|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, IVSC, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

The High Court allows service of financial damages claims by ‘NFT’

The Law Commission’s new Consultation Paper on Digital Assets, published on 28 July 2022, gives victims of crypto-asset fraud a means of direct action against exchanges who are in possession of those fraudulently obtained assets. A High Court case granted a first order under the Law Commission’s guidance permitting service of proceedings via a nonfungible token (NFT). This paves the way for victims of crypto-asset fraud to use novel technology to bring damages claims against unknown persons and also to attempt to reclaim their stolen crypto from any constructive trustees.

In D’Aloia v Person Unknown & Ors [2022] EWHC 1723 (Ch) (24 June 2022), the claimant’s financial experts had demonstrated that the claimant had been victimised by “unknown persons” behind a fraudulent website with the name www.tda-finan.com. The site appeared to investors to be part of the TD Ameritrade brokerage system. The claimant also filed claims against the crypto exchanges where the fraudulently obtained assets were transferred as “constructive trustees.”

Most of the exchanges were located outside of the UK, but the High Court froze the assets, arguing that the misrepresentations were made in England and the rightful owner of the assets was located here.

While the English courts have previously granted permission to serve proceedings by digital methods (including e-mail, Instagram, and Facebook), this is the first time that permission has been granted for service by NFT. |

