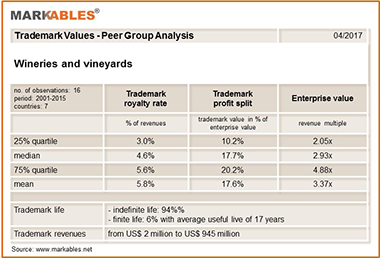

Vineyards and wineries do not face easy circumstances to build strong brands. For example, product quality may be subject to changes, and these businesses often cannot simply expand their capacity. Still, branding is important in the wine sector, which is the subject of this month’s sector snapshot from MARKABLES, a Switzerland firm that has a database of over 9,000 global trademark valuations published in financial reporting documents of listed companies. It analyzed the brand in the purchase price allocations of 16 different wine businesses acquired between 2001 and 2015 (see table). The businesses are located in seven countries and have revenues from $2 million to $945 million. The peer group includes brands such as Penfolds, Jackson-Triggs, Hardys, Robert Mondavi, Clos du Bois, Fetzer, and Meiomi, to name a few.

Because of the high value of tangible assets (vineyards, vines, cellars, and stock), wine businesses enjoy high valuations of 3x revenues on average. The brand is the single most important intangible asset, accounting for 17.5% of enterprise value on average. Wine brands are typically assumed to have an indefinite life and a mean royalty rate of 5% on revenues. This is higher than for coffee, pasta, and sports brands but less than nutraceuticals. However, as the retail price for a bottle of wine can go from less than $10 up to more than $1,000, there is a very wide range of brands—from commercial mass market wine brands to superpremium brands. Therefore, the range of observable royalty rates for wine brands goes from 1.25% to 15%. Hopefully, the next vintage of your favorite wine brand will be century-old wine!

(click image to view larger)