 miles at 2 different speeds and for 2 different distances:

- 60 miles/hour for 100 miles

- 40 miles/hour for another 140 miles

Then the weighted harmonic mean of your speeds (i.e. the average speed of your whole trip) is:

Average speed = (100 + 140) ÷ ((100 ÷ 60) + (140 ÷ 40)) = 46.45 miles/hour

Q: Would you please explain the "coefficient of variation" and how we should utilize and interpret each calculation?

A: The coefficient of variation = standard deviation/mean (the mean is also known as the average).

The coefficient of variation is a measure of dispersion around the mean (average).

The theory is that the valuation multiples with the lowest coefficient of variation are those with the least dispersion around their respective means and may be the better indicators of value. The value derived using these valuation multiples may be weighted more heavily than those with larger coefficient of variations.

Q: The SIC code I searched only contains a few transactions and may not be a reliable base for benchmarking values. Can you please comment?

A: In Gilbert E. Matthews' presentation titled Fairness Opinions dated April 2, 2001, he writes:

As companies broaden their range of activities, it is often not possible to find other companies with the same mix of businesses. It may be necessary to rely on companies which could be described as "secondary comparables," i.e., companies with significant similarities but which differ in certain substantive respects from the subject company. Sometimes companies which make different products than the subject company produces, but which serve the same markets, can be useful as comparable companies.

Shannon Pratt writes: "The court accepted the guideline companies for all three experts in the Estate of Gallo (wine), even though only one of the comparables was in the same business as the subject company." "All experts chose distilling and brewing companies. In addition to these companies, the IRS expert chose companies in the food processing industry."

"Hallmark Cards, Inc., was the subject company in the Estate of Hall." "Petitioner's experts also chose comparable companies, which the court accepted, that 'produced brand name consumer goods, were leading companies in their industries, had publicly traded common stock, had financial characteristics similar to Hallmark' and were 'highly regarded by the investment community for their quality management, leading market positions, and excellent financial conditions.' Examples of these guideline public companies include Avon, McDonald’s, Anheuser-Busch, IBM and Coca-Cola."

Pratt, Shannon. The Market Approach to Valuing Businesses, 2nd Edition, New York: Wiley, John & Sons, Inc., 2005. pp. 282-283.

Q: Are all the deal prices reported in DealStats truly MVIC prices? Do I need to add unassumed debt to the provided MVIC prices? Can I convert MVIC prices to equity prices?

A: In the DealStats database, the MVIC price for asset sales and stock sales are being reported correctly. You will never add the value of unassumed interest-bearing liabilities to the reported price. Doing so will overstate the price and create overinflated multiples. A user of the database will also not want to convert the given MVIC price to an equity price. Applying equity multiples assumes the same capital structure and proportion of debt between the subject company and the comparable. Often this is not the case. It is advisable to apply an MVIC multiple to the subject and then subtract the subject's interest-bearing liabilities (note that the user will next need to look at what transferred in the comparable sale and make adjustments accordingly to the subject's final value).

Here is an example of why you would not add the unassumed debt: Company X buys Company Y for $20 million in cash. Company Y has $10 million in debt on its books, but Company X does not assume this debt. Because this debt is not assumed, Company Y uses the proceeds of the cash sale to pay off its debt of $10 million. The MVIC price for this acquisition is $20 million not $30 million. Adding the unassumed debt of $10 million would overstate the price paid for the assets of the company and would cause an overinflated MVIC price. The MVIC price will only include those interest-bearing liabilities that are assumed, not those the seller retained.

Nancy Fannon, ASA, CPA, ABV, MCBA, in her webinar presentation, Transaction Databases(Oct. 23, 2008), stated, "In order to be an invested capital price, it need not be 'plus debt.' The important thing is that it is not net of debt." She went on to say, "Resist the urge to 'subtract debt' that was not assumed [from the reported MVIC price] in order to 're-create' an equity multiple when using Pratt’s Stats [now DealStats]."

Q: What is assumed to be transferred in an asset sale?

