Top questions valuators should be prepared to answer when valuing a healthcare business

In BVR’s recent webinar, The Devil in the Valuation Details: Top 10 Questions Lawyers and Healthcare Organizations Ask, experts Jessica Stack and Denise Palencik (both of Veralon) covered the top 10 questions that valuation analysts should be prepared to answer when valuing a healthcare business. These questions ranged from the basics, such as “Why do I need a fair market value opinion?” to “Why does the valuator need to consider all aspects of a transaction rather than just the component for which they’ve been engaged to provide an opinion?” Here, we summarize five of the questions and answers. For more information, be sure to check out the complete recording and transcript of the session.

1. Why do we need a fair market value opinion?

The healthcare industry is highly regulated, and some of those regulations specifically refer to fair market value compliance. Stark Law governs all physicians and requires, under certain exceptions, that transactions be at fair market value as well as commercially reasonable. The Anti-Kickback Statute governs all providers and directs them not to receive incentives to refer business. Private inurement applies to many clients because our health systems are 501(c)(3) entities and we must be sure they are not overpaying for individuals who are key to the organization. Lastly, there is the state fee-splitting law where many states have corporate practice of medicine doctrines that govern some of the unique arrangements you might put in place prohibiting nonphysicians from profiting from medical services.

2. When should we hire valuators? What is their role and responsibility?

Coming back to compliance, there is a risk factor to healthcare valuation engagements. It is not the same as valuations for the IRS and reporting for tax purposes; a valuator is giving a level of protection to the hospital so it knows that it has a third party who is objectively evaluating the deal and stating, in a formal deliverable, that the transaction is consistent with fair market value. This is the primary reason clients hire a valuator. Ultimately, though, the hospital is liable. Regardless of what opinion the valuator provides, and the advice a legal team gives, when there are enforcement actions, it is the hospital and sometimes the physicians that are on the hook. However, it doesn’t mean that valuation and legal professionals don’t take their jobs seriously. We are in partnership, and we never want to support clients in a way that would lead them into trouble.

3. Why can’t a valuator provide a quick answer based on summary data?

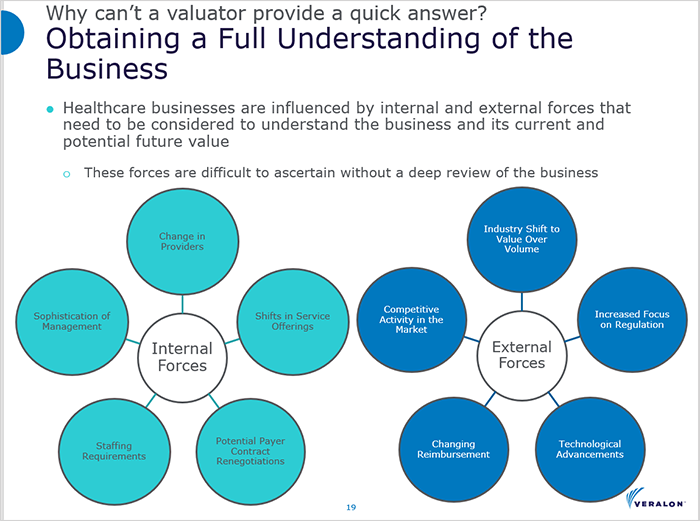

Providing a valuation conclusion requires a complete understanding of the business itself. This includes not only internal forces of the business, but external ones as well. Sometimes, it can be very time-consuming, difficult, and complicated to get your arms around all these different factors in a short time frame. The slide below shows some factors that a valuator should consider when preparing a valuation conclusion.

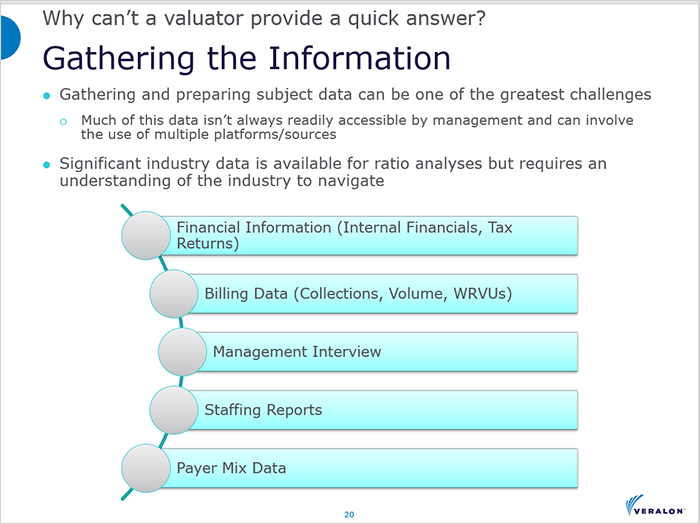

Gathering the necessary information can be one of the greatest challenges. Much of the data aren’t always readily accessible by management and may need to involve the use of multiple platforms and sources. The slide below covers some of what a valuator needs to perform a valuation in this industry.

