EBITDA multiples by industry: 2Q 2019 analysis on private-company selling prices

When business appraisers evaluate a company, they look at how much others have paid for similar businesses relative to various earnings measures. Selling price divided by earnings before interest, taxes, depreciation, and amortization (EBITDA) is a commonly used valuation multiple.

Business Valuation Resources recently published EBITDA multiples by industry in our DealStats Value Index (DVI). DVI presents an aggregated summary of valuation multiples and profit margins for over 30,000 sold private companies listed in our DealStats database. Below are some of the highlights from the report.

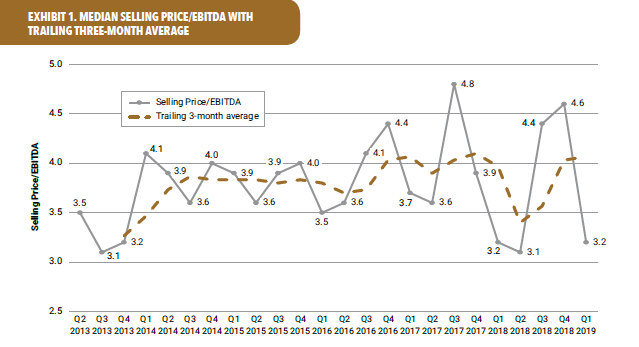

Multiples fall in 1Q 2019

EBITDA multiples across all industries were highest over a five-year period in the third quarter of 2017, at 4.8x. In the second quarter of 2018, these multiples fell to 3.1x—the lowest levels since the third quarter of 2013. After rising in the third and fourth quarters of 2018, these multiples once again fell to near recent lows (3.2x) in the first quarter of 2019. Nevertheless, the trailing three-month average for multiples has increased over the past three quarters. The relatively smooth trailing three-month average trend line from the third quarter of 2014 through the first half of 2017 gave no clear indication that large fluctuations in multiples paid would ensue in the quarters ahead.

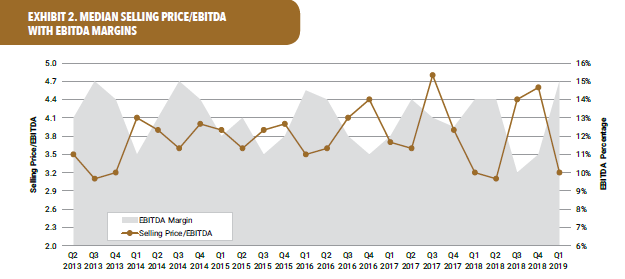

EBITDA margins on the rise

EBITDA, as a percentage of revenue, has trended upwards in the most recent two quarters, tying a five-year high in the first quarter of 2019, at 15%. After reporting at the lowest level (3.1x) in the second quarter of 2018, the selling price-to-EBITDA multiple steadily rose through the fourth quarter of 2018, to 4.6x, before falling near a five-year low, to 3.2x, in the first quarter of 2019. The peaks and valleys of the EBITDA multiple moved opposite to that of the EBITDA margins. DealStats is tracking the trend to see whether it continues through the rest of 2019.

Selling price/EBITDA median is 4.4x

EBITDA multiples are highest for the information sector (11.1x) and the mining, quarrying, and oil and gas extraction sector (8.4x). Meanwhile, the lowest EBITDA multiples are in the accommodation and food services (2.6x) and the other services sectors (3.0x). The median across all industry sectors is 4.4x.

Get more analysis and trends from private-company deals

For more analysis and trends from private-company deals, download the "2Q 2019 DealStats Value Index Digest," an abbreviated version that is available each month when you sign up for the free ezine. The full version is available with a subscription to DealStats.

Need a more precise valuation multiple? Access a custom set of comparable transactions in the DealStats platform. Search more than 36,000 private and public deals in 922 industries and drill down to a group of sold companies similar to the business you’re evaluating. View transaction details and statistics on up to 164 data points, including valuation multiples, purchase price allocations, financial statements, and deal structures.