A: Based on our experience with seeing what transfers in asset sales, we make the following assumptions:

Commonly transferred:

- Inventory (if applicable to industry, e.g., a CPA firm may not possess any inventory while a convenience store may);

- Fixed assets;

- Leasehold improvements (if any, are included in the “Fixed Assets” field);

- Intangibles (such as trade name, customer lists, etc.); and

- Goodwill.

Rarely transferred:

- Cash and equivalents;

- Trade receivables; and

- Real estate (this value will not be included in the DealStats MVIC price if transferred but will be noted in the “Additional Notes” field).

It is important to look at the “Purchase Price Allocation” and “Additional Notes” sections of the DealStats transaction report to see whether a purchase price allocation is given for the sale. This allocation will show you definitively what assets transacted as well as the values the buyer and the seller agreed upon. A user can also look at a group of transactions in the database by industry or SIC code to see what typically transfers.

Q: How does DealStats handle transferred real estate in a business sale?

A: The value of acquired real estate will not be included in the DealStats MVIC price if transferred but will be noted in the “Additional Notes” field. The exception to this are certain industries, such as oil and gas, where the predominant asset of the acquired business is land and removing the value of land creates a negative net asset value and therefore a negative selling price. DealStats reports the value of any acquired land and buildings in the “Deal Terms,” “Additional Notes,” and “Real Estate PPA” fields.

It should be noted that some of the larger transactions that are captured from the Securities and Exchange Commission website may not provide information that separates the value of buildings and real estate from fixed assets, and in these instances DealStats is unable to determine and separate their values.

Q: What is typically assumed to be transferred in a stock sale?

A: The typical items assumed to be transferred in a stock sale are:

- Entire legal entity of the company; and

- All assets and liabilities unless otherwise specified in the purchase agreement.

Q: Can you please provide more information about stock versus asset sales?

A: To answer this question, we quote a couple of authors.

Scott Gabehart and Richard J. Brinkley write:

The main point is that because of the greater risk of buying a company's stock rather than assets, the purchase price reflects this risk in the form of a lower value.

Generally speaking, the sale of stock is treated primarily as a capital gain, whereas the sale of assets generates a substantial gain (typically) that is taxed in large part as ordinary income. Ordinary income tax rates can be as much as twice as high as the current capital gains tax rate.

For the sake of clarity and understanding, review the following major differences between an asset sale and a stock sale:Scott Gabehart and Richard J. Brinkley. The Business Valuation Book: Proven Strategies for Measuring a Company's Value, New York, AMACOM a division of American Management Association, 2002. pp. 198-199.Asset Sale

- Seller keeps cash and receivables but delivers company free of any debt;

- Seller keeps corporate entity to later dissolve or use for new endeavor;

- Seller pays combination of capital gains tax and ordinary income;

- Buyer and seller agree to allocation of purchase price between IRS asset categories;

- Buyer may redepreciate fixed assets based on allocation;

- Buyer avoids assuming both known and unknown liabilities; and

- If price is greater than identifiable, tangible assets, the excess is allocated to one or more intangible assets (written off over 15 years for tax purposes and up to 42 for book purposes).

Stock Sale

- Seller pays primarily capital gains tax rather than higher ordinary income tax rate;

- Seller endorses stock certificates over to new owner;

- Buyer assumes all assets and liabilities unless specifically excluded;

- Buyer takes on risk associated with unknown liabilities;li>

- Buyer inherits tax depreciation schedules as they are (for better or mostly worse);

- Buyer may inherit tax loss carryforwards to shield future income; and

- There is no allocation of purchase prices or goodwill related to transaction.

Q: If the “Debt Assumed” field is blank, does this mean no interest-bearing liabilities were assumed?

A: In an asset sale, typically no interest-bearing liabilities are assumed.

