Blockage Discounts: Two Helpful Equations to Know

On March 31, Pasquale Rafanelli will be hosting the webinar Blockage Discounts: How Volume Can Impact Value. Before you check out this can’t-miss experience, get a sneak peek of what will be in the webinar! This preview will be a brief introduction to a pair of concepts that will be expanded upon in the webinar: how to determine excess price change and calculating days trading volume.

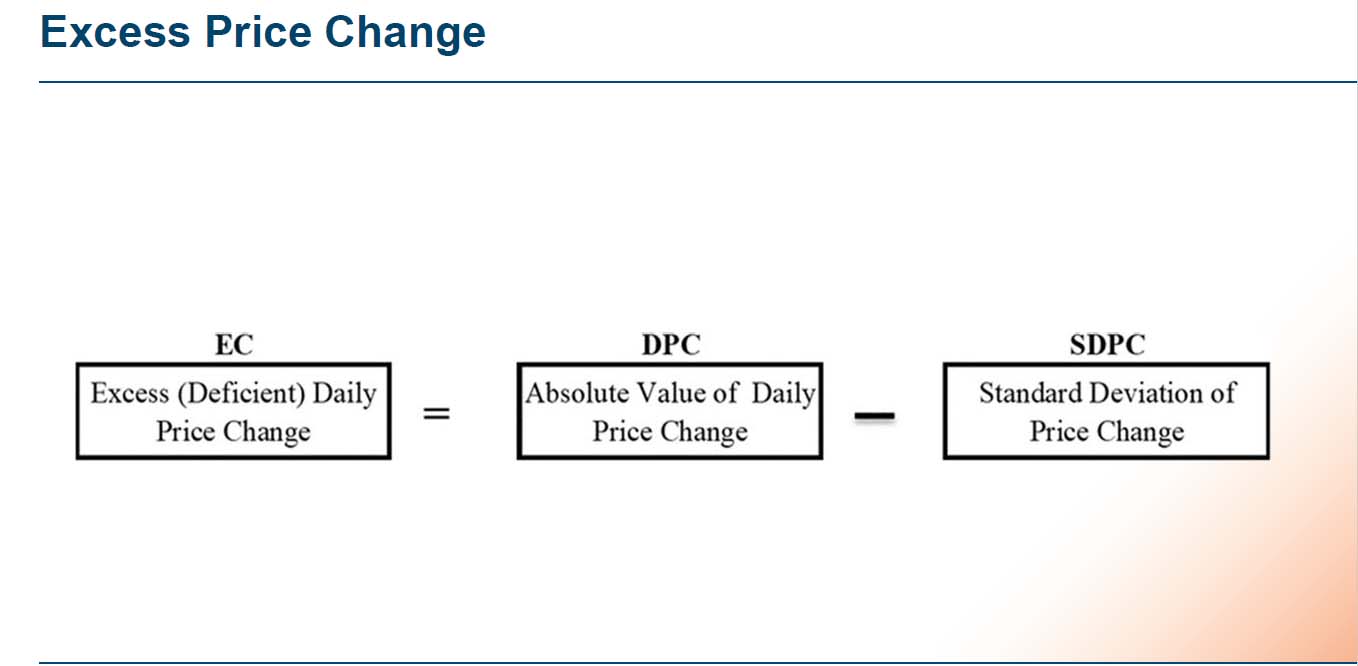

Excess Price Change

To set up an accurate frame of reference for excess daily price change, you will need to know two things:

- The absolute value of the daily price change; and

- The standard deviation of that price change.

To arrive at the excess price change you need to apply to following formula:

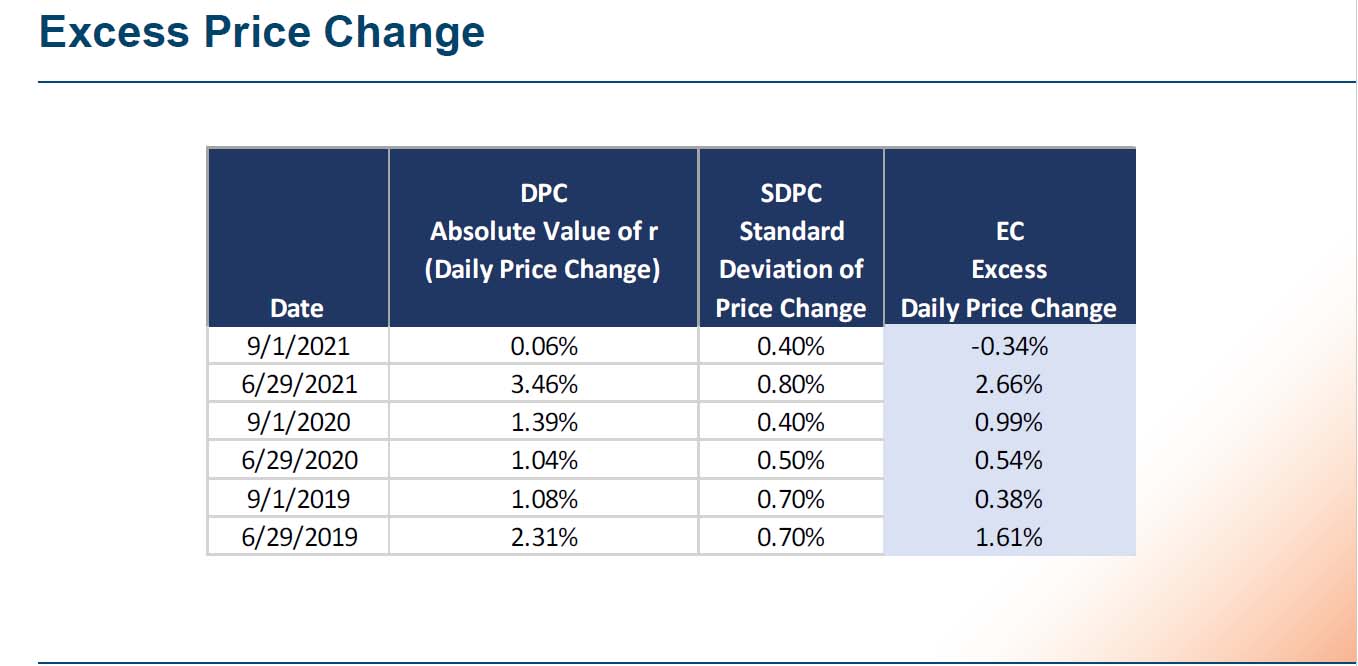

As you can see with the following example, determining the excess daily price change is a fairly straightforward process:

