|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

Big Four control of UK audit market increased again last year, FRC reports

For the 17th year, the Financial Reporting Council (FRC) surveyed members of the six UK accounting associations (Association of Chartered Certified Accountants (ACCA), Institute of Chartered Accountants in Ireland (ICAI/CAI), Chartered Institute of Public Finance and Accountancy (CIPFA), Chartered Institute of Management Accountants (CIMA), Institute of Chartered Accountants in England and Wales (ICAEW), and Institute of Chartered Accountants of Scotland (ICAS)), plus the Association of International Accountants (AIA).

The FRC’s Key Facts and Trends in the Accountancy Profession—October 2019 is a great read for anyone providing business valuation services in the UK or Republic of Ireland. Some findings of particular interest from this new edition:

- The Big Four took in an additional 1.7% in audit fee income, while the non-Big Four audit firms lost an additional 6.3%.

- This growth in audit fees for EY, KPMG, PwC, and Deloitte slowed compared to 2017—also not surprising because these firms already audit all 100 of the biggest firms in FTSE—or what Accounting Today calls ‘approximately 100% of the FTSE 100.’

- As the audit business concentrates, the number of firms registered with the FRC to carry out statutory audit work continues to fall. By 2018, that number dropped to 5,394, 4.7% less than at the end of 2017.

- There are 365,000 chartered accountant members between the six UK organizations, with ICAEW at 129,000, ACCA at 98,000, and CIMA at 83,000. Growth in total UK membership slowed slightly, to 1.7% (the compound rate from 2014 to 2018 is 2.2%). The worldwide growth in accountancy body members rose 2.9%, so the UK lagged marginally. (FRC counts members of the Association of Accounting Technicians (AAT) separately.)

- The average percentage of members who are female is now 37%, up slightly from 35% in 2014. ICAEW lags this overall average, with 29% female members. Gender issues continue to plague the profession, despite more attention to the protected characteristics (under the Equality Act of 2010). For instance, EY received negative social media attention for a training session for women partners earlier this year. (EY perhaps deserves a little better, since so many large firms offer little to support women in senior management. Nonetheless, the Big Four firm’s training event, out of context, appeared to mention just about every incorrect stereotype regarding professional women in the workplace and in leadership.)

- The FRC’s Audit Quality Review (AQR) team conducted 129 reviews of retained audits in the 12 months prior to March 2019. Of these, 98 were audits done by the Big Four. BDO and Grant Thornton received eight reviews each. Other reviewed audits were conducted at Mazars (five), Moore Stephens (three), Beever and Struthers (two), Crowe (two), Haysmacintyre (two), and Scott-Moncrieff (one). Of course, the accounting associations also conduct their own reviews.

|

|

Further responses from BVWire—UK's analysis of the 'headwind' effect of IFRS 16

BVWire—UK received a number of responses to the last issue’s coverage of a new study that suggests a possible reduction in forecasted profits as companies adapt IFRS 16. One helpful response is a summary of the accounting changes and an analysis of three business valuation changes that result from Henri Heinola, CFA, CAIA, senior valuation consultant at GlobalView in London.

IFRS 16 (Leases)—Impact on Business Valuations can be downloaded free from BVR. Heinola draws attention to the impact (and reminds all valuers that the use of pre-IFRS comparables will be particularly challenging during this implementation transition year) on three key valuation methods:

- DCF;

- Guideline public company comparables; and

- Transaction method comparables.

Our thanks to Henri for providing this summary for our readers! |

|

BVR/FactSet Control Premium Study updated

for 3Q

Buyers continue to pay more for control in the EU and UK than in most of the other major markets. One example from this week’s financial news: The investment bank Jeffries indicates that Peugeot has offered a 32% control premium to acquire Fiat/Chrysler. BVR is pleased to let you know that the “3Q 2019 Control Premium Study” report is now available to download and we have updated the online FactSet Mergerstat/BVR Control Premium Study platform.

Subscribers may download the current report by logging in to their “My BVR“ pages.

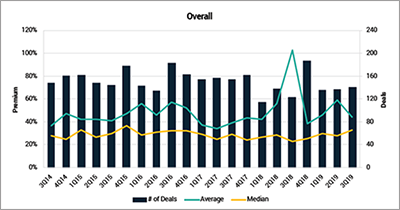

Below is an overall look at control premium analytics, which includes the number of completed deals, as well as the average and median control premiums, from 3Q 2014 through 3Q 2019.