In a stock sale, if the “Debt Assumed” field is blank, DealStats was not able to definitively determine whether interest-bearing liabilities were assumed. This could indicate the purchaser did not assume any of the seller's interest-bearing financing liabilities or that the amount of interest-bearing financing liabilities assumed was immaterial relative to the consideration paid. If the “Debt Assumed” field shows a zero, the information describing the business sale clearly defined no interest-bearing liabilities were assumed.

Q: Why are no assumed interest-bearing liabilities included for some transactions that include an interest expense and that are listed as a stock transaction?

A: The income data reported by DealStats are for the latest full fiscal year reported before the date of the closing of the sale. It would be incorrect to extrapolate that the sale included the assumption of interest-bearing financing liabilities from the fact that interest expense was reported for the business before the date of the sale.

Q: I would like to know whether the above information means that no interest-bearing liabilities were assumed in the deal or information is simply not available on interest-bearing liabilities assumed with the deal.

A: For asset and stock transactions where the “Debt Assumed” field is blank, DealStats makes the assumption that no interest-bearing liabilities were assumed or the amount of interest-bearing liabilities was insignificant relative to the purchase price.

In an asset sale, typically no interest-bearing liabilities are assumed.

For stock transactions, DealStats analyzes purchase price allocations (which are available for approximately 90%-plus of the stock transactions in the database) and records any interest-bearing liabilities that were assumed. DealStats also reviews all relevant filings from the buying firm (where the buyer is a public company with SEC filings), seeking specific language regarding the assumption of interest-bearing liabilities. It is DealStats’ belief and understanding that if interest-bearing liabilities were assumed and were significant in the transaction, the acquiring firm would report this to its shareholders and DealStats would subsequently note this amount in the “Debt Assumed” field.

In stock transactions, it is important to note that not all targets are carrying interest-bearing debt. Further, because a target has long-term liabilities on its balance sheet does not mean it possesses interest-bearing liabilities (various types of long-term liabilities do not bear interest, such as deferred tax payments). Additionally, the selling shareholders may retain the debt in the business sale and use the proceeds from the business sale to repay their outstanding debt.

Q: What is the relation between market multiples and capitalization rates?

A: The relation between market multiples and capitalization rates is:

- Market multiples and capitalization rates are the inverse of each other. For example, if the P/E ratio is 20 times last year's earnings, then last year's earnings are capitalized at 5%: 1/20 = 0.05 = 5%.

- Conversely, if the capitalization rate is 5%, then the market multiple for that variable is 20: 1/5% = 1/0.05 = 20x.

- Any market multiple can be converted to a capitalization rate, and vice versa. The capitalization-rate form of presentation is commonly used in the income approach to valuation. It is more common to use the market-multiple form of presentation in the market approach.

Q: When evaluating multiples such as MVIC/SDE, how do I know whether the owner's compensation has been adjusted to reflect market value?

A: The income statement in DealStats is either "As reported" or "As restated"—and is indicated as such above the "Net Sales" figure. If the income statement is "As restated," the details as to the restatements are included in the “Notes” field. The majority of the deals in DealStats are as reported, indicating no adjustments have been made.

Q: If I am using multiples from the DealStats database to value a closely held company, would I need to take a discount for lack of marketability or is the multiple assumed to be on a nonmarketable basis already?

A: To answer this question, we will quote several passages from Shannon Pratt's The Market Approach to Valuing Businesses (New York: John Wiley & Sons, 2001) [In the below narrative, the "merged and acquired company method" and the "guideline merged and acquired company method" both refer to utilizing information from private-company sales, not public-company sales]:

- "If valuing a controlling interest, a discount for lack of marketability may be appropriate in limited circumstances. There could be significant time and costs that would need to be incurred in order to make the subject company saleable, which could be the basis for a lack of marketability discount." (from Chapter 3, “The Guideline Merged and Acquired Company Method,” p. 39)

- "The merged and acquired company method produces a value on a control basis. A controlling interest is not as readily marketable as a publicly traded stock. Therefore, if valuing a controlling interest, some discount for lack of marketability may be warranted, although if so, it generally would not be as great a percentage as would be appropriate for a minority interest, in fact, probably substantially less.

