PitchBook/BVR Guideline Public Company Comps Tool Frequently Asked Questions (FAQs)

Thank you for visiting the FAQ page for PitchBook/BVR Guideline Public Company Comps Tool. If you're unable to find the answer you are looking for, please contact us at 1-503-479-8200 or customerservice@bvresources.com and we are happy to help.

- Download the PitchBook Excel Plugin User Guide

- Download PitchBook Excel Plugin Installation Instructions (Subscribers)

Q: Are there tutorial videos on how to use the PitchBook Excel Plugin?

A: Yes. Please visit these links:

Saved Searches (1:05)

Settings (0:35)

Unlinking a Workbook (0:34)

Refreshing a Workbook (0:38)

Opening PitchBook & Platform Help Center (0:38)

Using the Formula Builder (1:47)

Finding Companies & Data (1:41)

Opening a Template (1:06)

Building a Chart (1:00)

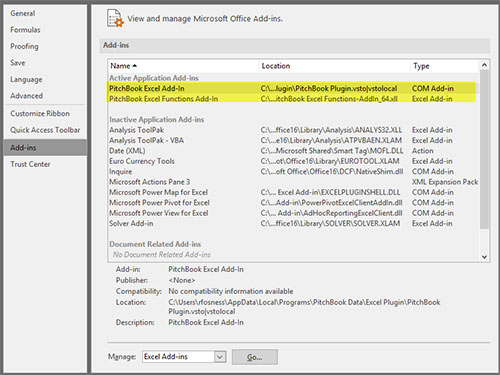

Q: The PitchBook Plugin does not appear in my Excel after I run the installation – can you please assist me?

A: Please verify the “COM Add-in” and the “Excel Add-in” are listed in the “Active Application Add-ins.” To locate these, from within Excel go to File/Options/Add-ins. You should be able to re-enable them if they are listed under the “Inactive Application Add-ins”. If this does not work, uninstall the PitchBook Plugin from your computer, restart the computer, then reinstall the Plugin.

Q: Is there a definitions page which defines the terms used in the PitchBook/BVR Guideline Public Company Comps Tool, as well as displays how the financial ratios and valuation multiples are calculated?

A: Yes. Click here to open a PDF which provides definitions for all the terms used in the PitchBook/BVR Guideline Public Company Comps Tool. You can also view these definitions within the PitchBook/BVR Guideline Public Company Comps Tool - once you have logged in and conducted your search, simply select the "Glossary" tab at the right side of the page.

Q: What is the source of data used in the PitchBook/BVR Guideline Public Company Comps Tool?

A: The data are pulled from public company filings at the Securities and Exchange Commission using a service provided by Morningstar.

Q: Are my exports from the PitchBook/BVR Guideline Public Company Comps Tool limited? Is the number of companies I retrieve data for in the PitchBook Excel Plugin limited?

A: There are a maximum of 250 downloads/exports per day, and 500 per month for the PitchBook/BVR Guideline Public Company Comps Tool, and a maximum of 250 per day and 500 per month retrievals for the PitchBook Excel Plugin. The exports from the PitchBook/BVR Guideline Public Company Comps Tool and the retrievals from the PitchBook Excel Plugin are independent; one does not count against the other. The limits are directed by Morningstar, the source of the data.

In the PitchBook Excel Plugin, the count is running daily against the number of companies that data are pulled for on a spreadsheet or template regardless of the number of data points for each company (e.g. one data point for a company or 1,000 data points for a company each count as one retrieval against the daily and monthly maximum). PitchBook does not double count companies within the same day.

Q: Does the PitchBook/BVR Guideline Public Company Comps Tool have data for non-U.S. countries? If so, which exchanges are included?

A: Yes, the Tool does provide data on non-U.S. public companies, in addition to U.S. public companies. Currently, the Tool provides data from 91 exchanges for more than 90,400 securities. Please click here to view detailed fundamental coverage statistics.

Q: Can I change the currency that’s displayed after seeing my search results?

A: Yes. After you login and are at the PitchBook page, click on “My Account” at the top of the page. From within your Account, click on the “Preferences” tab where you will see the option to change the currency to one of six options.

Q: How long after a public company files a 10-K or 10-Q with the Securities and Exchange Commission will the financial information from those filings be first available through the PitchBook/BVR Guideline Public Company Comps Tool?

A: The data will typically be available within one week after the document is filed with the Securities and Exchange Commission.

Q: I am trying to manually calculate the reported Market Cap value. I am multiplying the reported Total Shares Outstanding by the reported Stock Price, but the results are different than the reported Market Cap.

A: The reported Total Shares Outstanding figure is the aggregate total of all of the company’s outstanding shares for each of their share classes. The reported Stock Price is the per share price of the company’s primary share class. As a result, multiplying Total Shares Outstanding by the Stock Price will not equal Market Cap when the company has multiple types of outstanding share classes.

So, ultimately, the calculation for Market Cap is: (Share class A shares outstanding * Share class A share price) + (Share class B shares outstanding * share class B shares outstanding) + (share class C…..)

Because the Total Shares Outstanding figure is not broken out by share class, and only the primary share class price is presented, the user cannot manually recreate the provided Market Cap value.

Q: Which indexes are used when calculating Beta?

