Fair value for financial reporting: Work file checklist for contributory asset charges

Under the Mandatory Performance Framework (MPF) for the Certified in Entity and Intangibles Valuation (CEIV) credential, valuation experts will be expected to have a certain amount of documentation in their work files. Regardless of whether you hold the CEIV credential or not, anyone doing fair value for financial reporting should comply with these new rules.The new requirements are contained in the MPF, which is designed to make sure that the valuation expert adequately documents his or her work and thought processes. The guidance does not explain “how to” perform a valuation but rather “how much” documentation is required.

Practice aid

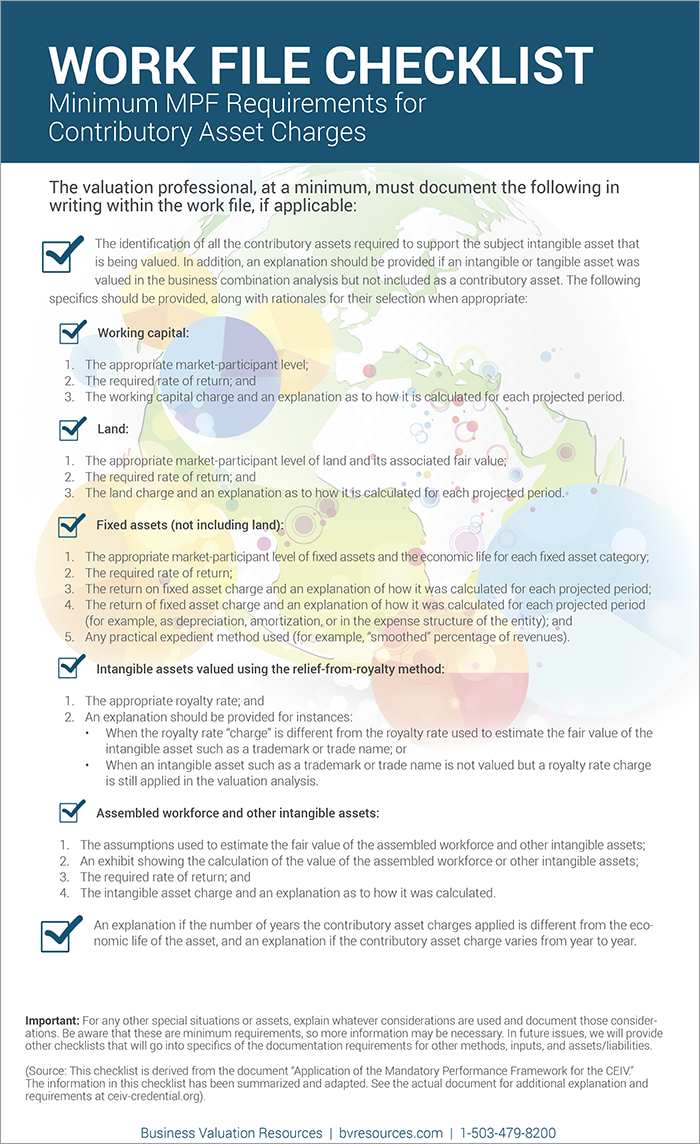

A work file checklist is a good compliance tool for what the MPF requires regarding all the different aspects involved in fair value measurement. In past posts, we presented checklists for a number of valuation areas, and, in this post, we provide a checklist for contributory asset charges.

Contributory assets are those tangible or intangible assets used in the generation of the cash flows associated with the subject intangible asset that is being valued. A contributory asset charge is a charge against revenues to reflect a fair return on or return of contributory assets used in the generation of the cash flows associated with the intangible asset being valued. Once determined, contributory asset charges are typically allocated based on revenues.

This checklist is based on what is contained in the two MPF documents, which you can download from a special website set up for the CEIV credential.

Download the PDF version of the work file checklist >>