Important notice regarding Duff & Phelps

Cost of Capital Resources

Thank you for your interest in BVR's cost of capital resource offerings. As of October 31, 2018 Business Valuation Resources is no longer a distributor of the Duff & Phelps Cost of Capital Navigator, the books in the Valuation Handbook series, or the SBBI Yearbook. All current subscription renewals will be handled by Duff & Phelps.

If you would like to speak to a member of the Duff & Phelps support team, please contact them at +1-877-212 9715, costofcapital.support@duffandphelps.com, or online at: dpcostofcapital.com.

New! BVR has launched a new Cost of Capital Professional platform

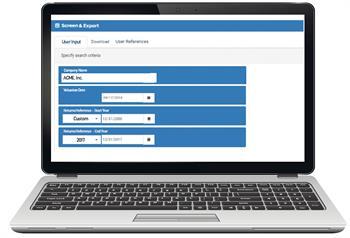

BVR is excited to announce our new Cost of Capital Professional platform that empowers business valuators and analysts. Built upon the principle of simplicity, the intuitive interface and flexible inputs allow you to quickly get risk-free rates, equity risk premiums, and size premiums based on your subject company’s valuation date and size. The platform is transparent and gives full view of tables and calculations, giving the power back to the analyst.

Learn more at bvresources.com/ccprofessional and request a live demo of the platform >>

Additional cost of capital resources

Looking for more resources on the topic of cost of capital? Check out our topical center that includes:

- Guides and books

- Webinars and eLearning courses

- Articles

- Blog posts

- And, more!

Request a live demo of BVR's

Cost of Capital Professional

Fill out the form below and we'll be in touch shortly to schedule your demo.