How does the Tax Cuts and Jobs Act impact business valuation?

The Tax Cuts and Jobs Act (TCJA) was a bombshell in the world of business valuation, and appraisers still have many questions about how it impacts different aspects of their work. Not the least of which is the question of how to adjust pre-Tax Act valuation multiples for post-Tax Act business valuations. Dan Van Vleet of The Griffing Group tackled this quandary in a BVR webinar, and the following is based on his presentation, excerpted from BVR’s “5 Questions & Answers Regarding the Tax Cuts and Jobs Act.”

How to adjust pre-TCJA multiples for post-TCJA valuations

Assuming that a pre-Act M&A corporate transaction does not reflect the changes in the cost of capital and corporate tax rates attributable to the Act, an adjustment should be considered when such pre-Act M&A multiple is used to value a subject company as of a post-Act valuation date. For ease of reference, Van Vleet refers to this adjustment as the enterprise value adjustment multiple (EVAM).

There are a few caveats regarding the EVAM. The EVAM only corrects for changes in the cost of capital and tax rates between a pre-Act M&A transaction date and a post-Act valuation date. The EVAM does not correct for other issues that may be as important, or more important, than changes in the cost of capital or tax rates attributable to the Act.

Enterprise Value Adjustment Multiple

The four steps used to calculate and apply the EVAM are as follows:

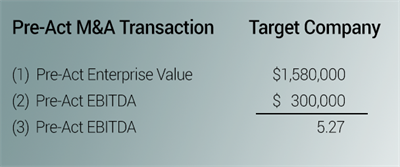

Step 1: Calculate the relevant pre-Act M&A multiple. In Table 1, Van Vleet uses an enterprise value of $1,580,000 and EBITDA of $300,000. The resulting pre-Act EBITDA multiple is 5.27.

Table 1

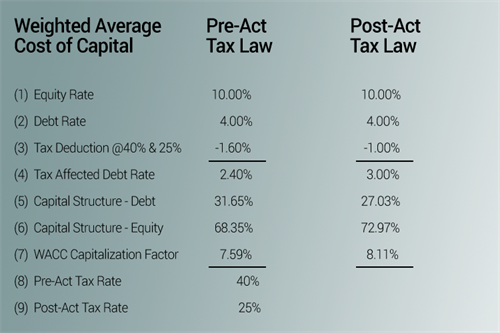

Step 2: Calculate the weighted average cost of capital (WACC) and corporate tax rates applicable to the subject company as of the pre-Act M&A transaction date and the post-Act valuation date. Table 2 illustrates these calculations.

Table 2

The pre-Act and post-Act changes in capital structure as presented on Lines 5 and 6 are based on an iterative capital structure analysis using a single-period capitalization (SPC) method. This analysis is conducted to ensure that changes in capital structure, WACC capitalization factors, and tax rates would result in identical indications of value provided by the SPC and EVAM-adjusted M&A methods.

Step 3: Use the following formula to calculate the EVAM:

In this example, Van Vleet calculated an EVAM of 1.1709 using the following components:

- Post-Act tax rate: 25.0%;

- Pre-Act tax rate: 40.0%;

- Post-Act WACC: 8.11%; and

- Pre-Act WACC: 7.59%.

Step 4: Multiply the pre-Act enterprise value of the subject company by the EVAM to conclude a post-Act enterprise value. Subtract subject company debt in order to quantify the post-Act value of equity, if desired. Table 3 illustrates these calculations.

Table 3

Table 4 provides the SPC method analysis used in the preparation of this blog. As mentioned, Table 4 was prepared to ensure that changes in capital structure, WACC capitalization factors, and tax rates would result in identical values provided by the SPC and EVAM-adjusted M&A methods.

Table 4

Summary

The EVAM may be used to adjust the post-Act enterprise value of a subject company when using pre-Act M&A multiples. The EVAM only corrects for changes in the cost of capital and tax rates between the pre-Act M&A transaction date and post-Act valuation date. Other Act-related issues such as bonus depreciation and business interest expense limitation should be separately considered and analyzed.

Explore other ways that tax reform has affected business valuation

Download BVR’s “5 Questions & Answers Regarding the Tax Cuts and Jobs Act” for additional insights on key issues related to this year’s tax code changes from recent BVR webinars, including:

- How do the changes impact engagements with a 2017 valuation date?

- Will financial statements reflect the impact of the TCJA?

- How does TCJA impact reasonable comp?

- How does the TCJA impact terminal value?

For more on the TCJA along with guidance on a range of other business valuation topics, explore BVR’s calendar of upcoming webinars and watch recordings of recent training events.