Preview: Valuing Fractional Interests in Real Estate 2.0

The income approach, as one of the three pillars of real estate valuation, is often a hot topic of discussion in the field, but rarely is integration with other methodologies discussed in great depth. In Valuing Fractional Interests in Real Estate 2.0, Dennis Webb, with his wealth of practical knowledge, created a complete resource for anyone looking to apply the income approach better in their next valuation. The following excerpt comes from the book’s first chapter, "Fractional Interests and Valuation."

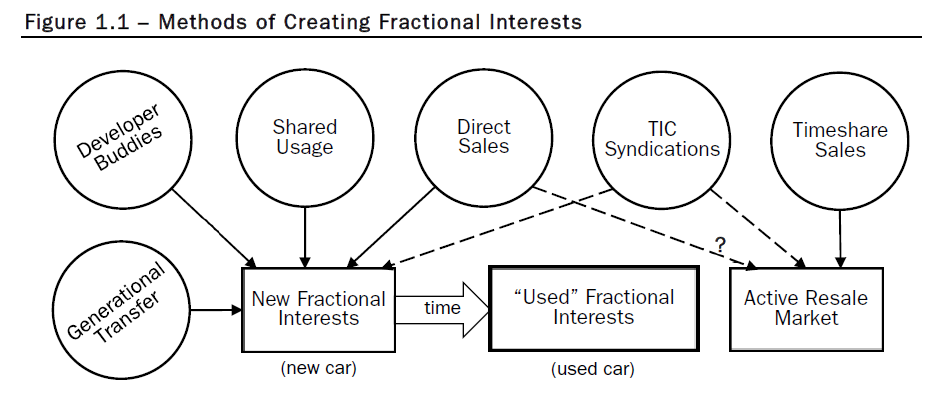

Fractional interests all have a curious life cycle. They are mostly created at a point in time where there are substantial benefits to pooling resources for purchasing and improving property or splitting usage of a property that would otherwise be prohibitively expensive or buying a vacation interval—all of which are intangible benefits. Such interests generally are formed by investing at a premium to a specific interest’s proportional (pro rata) share of a whole property. But in nearly all cases, the acquired interest is like a new car: Once you “drive it off the lot” so to speak, value declines, and often substantially. The intangible value, like the one that we associate with a brand-new car, evaporates when it is no longer brand-new. We refer to this value loss as a “discount” from the interest’s share of the whole property….

There is obviously no discount at the time of formation, and probably for some time after that. After all, market value requires a buyer and a seller; why would a person who just got in at formation be willing to exit at a discount? If their intangible benefits remain in place, then the value to that person hasn’t changed. But the value will certainly change. Conditions change over time, as do personal interests and objectives, and the interests become “used” in the sense that the perceived intangible benefits will have evaporated. Of course, if a buyer can be found years later and persuaded that the deal is as compelling as it was originally, then that buyer might indeed pay 100 cents on the dollar if he sees sufficient intangible benefit. This is investment value unless a market with such an objective could be found or reasonably hypothesized. While we do not find such markets for used interests, we can find many examples of investment activity concerning securities with the attributes of used interests. It is on the basis of these observations that we are able to apply discounts.

In some cases, there is an active market for the acquired share. We are not interested in these cases, since familiar valuation methods, such as the “sales comparison approach,” can be used to analyze transactions and extract value indications for the subject interest. (Valuation approaches are discussed in Chapter 3.) For most privately held fractional interests, there is no active market (mostly for reasons described in Chapter 7). Interests having impaired or nonexistent markets are the fractional interests that are the subject of this book. Various typical forms of fractional interest generation are shown in Figure 1.1.

Development buddies pool their talents and resources to develop and hold real estate. Many enterprising owners and developers were doing this in the post-World War II period and beyond. Many of the successful developments created by these generations have ended up providing income for multiple family members that continues to this day.

Shared usage is often seen in resort communities, as parties come together in small numbers to acquire residential units.

Want to take a deeper dive into fractional interests? Expand your theoretical and practical knowledge by taking advantage of Dennis Webb’s insights into this important field. You can order your copy of Valuing Fractional Interests in Real Estate 2.0 here.