|

SME deals slow dramatically, and valuation multiples drop

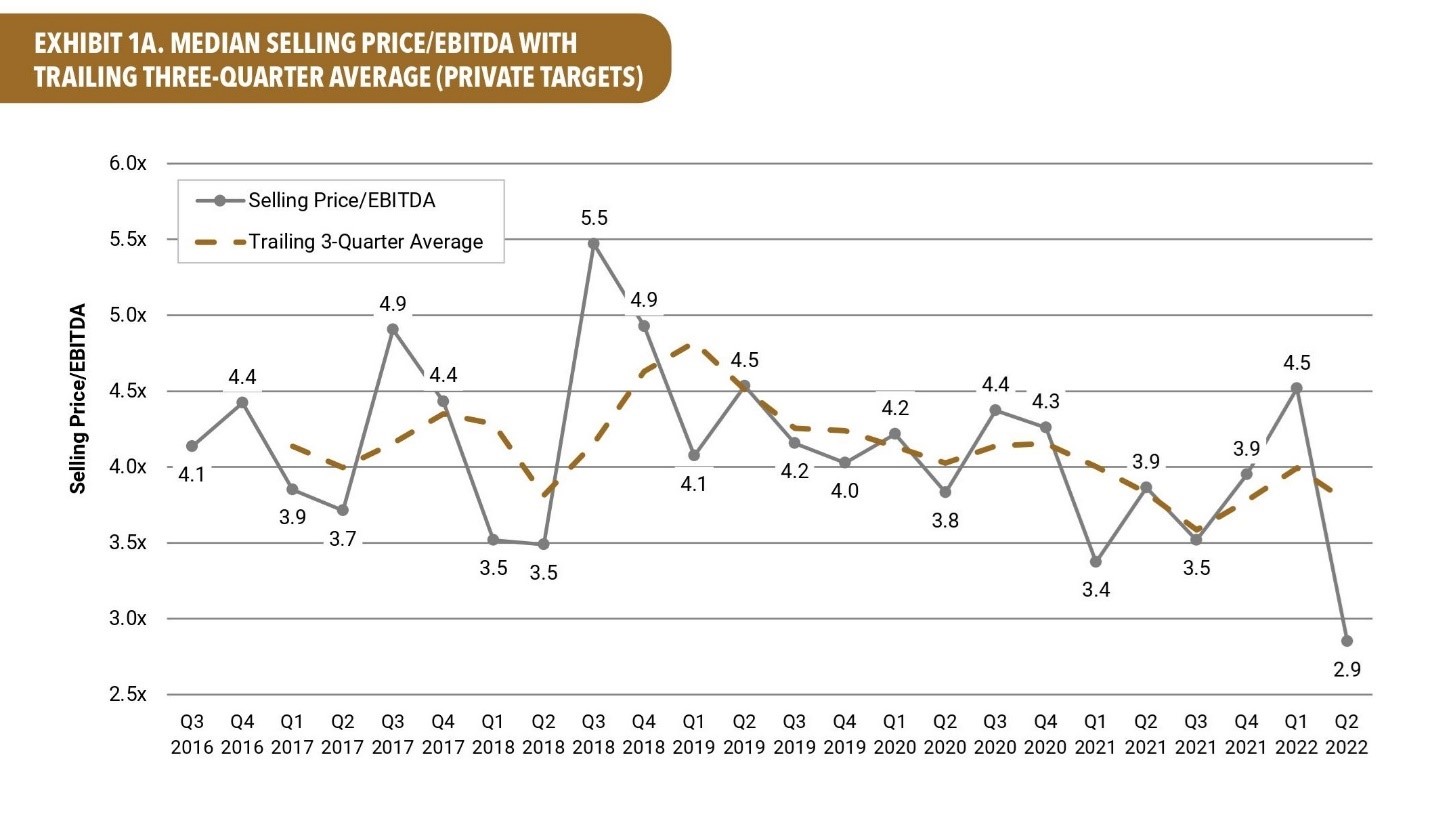

BVR’s latest DealStats Value Index (DVI), which reports deal values primarily for small and medium enterprises, confirms a significant reduction in business value for the quarter ending 30 June 2022. DVI reports EBITDA multiples are at 2.9x, which is down from the 4.5x rate in the first quarter of 2022. The DVI calculates valuation multiples and profit margins from closely held companies each quarter, as shown in the chart below. The index always reports lower multiples than other sources, which report on transactions financed by private equity or listed company only. The chart also highlights the median selling price/EBITDA with the trailing three-quarter average over a five-year period.

|

|

CapIQ acquires 100% stake in Private Market Connect

SPGI, the parent company of CapIQ, bought the remaining half of Private Market Connect (PMC) last week. This source of market data was already included in the expensive CapIQ data set, so there should be little difference to business valuation experts who already subscribe to SPGI private market data.

PMC competes with other data sources from Refinitiv/LSEG and the Association for Corporate Growth (GF Data). It reports average transaction multiples for deals completed by PE firms and their investors. It is primarily used by these same general and/or limited partners as a pricing benchmark in this sector. The company uses a large staff in India to refine and improve the limited financial information available on PE firm websites and other sources such as Companies House. |

|

Dates for your diary

6 September (today): ICAEW Practical Business Valuation, four days, virtual classroom (repeated 1 December)

13-15 September: IVSC Annual General Meeting, Fort Lauderdale, Fla.

15-16 September: ICAEW Advanced Valuation Techniques, virtual classroom (repeated 2-3 November)

21-22 September: RICS Northern Europe Real Property Valuation Conference 2022, online

27 September: ICEAW Annual Business Valuation Conference, virtual, 9:15-17:15

28 September: Kroll Webinar on Cost of Capital in the Current Environment, online, 16:30

3-5 October: 12th Annual International Valuation Conference, Riyadh, Saudi Arabia

19 October: Society of Shares & Business Valuers How to Lose at the Tax Tribunal With David Bowes, London and virtual, 17:30 BST-19:00 BST

10 November: Prevailing in an Unpredictable Market: The 15th Annual Houlihan Lokey Alternative Asset Valuation Symposium, New York City

14-16 November: CIMA and AICPA Forensic & Valuation Services Conference, Las Vegas

7 December: Society of Shares & Business Valuers’ Causation and Financial Losses: Factors to Consider With Prem Lobo, London and virtual, 17:30 BST-19:00 BST |

Want to share a news item? Have feedback or comments? Please contact

David Foster at ukeditor@bvresources.com. |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2021. All rights reserved.

|

|