|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, IVSC, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

Growth of UK employee ownership trusts accelerates in 2021, thanks to HMRC valuation rules, clarity on capital gains status, and continued social benefits

The government introduced employee ownership trusts in 2014, with more than half of them launched since 2018. A number of business valuation firms, including the Big Four, RSM, and RM2 Partnership, have strong established specialisations in employee ownership trust plans, and various groups, including the White Rose Centre for Employee Ownership and the Employee Ownership Association, provide extensive research on developments. Even Aardman Animations, the creators of Wallace & Gromit, switched to this new model (in 2018).

The sharp increase in appetite has continued into 2021. A sample of new trusts include:

- Swindon-based F1 supplier Retrac Group’s EOT took full equity of the Swindon-based company from chairman Andy Carter (ICON Corporate Finance and Shawbrook Bank advised and financed the transition);

- Purcell Architects, with studios in the UK, Hong Kong, and Australian, launched their EOT at the beginning of this month; and

- West Yorkshire rental company Horizon Platforms has announced that ownership of the company will transition from founders and majority owners Ben Hirst and Ruairi Duggan. RSM advised Horizon on structure, tax, and valuation issues.

Just last month, PwC joined the Employee Ownership Association, “after seeing the continued growth of businesses becoming employee owned via an employee ownership trust (EOT) … despite the pandemic.” PwC has already been involved in a number of EOT transactions including advising on tax, valuations, structuring, modelling, legal, debt advisory, employee communications, and governance. Dan Harris leads the PwC EOT team.

The largest EOT in the UK, which includes over 83,000 employee owners, is the retailer John Lewis Partnership. According to RM2 Partnership, Matt MacDonald Group (engineering), Arup Group (design and engineering), Greenwich Leisure (facility management), and Unipart Group (logistics) comprise the top five EOTs. Greenwich’s plan is new in 2021. |

|

CalcBench analysis shows IASB (and everyone else’s) efforts to clarify intangibles reporting hasn’t helped—yet

Many business valuers struggle to make sense of financial statement data from listed companies—never mind The Companies House. The lack of clarity in financial statements—particularly the sections business valuations influence—has been a common topic at ICAEW sessions and elsewhere. One can only wonder whether these statements are of any use to your clients or investors lacking extensive training in financial analysis.

Calcbench, the New York City-based market data and research firm, released a new report analysing how firms in the S&P 500 reported their adjusted earnings—and which adjustments accounted for the largest gaps between GAAP and non-GAAP statements. The differences can lead to opposing interpretation of results at a fundamental level, no matter whether you’re analysing statements from a small enterprise or an FTSE large cap.

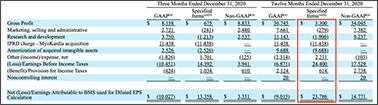

The CalcBench report offers a spectacular 2020 example of the problem: Bristol Myers Squibb. The company reported a $9 billion loss for 2020 and then added back another $23.78 billion in various adjustments—for a non-GAAP adjusted net income of $14.77 billion, as shown in the analysis below. While there are small adjustments to operating expenses, nearly all these changes have to do with the treatment and valuation of intangibles.

No small matter: BMS is not alone among the large S&P 500 firms but the highlights of the CalcBench study (download the complete report from the Calcbench Research Page) include:

- The non-GAAP net income the CalcBench sample group reported exceeded GAAP net income by $132.3 billion. This is more than double the total reported GAAP net income of $130.7 billion.

- The sample group made more than 240 adjustments to GAAP net income.

- Amortisation of intangibles was the single biggest category of specified adjustments, accounting for 30% of all adjustments.

Traditional investors can turn to the London Stock Exchange to see market pricing of listed company assets, but the sheer volume and degree of assumption built into many family business financial statements remains a critical challenge for the trustworthiness and skill of the business valuation profession. The regulators are not helping.

|

|

A new proxy for business value you probably won’t want to use

Last week, S&P Dow Jones Indices (S&P DJI) launched its new series of digital asset benchmarks. They are:

- S&P Cryptocurrency MegaCap Index (measures the performance of Bitcoin and Ethereum combined. Later this year, the S&P indices series will include additional coins).

These aren’t your grandmother’s FTSE nor are these particularly similar to the first global index Charles Dow created in 1884—in part because the appeal of cryptocurrencies to investors is they operate outside the parameters of traditional business assets and expensive financial institutions.

As such, while we can expect currencies to start promoting their returns as “top quartile vs the S&P benchmark,” they are not useful tools for the audit or business valuation profession. They do not reflect economic conditions or cost of capital assumptions for closely held businesses.

Nonetheless, the market for cryptocurrency assets continues to grow, new currencies are announced almost daily, and many UK investment banks are now getting involved. Peter Roffman, global head of innovation and strategy at S&P Dow Jones Indices, believes these markets need customized “indexing solutions.” He says, “[A]s cryptocurrency becomes more mainstream, investors now have access to reliable and transparent benchmarks backed by institutional quality pricing data.” Yes, but BVWire—UK assumes it will be some time before we see a digital index quoted in a valuation analysis submitted in support of a business dispute or fiscal matter. |

|

Will the future IVS support the growing importance of business valuation?