A: The following indexes are used to calculate Beta for the corresponding countries:

- Australia - S&P/ASX 200

- Austria - Austrian Traded Index in EUR

- Belgium - STOXX Europe 600

- Brazil - Índice Bovespa

- Canada - S&P 500 Index

- Switzerland - Swiss Market Index

- Chile - Bolsa De Santiago IPSA Chile

- China - SSE Composite Index

- Cyprus - CSE General Index

- Germany - BEL 20

- Denmark - OMX Copenhagen 20

- Spain - IBEX 35

- Finland - OMX Helsinki 25

- France - CAC 40

- United Kingdom - FTSE 100 Index

- Greece – Athens Stock Exchange General Index

- Hong Kong - Hang Seng Index

- India - BSE SENSEX

- Ireland – ISEQ Overall Index

- Iceland - OMX Iceland All-Share PI

- Italy - FTSE MIB

- Japan - Nikkei 225

- Korea, Republic of – KOSPI

- Mexico – BMV INMEX

- Malaysia – KLSE Composite Malaysia

- Netherlands – AEX index

- New Zealand - NZX 50 Index

- Philippines - FTSE All-Share Index

- Portugal - PSI ALL-SHARE GR

- Sweden - OMX Stockholm 30

- Thailand – SET PR THB

- Taiwan - TSEC weighted index

- USA - S&P 500 Index

- South Africa - FTSE/JSE Africa Top40 Tradeable Index

- Singapore - Straits Times Index

- Russia - MICEX 10

- Romania - Bucharest Stock Exchange Trading Index

- Norway - OBX Total Return Index

- Luxembourg - LuxX Index

Q: Are users able to verify their search results? Are users able to easily get access to more information for the companies in their search results?

A: Yes. All the data have been captured from the Securities and Exchange Commission website, and the Tool provides easy access to the source documents. The financial figures in the search results, such as the numeric value for Revenue or Gross Profit, are hyperlinked to the original public filing at the Securities and Exchange Commission website. To verify a number, click on it and you will open the original filing where the number was reported.

Also, a user can click on the name of any guideline company in their search results to be taken to a page dedicated to extensive information about that company, including all recent news, deal activity, company information, recent investment activity, executives and their contact information, key metrics and stock price history.

Q: Can the PitchBook/BVR Guideline Public Company Comps Tool be used to gain information on companies that have delisted (are no longer actively traded)?

A: Yes. On the search page, check the box for "Include Inactive Companies (No longer actively traded)". This box is located towards the bottom of the search page.

Q: If users wish to search by industry, do they have to use SIC codes, or is there an alternative?

A: Users can search by SIC code if they choose, or they may search by PitchBook industry classification. Each public company who has ever filed with the Securities and Exchange Commission has been assigned a PitchBook industry classification so a user can easily retrieve companies in a manner that is more intuitive and user-friendly than using an SIC code search.

Q: Can searches be saved, so a user can return to the results later?

A: Yes. After a user conducts a search and receives the results, they can select the "Save Comparables" option in the upper right side of the screen. From there, the search can be named and saved.

Q: Can the search results be exported into Excel?

A: Yes. The results can easily be exported into Excel using the "Download" option in the upper right side of the screen.

Q: When searching for guideline companies using their name or ticker symbol, should I enter them all at once into the "name/symbol" field, or should I enter them one at a time?

A: One at a time. The Tool was created with an autosuggest feature. This allows users to easily find the company they are looking for by name or ticker symbol if they do not know or can't remember the full name or ticker symbol. As a result, it is best to enter each company individually into the "Name/Symbol" field.

Q: It appears that, at times, enterprise value is not available for my guideline companies. Why is this?

A: The service utilized to pull financial data does not capturing the weighted average shares (basic & diluted) when these are disclosed in the footnotes. Since these values are used to calculate the enterprise values, they will be missing. As an alternative, users should be able to find and use the Enterprise Value -TSO which are almost always available and use the TSO (total shares outstanding) for the calculations.

Q: Which enterprise value definition is being used in the EV/Revenue TTM definition? Is it enterprise value - TSO (total shares outstanding), enterprise value - FQ (fiscal quarter end), or enterprise value FY (fiscal year end)?

A: The Enterprise Value that is used in the EV multiples (without the TSO) is either the enterprise value, FY or enterprise value, FQ - both of these use Diluted Basic Average Shares as of the end of the selected period, whichever that period may be- the year or quarter.

The enterprise value that is used in the EV-TSO multiples (with the TSO) is the enterprise value - TSO.

Q: Is it possible to have data fields reported as of a certain date?

A: Yes. On the "Peer Group" tab, a user can specify an "As of Date," and all the data fields on that page (such as enterprise value) will be calculated as of the user's specified date. If a user wishes to add additional data fields to the "Peer Group" tab, the user can select the "+ Add Columns" option to add any additional desired fields.

Q: What date does the "As of Date" use when a date is selected?

A: If there are data for that date, then that is the date that is used. If not, the tool uses the closest date prior to this date for financials, stock price, etc.

Q: Is it possible save my results with a certain "As of Date?"

A: Currently, selecting the option to save your comparable companies will return the "As of Date" to today's date. One option is to specify your "As of Date," then export the data to Excel using the "Download" option in the upper-right corner. This will download your comparable companies into Excel with your specified "As of Date."

Q: Where does the international (none-U.S.) data come from?

A: Morningstar is scrubbing SEC filings and PDF reports from companies.