A Closer Look at BVR’s New Guideline Public Company Comps Tool

BVR is excited to announce the release of its new Guideline Public Company Comps Tool (GPCCT), a state-of-the-art, web-based platform that offers access to complete financial statements, financial ratios, and multiples for comparable companies—and even includes an Excel add-in. BVR’s goal with the development of this new tool was to assist the business valuation community in maximizing its guideline public company method work, while providing an advanced and affordable solution to determine and identify a comprehensive set of comparable guideline public companies.

We recently spoke with three individuals at BVR that had a hand in creating the GPCCT: Adam Manson, director of valuation data; Oday Merhi, senior financial analyst; and Gaelan Duncan, financial analyst. Among the GPCCT’s many features, including user-friendliness, daily updates, and affordability, we asked them about their favorite features of the new tool, and here is what they had to say.

- Related comps

After one or more comparable companies are identified, this feature provides users with the ability to discover other comps that were used in sets of guideline comparable companies disclosed in public fairness opinions.

- Search functionality

This feature provides users with the ability to either select specific comps by ticker and/or by industry, revenue, and any other metric provided in the platform.

- Excel add-In

The Excel add-in provides users with direct access to the data from within Excel, where they can directly call specific values into their Excel spreadsheets or use premade templates.

- Customizable display

A customizable display provides users with the ability to change the way they view their comps in order to observe and arrange the specific fields that are most relevant to their analysis.

- Valuation date feature

As an absolute necessity when performing valuations, this feature provides users with the ability to specify a valuation date and retrieve the most recent data until their valuation date.

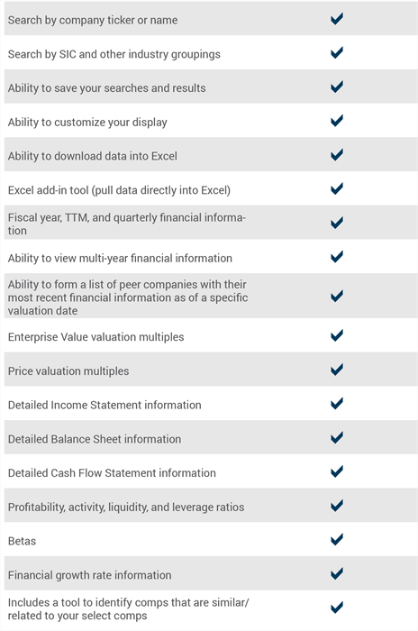

In addition, below is a helpful checklist highlighting a more in-depth list of the GPCCT’s features.

BVR’s new GPCCT platform allows appraisers and analysts to implement the guideline public company method (GPCM) to value a subject company. This method involves using enterprise value multiples or equity multiples derived from the trading prices of publicly held companies that analysts deem similar to their subject company. The steps taken in applying the GPCM include identifying comparable public companies, adjusting the guideline public company multiples to account for any differences in size, risk, and growth between the comparables and the analyst’s subject company, and then applying the adjusted multiples to the subject company.

Discover more about the GPCCT

Interested in learning more about the GPCCT? BVR hosted a free webinar, Built for BV: The New Platform for Guideline Public Company Comps, featuring Adam, Oday, Gaelan, and Yates Sayers, vice president of sales at Intrinio, a disruptive financial data platform launched in 2015 that helps power the GPCCT. Visit us online to watch the recording, view free downloads, FAQs, and more.

We would love your feedback on this new tool for the business valuation profession! BVR, along with the professionals known for their experience with the Guideline Public Company Comps Tool, will review your comments to further enhance the tool.