|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

What is control worth? New update from BVR/FactSet

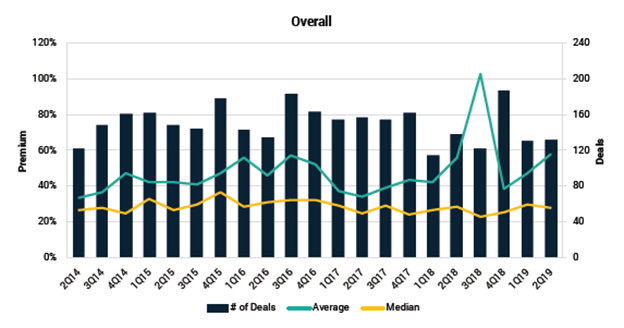

The median price paid for the benefit of acquiring a controlling interest dropped slightly, to 26.5%, during the second quarter, according to data from the FactSet/BVR Control Premium Study. Median premia were much higher, as usual, due to a few well-publicised private equity acquisitions, as shown in the table below, which includes the number of completed deals, as well as the average and median control premiums, from 2Q 2014 through 2Q 2019.

These averages tend to understate the value purchasers are willing to pay for control of UK business assets and for most transactions outside of North America. However, for the 2nd quarter, control premia outside North America also dropped slightly, to approximately 27%, down from 30% on transactions in the preceding quarter. Similar to most economic indicators, Brexit anxieties may play a role in this downward trend.

Click here to view full size image

|

|

Study on abandoned mergers and acquisitions identifies areas for process of improvement

Business valuers must recognise the risks associated with failed business deals. In fact, a new study from McKinsey confirms that one of 10 large merger and acquisition deals fails to close, often causing significant harm to both proposed buyers and sellers. The study, by Gerd Finck, Roerich Bansal, Marjan Firouzgar, and Dariush Bahreini, identifies disagreements on value and potential value creation as the main problem (42% of the failed deals were halted for this reason), followed by regulatory hurdles and political issues as the most common causes of abandoned mergers and acquisitions transactions. (The authors recommend approaches for deal transparency, mutual bargaining, and active political landscape monitoring as the best ways to minimise this risk factor.)

Other factors for deal failure are also familiar, ranging from activist investor opposition to corporate leaders second-guessing synergies.

The study analysed 265 cancelled deals. Among the findings that may help valuers understand M&A risk characteristics are the following:

- Generally, the larger the transaction, the more likely it was to fail. Transactions greater than 10 billion euros failed twice as often as deals valued between 1 billion euros and 5 billion euros.

- ‘Whenever possible, simpler structures for transactions should be favoured over more complex ones,’ the authors conclude, suggesting that one way to improve closing success was to work in all-cash or all-share terms.

- Speed helps. Shorter closing cycles mean fewer abandoned transactions.

|

|

New economic report from ICAEW

The dour tone of the latest economic report from IAECW won’t surprise business valuers. The report, a necessary tool for valuers since most valuation standards require that each report contain a summary of general economic conditions, says simply: ‘[B]usiness investment [in the UK] falls back into contractionary territory.’ The study cites a 0.5% drop in business investment, potential overstatements of growth caused by the implementation of IFRS 16 (and its new requirements on how to measure fixed assets), and low BCM Confidence Index as some key ‘big picture’ elements indicating continued declines for the remainder of the year. |

|

Goodwill should not be a 'wasting asset'

Goodwill has resurfaced as a valuation topic globally this year, so much so that the IVSC’s first article on the subject, ‘Is Goodwill a Wasting Asset?’ has been downloaded thousands of times already. The IVSC plans two more articles on this subject due later this fall. BVWire—UK highly recommends this thoughtful first analysis, available free.

BVWire—UK’s discussions with many business valuers indicate that many in the profession think proposed changes to acquisition accounting are bad for investors, the clarity of financial reporting, and even the integrity of the audit process. There’s also suspicion in some circles that the changes are motivated by a desire of the auditors at the Big Four to do less work, particularly as they absorb changes in leasehold accounting and elsewhere required by new IFRS schemes effective this year.

