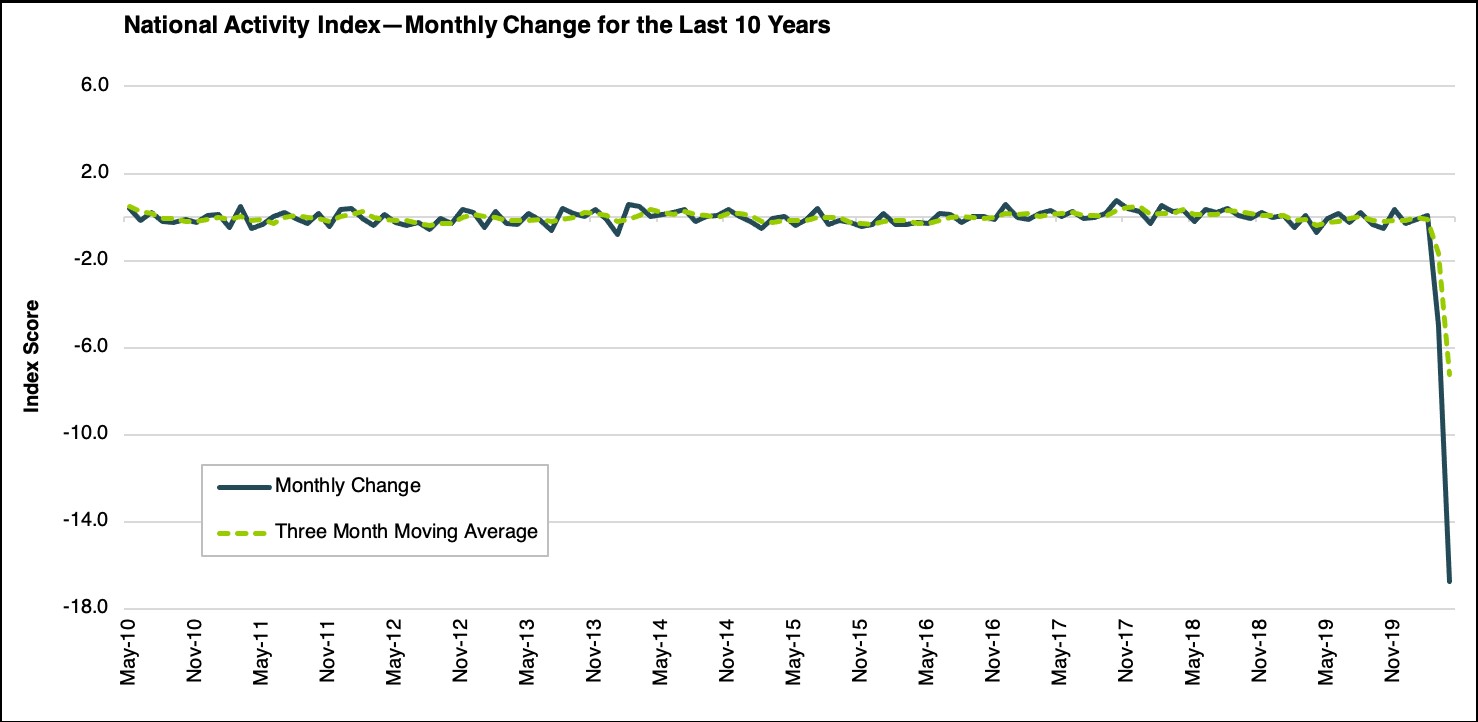

The Chicago Fed’s National Activity Index (CFNAI) came in at -16.74 in April, down from a revised -4.97 in March, as reported in the April 2020 issue of the Economic Outlook Update (see chart below). The April score, the lowest on record, fell as a result of the decline to 79 of the 85 individual indicators and to all four of the broad categories of indicators used to construct the index. All four categories decreased from their March levels as well. The index’s three-month moving average decreased to -7.22 in April, down from -1.69 in March. Following a period of economic expansion, an increasing likelihood of a recession has historically been associated with a three-month moving average value below -0.70.

The National Activity Index is designed to gauge overall economic activity and related inflationary pressure and includes 85 economic indicators that are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories. Each of these data series measures some aspect of overall macroeconomic activity. The derived index provides a single, summary measure of a factor common to these national economic data. In the history of the data series, the lowest score, 16.74, was recorded in April 2020 and the highest score, 2.07, was recorded in April 1978.

The April edition of the Economic Outlook Update also includes economic data that capture the full economic impact caused by the coronavirus lockdown. This includes the customary April data featuring the jobs and unemployment report, retail sales, housing market, and construction data but also added special reports from the University of Michigan and its Consumer Sentiment Survey, the U.S. Chamber of Commerce publishing its Small Business Coronavirus Impact Poll, the RSM Middle Market Business Index, White House Council of Economic Advisors, the PMI and NMI semiannual surveys, and the National Association of Realtors (NAR) Flash Survey, all of which provide an in-depth look at the economic damage caused by the coronavirus lockdown in their respective industries.

The 47-page April 2020 Economic Outlook Update contains expansive research from leading authoritative resources, which you can use in your valuation reports as long as you give proper attribution. To learn more, visit www.bvresources.com/eou.