|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, IVSC, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

Free Excel models for valuing complex debt instruments available from BVR

The recent BVR webinar Navigation Through the Maze in Complex Debt Instruments Valuation reviewed three case studies and offered an Excel file that contained the following models:

- Simple convertible debt using the DCF/yield method for the debt component and the Black-Scholes model for the option component;

- Convertible debt using a lattice model approach; and

- Valuation of warrants.

The webinar was presented by Mark Zyla (Zyla Valuation Advisors), Rajesh C. Khairajani (KNAV), and Faisal Lakhani (KNAV).

BVWire—UK readers who would like a copy of the Excel file can download a copy here. The models are described in the recording of the webinar, which you can access if you click here (free to BVR Training Passport Pro holders; otherwise, it must be purchased). |

|

20 May is rescheduled date for ICAEW Valuation Conference, headlined by Fernandez, Strickland, Cooper, and HMRC’s Thomas

Good news for UK business valuers: The ICAEW Valuation Conference is back on the calendar after it was postponed last fall. The new day-long virtual programme is scheduled for 20 May beginning at 8:55 BT.

Those who registered for the 2020 programme should have received their new registration, along with a refund. New registrants can sign up for the ICAEW business valuation event here. Rates are as follows:

- Valuation community member: £60 + VAT;

- ICAEW member: £85 + VAT; and

The programme begins with Professor Pablo Fernandez discussing his recent article ‘Valuation, Common Sense and Common Errors.’ Among his topics are:

- Where discounted cash flow valuations come from?

- A closer look at assumptions in valuation models.

- Facts, opinions, and theories.

- Problems with calculated betas.

- Errors due to forgetting what are we doing.

- Errors due to ‘not remembering the definition of WACC,’ the most common error using WACC.

- Errors due to ‘following a recipe without thinking.’

- How to correct common errors?

Fernandez is followed by Ian Cooper’s discussion of valuation anomalies such as the small-firm effect, liquidity, the low beta anomaly, profitability, and sentiment. Afternoon sessions include Andrew Strickland’s session on cost of capital for family companies. A further highlight for the event will be the unusual opportunity to hear directly from HMRC’s Shares and Asset Valuation (SAV) section assistant director, Steve Thomas. SAV offered well-attended meetings for years for the valuation profession, but they’ve been postponed since 2018. |

|

Refinitiv ranks the top providers of 2020 fairness opinion valuations

The ‘Global Mergers & Acquisitions Review: Full Year 2020/Financial Advisors’ from Refinitiv contains statistics and also rankings for worldwide providers in the M&A marketplace. Despite COVID-19 and Brexit (and everything else), the UK remained at the top in global activity.

Of course, this was led by some significant UK deals in 2020 that drove valuation multiple averages higher. While the Dutch Unilever deal was the largest last year (at £80,000 million, it was more than twice as large as the as China’s Petro China pipeline business, at No. 2), the UK is well represented in the top 10:

- 4. IHS Markit acquisition by SPGI;

- 6. Arm acquisition by Nvidia;

- 10. Willis Towers Watson acquisition by Aon; and

- 22. O2 acquisition by Virgin Mediq.

The Refinitiv study summarises results in a number of areas directly related to business valuation—confirming the picture that the UK market for valuation services is still centrally controlled by a handful of global financial services and audit ‘brands.’ One exception to this centralization of valuations for financial reporting purposes is in the fairness opinion market. In the EMEA region (still including the UK!), the 10 top providers of announced fairness opinions in 2020 were:

- KMPG;

- JP Morgan;

- Deloitte;

- PwC;

- Rothschild;

- Duff & Phelps;

- BofA Securities;

- Mediobanca;

- Lazard; and

- Evercore.

Globally, the list reflects strong specialization:

- CITIC (2019 rank: 8);

- Duff & Phelps (2019 rank: 1);

- (tie) Houlihan Lokey (2019 rank: 4);

- (tie) Stout (2018 rank: tied for 3); and

- J.P. Morgan (2018 rank: 2).

|

|

2021 cost of capital benchmarks now available in BVR’s Cost of Capital Professional

Year-end 2020 data, including equity risk premia, CRSP decile size premia, and industry betas/IRPs, are now available in BVR’s Cost of Capital Professional (CoCPro) platform. The platform is a simple, transparent, and cost-effective service for estimating the cost of capital and is designed to bring more professional judgment and common sense back into the process, which has become too much of a complex ‘black box’ of applied mathematics.

CoCPro is directed by Professor Mike Crain, and it benefits from research conducted by valuation experts as disparate as Professor Aswath Damodaran (New York University Stern School of Business) and Ascanio Salvideo (Salvideo and Associates). In those cases where a valuation engagement allows for an income approach (DCF analyses are becoming more widely accepted in UK courts), CoCPro supports the buildup method and CAPM calculations for any valuation date. It also gives you the flexibility to choose the start year for historical return data based on what segment of history you believe best offers a reasonable basis to make estimates of expected future returns. For a personalized demo of the platform, click here.