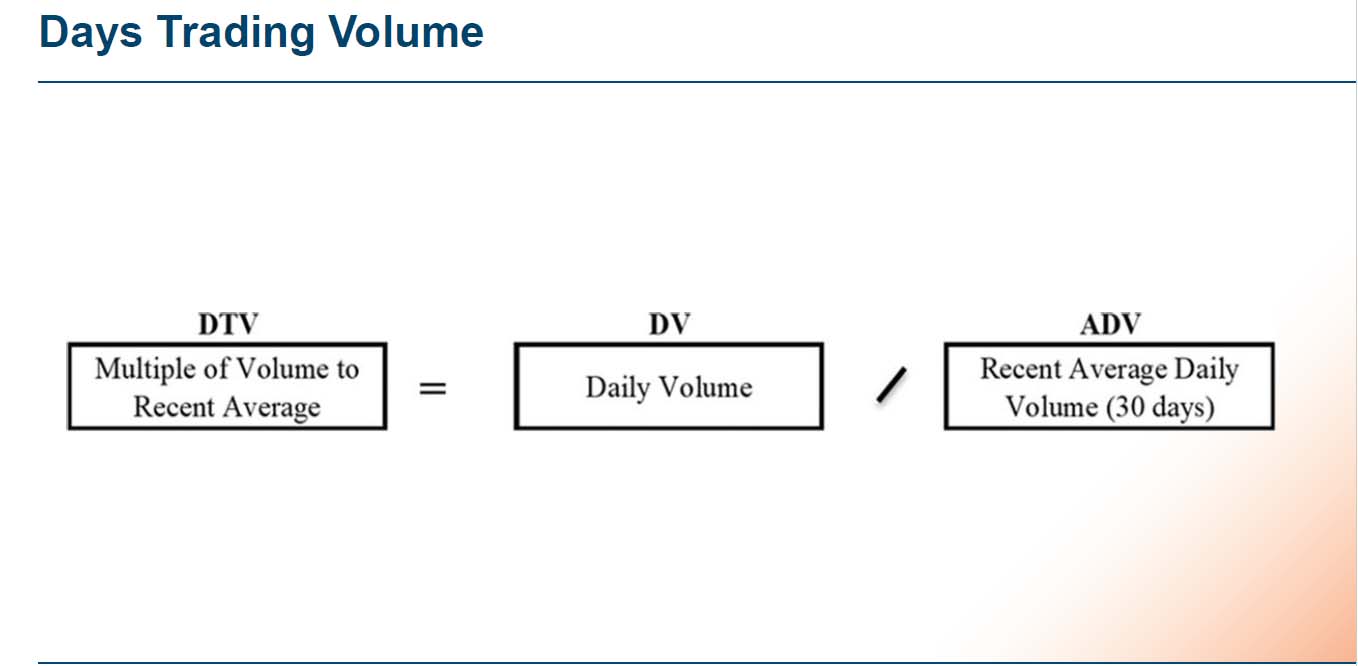

Days Trading Volume

Setting up the days trading volume requires two pieces of information:

- Thirty days' worth of trading volume averaged out; and

- Daily volume for the target date.

Now we set up the formula as follows:

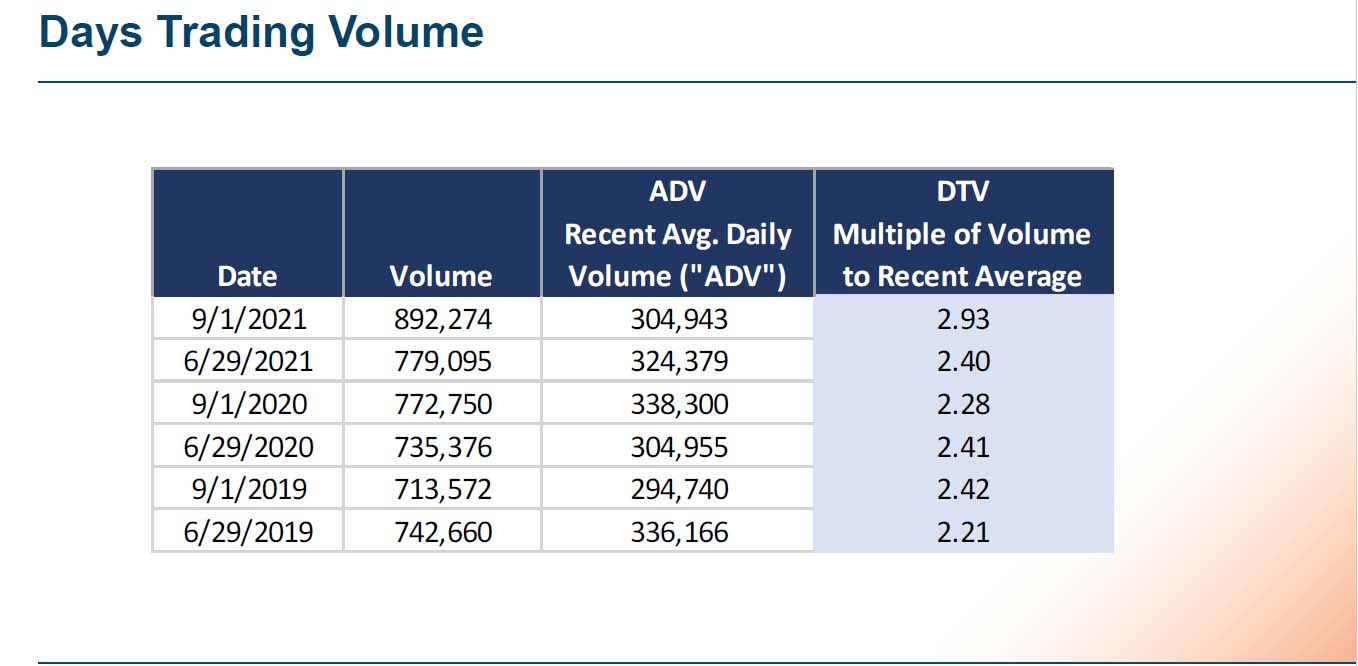

Now let's put that into practice with the following example:

These equations are just a small component of the overall process for determining blockage discounts as they factor into the Black-Scholes option pricing model, which is a key pillar of calculating blockage discounts. Don't miss out on the opportunity to learn more about these concepts and their impact on your next valuation by signing up for the webinar here.