Click on image to view full size

|

|

D&P lowers its normalized risk-free rate to 3.0%

Duff & Phelps has decreased its U.S. normalized risk-free rate from 3.5% to 3.0% effective 30 September 2019, the firm says in a statement. This new rate, used in conjunction with D&P’s equity risk premium of 5.5% (reaffirmed), implies a “base” U.S. cost of equity capital estimate of 8.5% (3.0% + 5.5%), the firm says.

The concept of normalizing the risk-free rate emerged around the time of the last financial crisis, since historical rates lagged actual values badly during that period. A number of international BV leaders strongly disagree with the use of a normalized rate, such as Chris Mercer of Mercer Capital (see his post on this topic) and Professor Aswath Damodaran of the New York University Stern School of Business, who writes that “a valuation is an assessment of the future as of right now, and you have to use the current risk-free rate.” |

|

The state of the business valuation profession,

a la KPMG

Unresolved political uncertainties over the past quarter continue, reports KPMG in its 10th edition of the International Valuation Newsletter, published quarterly. As a result of these developments and low inflation rates, central banks around the world continued to cut interest rates over the past three months.

Highlights of the report’s market update are:

- Major stock market performances: Emerging markets significantly decline in Q3;

- EURO STOXX 600 sector multiples: IT dominates Q3 but loses significantly on a quarterly basis;

- Current risk-free rates for major currencies: Interest rates continue to decline; and

- Recent country risk premiums and inflation forecasts for the BRIC countries: Both short-term growth expectations and risk premium for China have increased.

The report also focuses on the importance of “achieving consistency in currency conversions” in company valuation. |

|

What's a trillion $ between friends

Saudi Aramco floated last week, and anyone intrigued by fair market value had to take note. The company, by far the most profitable in the world, released less than 5% of its shares on Tadawul, the Saudi exchange. Investment firms (27 of which are involved in this initial float) and analysts had compared notes on geopolitical, climate, and business risk, and Fortune reported prior to the official IPO that values ranged from $1.2 trillion to $2.3 trillion—close enough. For the record, Aramco reported profits of $111 billion in the last year, more than Apple and Microsoft combined. Several BVWire—UK readers commented that it was refreshing to see an IPO from a company that was already profitable, after the various ‘tiny’ efforts for ‘unicorns’ with continued forecasted losses, in some cases, into perpetuity. |

|

Do alliances and partnerships increase value?

Most business valuation experts accept the fact that business partnerships (for IP or shared revenue opportunities) add to the value of a pool of assets. A very interesting interview with IAG chief Willie Walsh, published by Flightglobal.com (9 November 2019) offers a cautionary perspective. IAG’s primary carriers—British Airways and Iberia—are allied with Oneworld, and its latest acquisition, Air Europa, will be rescinding its SkyTeam membership.

Walsh told an investor group earlier this month that alliances have a ‘role to play,’ but their structure is proving ‘fragile’ with several carriers, including Air Europa and LATAM (following Delta’s acquisition of a 20% share).

He’s suspicious of alliances and minority shareholdings for the major carriers such as IAG because, while there may be revenue synergies, ‘anyone who tells you that there’s a cost benefit, or any cost synergy, they’re misleading you.’ (That being said, Walsh still agrees, ‘[i]f we see that we can generate strategic value by taking any minority stake in another airline, then we would have to consider it.’)

‘But taking a minority stake without having some form of control, or some influence over what the airline will do, has no value whatsoever. Again, Walsh refers to Delta, which has a 49% ownership share in Virgin Atlantic and a 49% voting share in Aeromexico. Despite these minority numbers, Walsh believes Delta’s stake is ‘non-controlling … on paper only.’

Alliances and acquisitions only add value with elements of control: In summary, Walsh cautions investors (and valuers): ‘We only see [minority stakes] making sense where you get an element of control.… If you can’t get control or influence …[y]ou think you have control, they take your money, they spend it, and then they tell you to get lost.’ |

|

Dates for your business valuation diary

HMRC Shares and Assets Valuation Fiscal Forum,

25 February 2020, London

ICAEW Practical Business Valuation, 16-17 March 2020, London; 14 and 26 May 2020, London; 9 and 29 July 2020, London; 9 and 19 November 2020, London

ICAEW Business Acquisition & Due Diligence,

22 April 2020, London

73rd CFA Institute Annual Conference,

17-20 May 2020, Atlanta |

Our thanks to Marianne Tissier for their valuable contributions to BVWire—UK.

Interested in working with BVR in the UK as a partner or ambassador?

Want to share a news item? Have feedback or comments?

Please contact David Foster (Executive Editor) at:

ukeditor@bvresources.com or +011-917-741-3853 |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2019. All rights reserved.

|

|