From the valuation profession, there are serious concerns that the concept of amortisation of goodwill (rather than impairment testing) is not compatible with the principals of business valuation. As simply stated in the IVSC discussion paper, ‘If one were to assume goodwill is a finite lived and wasting asset, it would be inconsistent with the premise of going concern inherent in the consideration paid to acquire nearly all businesses’ (the IVSC sees one possible exception being businesses comprised nearly entirely of tangible assets).

BVWire—UK has heard less polite comments on the contradictions inherent in amortising goodwill. Some complaints:

- Acquired assets assigned to goodwill will be the only amortised asset (‘why not amortise the Apple stock you bought last month?’ one business valuer asked).

- Amortisation assumes a finite life of acquisitions, such as 15 years. Several of our readers have commented that there’s nowhere else in valuation or finance theory where assets have finite lives.

- The users of financial statements aren’t asking for this change, and in fact many are concerned that this step removes a valuable ‘early warning’ sign for investors concerned about problem acquisitions. It’s noteworthy that the CFA Institute is responding to international accounting standards-setters and the U.S. FASB with the position that their members (the investors) depend on current systems of acquisition asset impairment testing.

- The discipline required to review acquisitions with an eye toward potential impairment is beneficial to corporate leadership. One BVWire—UK reader who works for one of the largest audit firms said she feels that impairment testing issues bring nonfinancial executives into the audit process, creating valuable alignment.

- Business valuation, built on its assumptions of ‘going concern’ and ‘terminal value,’ looks longer term, which counters the prevailing tendencies that often focus on the most recent quarterly report. Amortising goodwill would eliminate this balance between short-term goals and strategic results.

- Synergies in acquisitions often appear in the goodwill allocation. But no analyst looks at a deal and thinks that synergies will sunset. ‘If you project a 2% cost savings, that synergistic benefit will continue indefinitely. They don’t go away and they aren’t finite lived,’ one valuer told BVWire—UK. They continue into perpetuity.

- It appears that the debt issuers—whether banks or private capital—generally support continuing the current practice of testing assets.

|

|

How should business valuers measure country risk when revenues originate outside of the UK?

Aswath Damodaran (New York University Stern School of Business) continues to provide country risk comparisons on his website. His latest midyear 2019 update includes free spreadsheets on country risk premiums, sovereign credit default swap (CDS) spreads, corruption scores, political risk scores, and more. The UK, of course, scores relatively well on many of the risk measurement factors Damodaran reviews.

Many of his sources are not well known within the business valuation profession. For instance, he factors in interesting perspectives such as:

- Dependence on commodities, from the United Nations Conference on Trade and Development (UNCTAD);

- Legal risk to property rights;

- The Global Peace Index, from the Institute of Economics and Peace;

- Relative corruption scores, from Transparency International;

- Other country risk services, available from the Economist, the World Bank, and the PRS Group, for example (Ireland scores as one of the least risky countries in the current PRS ranking);

- Sovereign ratings from the usual sources (Moody’s, S&P, Fitch); and

- Credit default and equity risk comparisons, from Bloomberg.

Damodaran continues to stress that risk is not a factor of where a company is incorporated, nor where it’s traded; what matters is where it gets its revenue. Analysts must consider country risk premia as a way to adjust either the cash flows or the discount rate when reviewing the sources of revenue, he argues. |

|

Dates for your business valuation diary

IVSC Annual General Meeting and IVAS/IVSC Business Valuation Conference, 7-9 October, Singapore

ACG UK Chapter Trends in Alternative Capital, 15 October, London

ICAEW Excel Modelling—Investment Appraisal, Valuation and Business Cases, 18 October or 15 November, London

ICAEW Annual Business Valuation Conference,

23 October, London

ICAS New April 2019 Corporate Insolvency Rules for Scotland course, 31 October, Glasgow; 1 November, Aberdeen; 7 November, Edinburgh; 15 November, Perth

ICAEW Forensic and Expert Witness Conference,

7 November, London

UK200 Group Annual Conference,13-15 November, Liverpool

ICAEW Practical Business Valuation, 11 and 25 November, London |

Our thanks to Andrew Strickland and Marianne Tissier for their valuable contributions to BVWire—UK.

Interested in working with BVR in the UK as a partner or ambassador?

Want to share a news item? Have feedback or comments?

Please contact David Foster (Executive Editor) at:

ukeditor@bvresources.com or +011-917-741-3853 |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2019. All rights reserved.

|

|