How to document the life for the projection period with respect to noncontractual customer-related intangible assets

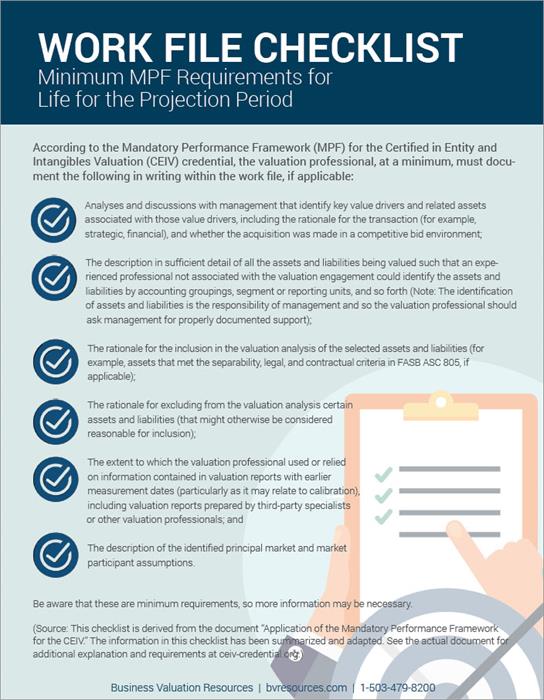

Under the new requirements for fair value for financial reporting, valuation experts will be expected to have a certain amount of documentation in their work files. The new requirements are contained in the Mandatory Performance Framework (MPF) for the Certified in Entity and Intangibles Valuation (CEIV) credential. Regardless of whether you hold the CEIV credential or not, anyone doing fair value for financial reporting should comply with these new rules.

Practice aid

A work file checklist is a good compliance tool for what the MPF requires regarding all the different aspects involved in fair value measurement. In this blog post, we give you a checklist for how to document the life for the projection period with respect to noncontractual customer-related intangible assets (see Section A3.4 of the MPF). A typical asset of this type is a customer list, which represents customer relationships and can be a significant asset that must be quantified in certain instances.

The fair value of a customer relationship asset is the present value of the after-tax cash flow projected over its remaining useful life, which must be determined. The remaining useful life is generally computed using:

- Customer survival rates;

- Customer mortality;

- Whether or not a contract exists;

- The type of business; and

- Whether the subject business can offer an inherent competitive advantage to its customers that other businesses cannot.

The MPF (in Section A3.4.4) contains the following important point:

An economic life is estimated only for purposes of valuing the subject interest. Although this information may assist management in its determination of the amortizable life of the subject interest, it is not the valuation professional’s responsibility to conclude a specific life for amortization purposes. Thus, the valuation professional’s report should not provide any conclusions of amortization life and must clearly state that determining the pattern of amortization life of the subject interest is management’s responsibility.

Important: Though management may retain a valuation professional to consult on the pattern of amortization life of a subject interest, management is always responsible for the estimates and results.

This checklist is based on what is contained in the two MPF documents, which you can download from a special website set up for the CEIV credential (ceiv-credential.org).