Since January 2020, the IVSC have solicited feedback on the most urgent standard-setting priorities to help the valuation professions. Last week, they released the results and the long list of professional organisations, academic institutions, regulators, and valuation firms who responded.

About 50 formal responses were received as a basis for confirming an IVS gap analysis. The majority of the respondents were from organisations such as RICS or the Appraisal Institute in the US whose mandate is primarily real property valuation. Not surprisingly, the summary priorities favour automated real property valuation methods, personal property, and analysis of commercial lease transactions.

For business valuation specialists, the short, medium, and long-term priorities that emerged may be a bit dispiriting. For instance, critical topics for BV, including discounts and premia, cost of capital, early-stage businesses, goodwill, the income approach, transfer pricing, risk and material uncertainty, and IP valuation, were added as afterthoughts and do not appear directly on the priority list of IVSC projects. These topics were “reviewed,” and it was determined that many “could be incorporated into existing topics.”

Instead, the BV topics that received the highest immediate prioritisation were contingent considerations (essential), internally generated intangibles (important), negative interest rates (topical but perhaps not worthy of standards?), and workforce valuation (questionable).

As usual, even within the business valuation profession, the future work of the IVSC has a decidedly financial reporting perspective. Financial analysts who work with family and small enterprises shouldn’t expect a lot of new guidance from the IVS if this new proposed agenda is approved.

No pure BV topics ended up on the list of medium- or long-term priorities.

You can download the IVSC Proposed Agenda & Summary of Responses here. |

|

Virtual Damodaran valuation courses available

via IMAA

The Institute for Mergers, Acquisitions and Alliances (IMAA) has announced a series of virtual valuation training courses led by international valuation expert Professor Aswath Damodaran—Kerschner Family Chair Professor of Finance at the Stern School of Business at New York University.

The course includes four three-hour sessions and is live online. Registration for the Damodaran course is available now. Members of IVSC-aligned organisations (such as RICS) are offered a 10% discount for the courses, which begin 25 May through 28 May, by using the discount code IVSC10 at registration.

The course will be repeated 13-16 September and 8-11 November. |

|

Company resources may not be used to fund strictly intershareholder dispute

In a new case, Koza Ltd v Koza Altin Işletmeleri AS [2021] EWHC 786 (Ch), the High Court held that the finances of a company could not be used to fund what was effectively litigation by one shareholder against another.

Koza UK’s share capital consisted of 60 million ordinary shares Koza Altin, a listed Turkish company, held and two “A” shares a Mr Ipek and his brother held.

Eventually, a dispute arose between Koza Altin and Mr Ipek. Koza Altin tried to convene a general meeting to remove Koza UK’s board, of which Mr Ipek was the sole director, but Ipek refused (and sought an injunction to prevent the meeting). The central question was whether Ipek was entitled to finance the proceedings with Koza UK’s cash and resources.

What did the decision conclude? The court agreed with Koza Altin and emphasised that the key question was whether a claim is brought in good faith in the interests of a company, or rather is advanced as a response to a shareholders’ dispute. In this case, the company was not the “genuine protagonist” but instead was “merely an object” of the dispute between the “A” shareholders.

This conclusion is of interest to business valuers for the following potential reasons that affect noncontrolling discounts:

- How powerful are “veto rights” compared to other shareholders?

- May a controlling shareholder simply treat a company as its own and use that company’s resources to fund its own litigation?

- May directors commit company resources to ongoing litigation unless they can prove that a successful result will improve the performance of the company?

|

|

Dates for your diary

17 May: IVSC Coming Out of Lockdown: The Post-Pandemic Economic Environment and Its Impact on Valuation, 13:00-14:30 (BST) 20 May: ICAEW Virtual Valuation Conference, 8:55-16:00, virtual

20 May: ASA First Complex Securities Conference, 16:00-22:40 BT, virtual

20 May: IVSC's Valuation and the Rise of Alternative Investments, 14:30-16:00 (BST)

21 May: IVSC's The Treatment of Operating Leases Under IFRS and U.S. GAAP—Valuation Considerations, 15:00-16:30 (BST)

25-28 May: Damodaran on Valuation, live-online (repeated 13-16 Sept and 8-11 Nov)

26 May: IVSC Putting Value at the Core of ESG, 12:00-13:30 (BST)

27 May: IVSC What Will LIBOR Cessation Mean for Valuation? 12:00-13:30 (BST)

14-15 June: ICAEW Advanced Valuation Techniques, virtual classroom taught live by Steve Shaw

21-25 June: NACVA Business Valuation and Financial Litigation Hybrid and Virtual Super Conference

24-26 October: ASA International Conference, Las Vegas

27-29 October: IVSC Annual General Meeting (programme and format information to come)

|

Want to share a news item? Have feedback or comments? Please contact

David Foster at ukeditor@bvresources.com. |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2021. All rights reserved.

|

|