Damodaran continues to offer business valuers a treasure trove of analyses via his annual posting of data updates. He covers risk-free rates, equity risk premiums, corporate default spreads, corporate tax rates, country risk premiums, and other data—all of which is free. He does a series of posts on his blog based on these new data. The first post takes a look back at 2020 and explains the background of his annual data analysis. |

|

Help IVSC determine changes to the IVS business valuation standards by submitting comments prior to 30 April

The next consultation process for IVS (‘Additional Technical Revisions’) is now open. Accordingly, the IVSC Standards Review Board encourages input from VPOs, professionals, and their organisations.

This process is similar to the review and comment period that led to the current IVS (effective 31 January 2020) with one exception. IVSC’s Standards Review Board, together with the Business Valuation Board, Financial Instruments Board, and the Tangible Assets Board, decided to publish an exposure draft of targeted revisions to IVS based on feedback received last year, as well as valuation standards harmonisation discussions held with The Appraisal Foundation and the Appraisal Institute of Canada during 2020, and consequential amendments in light of expected revisions to the Financial Instruments standards.

The IVSC is planning to publish revisions as needed based on market feedback. The IVSC is committed to a fully open and collaborative consultation process. All comments received as part of the consultation process will consequently be published on the IVSC website. |

|

It’s official: KPMG, BDO, and Pinsent Masons offer new summaries of the deal market rebound in the last half of 2020

Business valuers trying to provide an economic overview (as required by IVS, RICS, ASA, and most international valuation standards) can be forgiven if they struggle describing 2020 and forecasting 2021.

Three sources of summary data on the deal market and prices were published in the last two weeks. The overall conclusion of these four courses comes from a KPMG report:

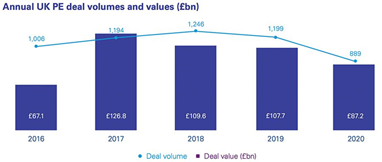

UK private equity deal activity bounced back in the second half of 2020, although a profound slump in transactions in Q2 as lockdown gripped the M&A market meant that total annual deal volumes hit their lowest levels in more than seven years.

KPMG’s latest study of UK transactions involving private equity investors indicates that a total of 889 deals were completed over the course of 2020, with a combined value of GBP87.2 billion. This was the fewest number of private equity transactions seen in the UK since before 2014 and a fall of 26% from the previous year. KPMG concludes that midmarket PE deals were particularly impacted. Jonathan Boyers, head of M&A for KPMG in the UK, says: ‘Once the initial shock of lockdown had worn off, and after a number of years of hesitancy caused by issues such as Brexit, general elections and broader international uncertainty, we saw a renewed urgency amongst private equity investors to get deals done. They had plenty of cash ready to be deployed, and with a similar appetite for transactions in the debt markets, it wasn’t long before the M&A tap was turned back on.’

The KPMG forecast remains upbeat: Boyers says: ‘We’re certainly not seeing any signs that the latest lockdown is quelling momentum. Rather, there seems to be a mindset that nobody wants 2021 to be another “lost year” after such a prolonged period of economic and geo-political uncertainty.’

Another subsector of the large-deal marketplace also, somewhat surprisingly, thrived in 2020, according to BDO’s annual analysis of listed companies taken private. John Stephan, partner and head of global M&A at BDO, says: ‘Private equity houses are taking UK listed companies private at an ever-increasing rate.… PE funds have dominated deal activity whilst corporate buyers have been generally more cautious.’ Stephen believes these conditions will continue into the future. ‘The combination of UK listed companies at attractive multiples and PE funds with large amounts of unspent cash that they need to invest means that the public to private trend is likely to continue at pace,’ he says.

As 2020 came to a close, UK-listed company prices were attractive. At the end of November, valuers will recall, the FTSE 100 had fallen 16% from its value at the start of the year (compared to falls of 9% for the French CAC 40 index and 2% for the German DAX—and a 9% increase for the big-tech company-dominated S&P 500 index in the US).

The three most recent UK-listed companies to have been taken over by PE firms are HML Holdings (property management), HWSI Realisation Fund (fund manager), and Be Heard Group (marketing agency).

To support these conclusions further, Julian Stanier and Adam Cain of Pinsent Masons highlighted how the UK public M&A market recovered in the second half of last year after a sharp reduction in deal activity in the first six months (H1) in their analysis for Out-Law News. They report that, across the whole of 2020, there were 100 transactions involving businesses listed on the London Stock Exchange’s Main Market or AIM that were subject to the UK’s Takeover Code.

‘Market conditions still appear fertile for prospective private equity purchasers and we see take-private bids backed by investment funds and infrastructure funds being particularly prevalent,’ Stanier says. |

|

Dates for your diary

16 and 18 February: IVSC Financial Instruments Valuation virtual roundtables

25 February: Forecasting: Removing the Rose-Coloured Glasses, BVR webinar

17-18 February: ICAEW Advanced Valuation Techniques (repeated 14-15 June), virtual classroom taught live by Steve Shaw

12 March: EACVA Business Valuation Virtual Conference 2021, online

30 April: IVSC closes comment period on technical revisions to business valuation standards in IVS

|

Want to share a news item? Have feedback or comments? Please contact

David Foster at ukeditor@bvresources.com. |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2020. All rights reserved.

|

|