“If the merged and acquired company method is used for valuing a minority interest, usually both a discount for lack of control and also a discount or lack of marketability would be applied, as shown in the schematic levels of value in Exhibit 11.1 (not shown here). These discounts would be applied consecutively, usually first the discount for lack of control to get a minority value, and then the discount for lack of marketability." (from Chapter 12, “Discounts for Lack of Marketability,” pp. 146-147)

- "Using the guideline merged and acquired company method, the analyst arrives at an indicated value for a controlling interest. Even a controlling interest may suffer from lack of marketability. If valuing a controlling interest, the analyst could consider the costs of preparing the company for sale, transaction costs, and the risk of not receiving the expected proceeds as factors in quantifying a discount for lack of marketability from the value of the expected proceeds.

“If the analyst is using the guideline merged and acquired company method to value a minority interest, then both a discount for lack of control and a discount for lack of marketability usually are appropriate. These are taken multiplicatively, not additively, that is, they are taken sequentially. Usually the discount for lack of control is applied to a minority value, and then the discount for lack of marketability is applied to the minority value." (from Chapter 12, “Discounts for Lack of Marketability,” pp. 154-155)

Q: I have noticed there are many transactions from the state of Florida. Why is this? Do the multiples for the businesses in Florida differ from the rest of the country?

A: The Florida brokers who are part of the association known as Business Brokers of Florida (BBF) are incentivized to report the transactional information from each of their sales to the BBF by the use of an annual awards and recognition program. To our knowledge, this is the only state association that has this level of participation and cooperation in the world. Also, it appears the brokerage operating model is different in Florida when compared with the rest of the country. In Florida, a multiple listing service was formed to which business brokers are encouraged to join. The BBF has structured a system encompassing bylaws/rules and regulations to where members must co-broker their listings with fellow business broker members. This system has proven to be very successful on many levels, not only in capturing more sold data, but even more so to the benefit of allowing business brokers to close more deals than they normally would with only their own in-house listings. In the BBF co-brokering system, more than 95% of the deals closed in the association are at a 50-50 commission split between the listing agent and the buyer’s agent. Everywhere else in the country, all co-brokerage is voluntary and practiced on a case-by-case arrangement. There are benefits to the public through the use of the co-brokerage arrangement in Florida. It provides prospective buyers the opportunity to select a broker of their choosing to help navigate the complexity of the deal and feel comforted that someone is looking out for their best interests. Sellers appreciate the co-brokerage arrangement because it provides much more exposure to incentivized buyer brokers and their prospects.

When reviewing the transaction data across all industries, for private buyers and private sellers, and eliminating transactions with minimal SDE, DealStats has found that the median MVIC/Net Sales multiple for Florida transactions is 0.46 compared with 0.47 for non-Florida transactions (relatively similar). Florida transactions had a median MVIC/SDE multiple of 2.08 compared with 2.37 for non-Florida transactions. Here, Florida deals had a lower MVIC/SDE multiple, but a higher SDE margin (22.6% vs. 20.5%). When removing small companies with sales below $100,000 and larger companies with sales above $10 million, the median MVIC/SDE multiple was 2.67 for Florida transactions compared with 2.79 for non-Florida transactions. Here, the MVIC/SDE multiple was still lower for Florida transactions but to a lesser degree. Overall, it appears the SDE margins are generally slightly higher in Florida transactions (about 2.0 percentage points) while the SDE multiples are generally slightly lower (about 0.12 points, or about 4.0%).

BVR is committed to providing the valuation and transaction professions with the most comprehensive collection of details on private- and public-company acquisitions. We are focused on consistently working to expand the DealStats Contributor Network to include more business brokers, M&A advisors, PE professionals, and other transaction intermediaries across the country in order to bolster the DealStats database.

If you or your firm would like to learn more and get involved, please join our Contributor Network, where you can receive complimentary access to DealStats for contributing your closed deal information. If you belong to a state or other professional association and would like to discuss complimentary access for all your members, please contact deals@bvresources.com.