|

|

BVWire—UK is a free service from BVR focusing on the business valuation profession in the United Kingdom. We offer news and perspectives from valuation thought leaders, the High Courts, HMRC, the standard-setters, ICAEW, RICS, IVSC, and more.

Please be in touch with your perspectives, news, and ideas—and pass this issue along to colleagues (complimentary sign-up instructions are here).

|

Valuations that rely on the income approach often overstate implied exit multiples

Debate continues on the tendency to overstate growth rates and exit multiples when calculating the terminal value component of a multiperiod DCF. This is particularly important for business valuers in the UK, where limited SME transaction comparables are available.

The January issue of Business Valuation Update points to two discussions of terminal-year value. First, Jim Hitchner (Financial Valuation Advisors Inc.) supports the use of exit multiples on the terminal year of a DCF model in his recent Hardball With Hitchner but argues that “[m]istakes happen when analysts don’t consider the reasonableness of the implied long-term growth rate embedded in the selected exit multiple.” Current growth projections are rarely maintained into perpetuity, though many forecasts—and business owners—claim that they will.

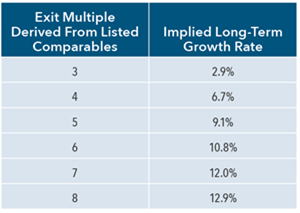

In fact, both the growth rate and the valuation date multiples calculated at the valuation date “nearly always need to be reduced” because of the increased risk and uncertainty of cash flows in the future (typically, three to five years in many DCF analyses), Hitchner states. It’s extremely rare that any company exceeds the economic growth rate in perpetuity after five years, so, referring to Hitchner’s analysis, a growth rate assumption implied by an exit multiple higher than 3 would seem optimistic.

Hitchner offers the above table of the long-term growth rates to support exit multiples of 3 to 8. A multiple of 3 supports the most common long-term growth rates for small businesses—but no M&A advisor, focused on investment value, would be happy with a multiple below 6 times EBITDA.

Hitchner points out that higher assumed exit multiples create the situation where “the terminal value is higher than the present value of the interim cash flows.” In these valuations, the single biggest determiner of value in a DCF analysis is the financial expert’s terminal growth rate assumption.

Another take: The Footnotes Analyst also examined the problem of using exit multiples in a series of recent articles. “If a valuation multiple, such as EV/EBITDA, is used to calculate a DCF terminal value, the multiple should reflect expected business dynamics at the end of the explicit forecast period and not at the valuation date,” the authors say. “This is best achieved by basing the exit multiple on forward-priced multiples for the selected group of comparable companies,” which they demonstrate with a series of examples. They also provide a downloadable model that business valuers can use to calculate their own DCF terminal values using forward-priced multiples.

The authors also discuss the choice of multiple, including why EV/EBITDA may not be the best. “In our view, this multiple has serious shortcomings due to the exclusion of depreciation and taxation. Effective tax rates and particularly capital intensity (the level of maintenance capital expenditure relative to other operating expenses) can vary considerably, even amongst companies in the same peer group.”

They believe it is “best to build the differences in capital intensity in the multiple used. This means using EV/NOPAT or, even better, use an adjusted form of NOPAT in which the depreciation is replaced by estimated maintenance capital expenditure.”

As to whether to apply the exit multiple to reported or adjusted profit, the authors conclude: “Profit forecasts used in DCF terminal values should be based on GAAP not non-GAAP performance, except that you should exclude amortisation of ‘replacement-expensed’ intangibles, unless making comprehensive adjustments to capitalise all estimated intangible investment.” |

|

EU study shows continued confusion among business leaders about business valuation standards

IVSC have made available a study on how business leaders perceive the valuation profession and particularly its evolving standards. Almost three-quarters (72%) of finance executives around the world believe there are material inconsistencies and/or contradictions between the various business valuation standards currently in use globally, the study, published in Bewertungs Praktiker, concludes.

The study was led by three academics, all of whom are members of the International Valuation Standards Council’s Europe Board: Dr. Marc Broekema, assistant professor at the Department of Business Studies, Leiden Law School of the Leiden University; Dr. Olesya Perepechko, lecturer at the Great St. Petersburg Polytechnic University; and Professor Klaus Rabel, a professor of business valuation at the University of Graz. Their final sample consists of 196 participants from 32 different countries across all continents.

The business valuation profession have taken huge steps toward global standards harmonisation in the last five years particularly, but this study suggests that, lacking a single source, the business community remains ignorant of this progress. IVSC and BVWire—UK note that the study does not mention the detailed comparison that has been made of the global valuation standards that concludes that they do not conflict with each other. The new study includes a comparative chart of current international business valuation standards, and here’s an additional point-by-point comparison of the different U.S. business valuation standards. |

|

Updated KPMG fair value guide reflect changes in projections and discount rates

KPMG have update their free guide designed to help UK financial experts apply the principles of IFRS 13 Fair Value Measurement and ASC Topic 820 Fair Value Measurement and understand the key differences between them. The update highlights those components of valuations done for financial reporting that have drawn the most attention from FRC and international regulators. “Valuation practices continue to evolve, partly as a result of standard-setting activities and partly because of the increasing attention being paid to how climate-related risks (and opportunities) and reference rate (IBOR) reform affect the components of a valuation—e.g., cash flow projections and discount rates,” says KPMG.

|

|

Looking back: take special care when determining minority discounts

An article by Andrew Strickland and Bob Dohmeyer, originally published in Business Valuation Update, has become the basis of a new business valuation training course developed for the US-based group NACVA.

The course considers the “Misuse of Bid Premium Data to Determine Minority Discounts.” One example of this misuse Strickland and Dohmeyer prepared compares the control status of three different small enterprise;

- Company A—Diverse shareholder group, no subgroup has control, management team has no control, like a public company, no discount for lack of control required, liquidity discount required.

- Company B—Control resides with management, company is run optimally, no evidence that minority shareholders receive a minority rather than a majority of cash flows. If this situation continues, no discount required if tenuous and might not continue. A minority discount should be applied. DLOM required.

- Company C—Control resides with management, take advantage of perquisites of control, with enhanced compensation, employment of ineffective family members, minority shareholder has no access to majority cash flows, minority holding should be determined by reference to minority cash flows but no further need for a discount.

Each of the three companies has a different minority discount perspective. “As can be seen, one of the most difficult areas of BV is to value fractional interests in private companies,” the authors concluded in BVU. |

|

Dates for your diary

17-18 February: ICAEW Advanced Valuation

Techniques, virtual classroom

29-30 March: IPBC Europe IP Value Creation Conference, London

12-20 April: ICAEW Practical Business Valuation, virtual classroom Repeated 21-29 June

14-16 September: IVSC Annual General Meeting, Fort Lauderdale, Fla.

3-5 October: 12th Annual International Valuation Conference, Riyadh, Saudi Arabia

Want to share a news item? Have feedback or comments? Please contact David Foster at ukeditor@bvresources.com. |

Want to share a news item? Have feedback or comments? Please contact

David Foster at ukeditor@bvresources.com. |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201 U.S.A.

+011-503-479-8200 | info@bvresources.com

© 2021. All rights reserved.

|

|