Business Valuation’s ‘Dirty Little Secret’

Recent developments have put the spotlight squarely on projected financial information (PFI). The perception is that too many valuation experts simply accept projections and forecasts they’re given without applying enough scrutiny—or any scrutiny at all. Fortunately, there is some new guidance on how to examine and substantiate PFI you get from management or other third parties in BVR’s new Guide to Management Projections and Business Valuation: Analysis and Case Law. The following is an excerpt from that guide.

Watch out. “Projections are valuation’s dirty little secret,” says Jim Hitchner (Financial Valuation Advisors Inc.). Hitchner and Harold Martin (Keiter) conducted one of the most popular sessions at the last AICPA FVS conference titled “How to Detect a Rigged Valuation.” They stressed that appraisers must not simply accept the projections the client provides, plug them into a discounted cash flow analysis, slap on a discount rate, and be done with the analysis.

While there are other ways to manipulate a valuation (e.g., through the discount rate or growth rate), the PFI can be particularly troublesome. Hitchner warns that clients, knowing that the appraiser applies a discount rate, may manipulate their projections accordingly. Similarly, clients may change projections in anticipation of litigation. A “good appraiser” performs an independent review and keeps a record of his or her questions to management and the resulting changes, the speakers advise.

New spotlight. The architects of the Fair Value Quality Initiative (FVQI) have recognized the concern over PFI in their development of the new credential for fair value for financial reporting. During a recent BVR webinar, Anthony Aaron, chair of the Performance Requirements Work Stream of the FVQI, pointed out that there is a section on “professional skepticism” in the new set of best practices for appraisers doing fair value work. These best practices, known as the Mandatory Performance Framework (MPF), lay out the requirements for documenting the extent of the work done during a fair value engagement.

During the webinar, an attendee asked: “Is there any area addressed in the MPF where valuation specialists may have been particularly lax?” The questioner suggested that one area is possibly the scrutiny of management projections and noted that the MPF has a section on professional skepticism. Aaron confirmed that there is a perception that too many projections have been accepted without applying an appropriate level of skepticism. He made it clear that he is not suggesting that everyone just accept projections mindlessly or that anyone does so, but the perception is there.

“I think personally, the emphasis on skepticism is not just in the valuation field but more broadly in the audit area,” said Aaron, who had a long career in business valuation at Ernst & Young and is now an adjunct professor with the Leventhal School of Accounting at the University of Southern California. “And it’s an area that regulators are concerned about. I think that the potential for bias to creep into our analysis is something that we always have to be on guard for and concerned about.”

PFI assessment. There are several general considerations when evaluating PFI, which can be boiled down to four questions you should be asking:

- Does the forecast correspond to internal budgets or external forecasts by stock analysts?

- Is the current forecast consistent with previous forecasts?

- Do the assumptions in the forecast appear reasonable in relation to historical performance?

- Do the assumptions in the forecast appear reasonable in relation to performance of guideline companies or assets?

The recently finalized MPF takes these general considerations and crafts a series of best practices that get more into the specifics. While this is designed specifically for fair value engagements, the concepts are applicable in other situations where PFI comes into play. We summarize here the factors and common procedures to consider but note that the MPF says that this list is not necessarily all inclusive.

- Compare the PFI for an underlying asset of the subject entity to expected values of the cash flows. The evaluation of any differences between PFI and expected cash flows should be thoroughly documented in the work file.

- Compare the PFI for an underlying asset of the subject entity to expected values of the cash flows. The evaluation of any differences between PFI and expected cash flows should be thoroughly documented in the work file.

- Examine the frequency of preparation. Does management regularly prepare forecasts? If so, they are likely to be consistent and meaningful.

- Measure prior forecasts against actual results. This will help assess whether management’s forecasts tend to be optimistic, conservative, or just generally inaccurate.

- Do a mathematical and logic check. Common errors include inaccurate cell references, simple summation errors, use of improper functions, and many others.

- Compare to historical trends. The PFI should be compared to historical information and trends focusing on items such as revenue growth, decline, or variability; various levels of profitability; and levels of specific items (such as sales and marketing expense).

- Match up to industry expectations. Analyze the PFI relative to the economy, industry, and other external data.

- Check for internal consistency. Evaluate whether all of the metrics used in the analysis are collectively consistent with each other. For example, if a PFI has an aggressive growth rate and improving margins but also shows significant reduction in sales and marketing expenses, this would not be consistent.

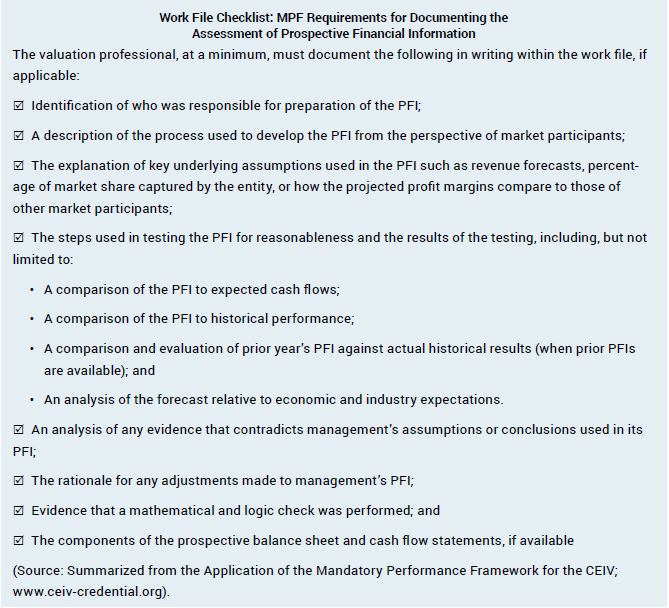

Work file checklist. To demonstrate that an appropriate assessment of PFI was done, the MPF requires, at a minimum, that certain items be documented in writing within the work file. Below is a checklist of what the work file must contain with regard to PFI.

It’s important to note that CEIV credential holders must submit a work file periodically for a quality control review to the organization that issued the credential. The work file will be reviewed for compliance with the MPF. Auditors or an outside agency may also hold practitioners without the credential to these standards. Therefore, the MPF is relevant for everyone doing fair value work.

To learn more about projections as they relate to business valuation, be sure to check out BVR’s Guide to Management Projections and Business Valuation: Analysis and Case Law. Preview the table of contents and look inside to learn more about this invaluable resource that helps every law practitioner and business valuation professional stay ahead of the game.

Editor’s note: This article originally appeared in the May 2017 issue of Business Valuation Update.