4. Why is it important to review such detailed information, including billing reports?

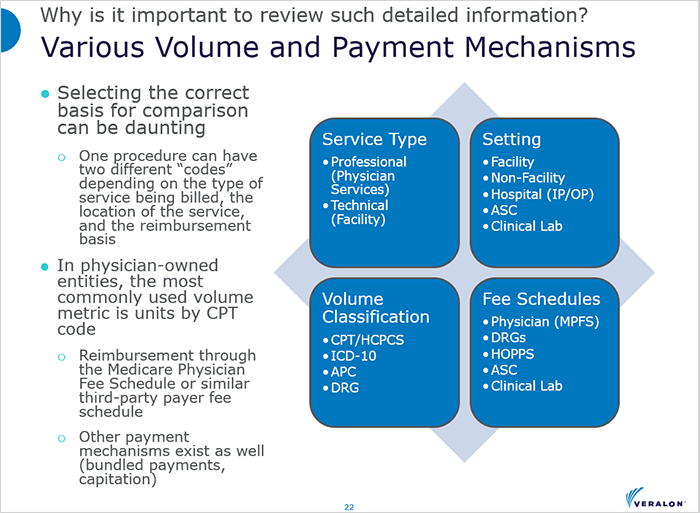

The healthcare industry is very complex and fragmented. Generally, when working on a healthcare-entity valuation, valuators are instrumental in preparing the financial projections. They are not just reviewing management-prepared financial projections. They are looking at the nitty-gritty and helping management to prepare those projections in order to move forward with the valuation process. Figuring out the correct basis for comparison to market data can sometimes be daunting. The slide below shows various volume and payment mechanisms a valuator needs to take into account.

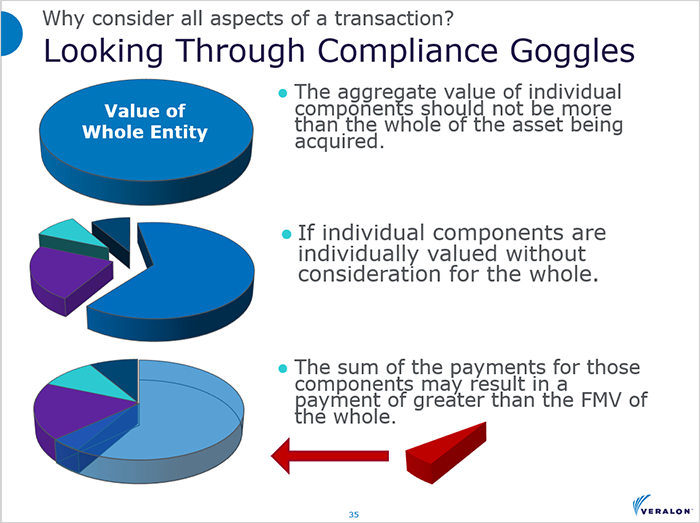

5. Why do valuators need to consider all aspects of a transaction rather than just the component for which they’ve been engaged to provide an opinion?

In other businesses and other industries, this is a valid question. However, as discussed earlier, most healthcare valuations must reflect the fair market value standard. Since the definition of fair market value references hypothetical buyers and sellers, we have to look at it through that lens.

Unlike other industries where businesses can set their own prices based on supply and demand between two parties, the healthcare industry has a third-party system whereby the patients, their employers, or the government contribute premiums to insurance companies, which can in turn negotiate rates with providers to provide services to those beneficiaries.

Given that there are so many different negotiations and agreements in place, the hypothetical buyer is one that oftentimes won’t have additional clout to achieve improved rates from third-party payers. In other industries, businesses are able to pay what they want or what they are able to pay to consummate a transaction. Often, that includes a strategic value for the acquirer. However, because of the limitation of paying only fair market value, the question really becomes: Who is the hypothetical buyer?

In looking at the healthcare marketplace, buyers can be any number of entities such as hospitals, health systems, joint ventures, other physician-owned entities, or even private equity firms. While it can be tempting to say that an acquirer will get more attractive payment rates post-transaction, that reflects the reality of a specific buyer, not a hypothetical one. The question a valuator could pose to the person asking about the hospital’s payer rates is really: If the hypothetical buyer could negotiate more favorable rates, then why hasn’t the business already achieved them?

This question usually drives the point home to the person asking the initial question. Really the answer behind that lies in the difference of the healthcare market itself compared to other industries.

Conclusion

As mentioned above, the healthcare industry is highly regulated and can be complex and fragmented. Providing a valuation conclusion in this industry requires a complete understanding of the business, which can be time-consuming. Also, getting your arms around all of the unique considerations can be difficult. To see more detailed questions and answers that valuation analysts should be prepared to answer when valuing a healthcare entity, check out BVR’s webinar, The Devil in the Valuation Details: Top 10 Questions Lawyers and Healthcare Organizations Ask,with experts Jessica Stack and Denise Palencik.