Is Personal Goodwill Transferrable?

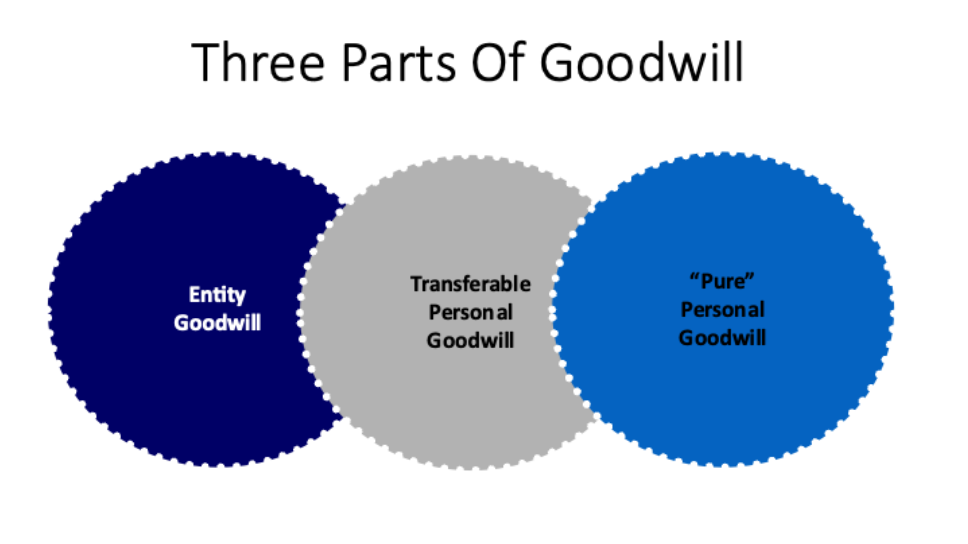

For years, I have contended that there are three types of goodwill: entity goodwill, transferrable personal goodwill, and “pure” (nontransferrable) personal goodwill. Here is what I use to describe this in webinars and presentations:

1

The Wisconsin Supreme Court McReath2 case has followed this trifurcated pattern in allowing the full amount of salable personal goodwill to be included in the marital estate. A new case has raised questions and issues about the trifurcation of personal goodwill once again.

In Lamm v. Preston (an Idaho divorce case), Ross Lamm had developed successful antidrone technology that, during the divorce proceedings, he sold, along with his partner, to a company named Acorn Growth Cos. LLC, a private equity firm. Their company was named Black Sage Technology Inc. As part of the sale transaction, Acorn paid some cash for 55% of Black Sage Technology and transferred 45% of Black Sage Technology to a new company the parties formed, Black Sage Acquisition LLC (BSA). In addition to 45% of Black Sage Technology, Black Sage Acquisition signed an employment agreement with Ross whereby any and all work product or intellectual property Ross developed became the property of Black Sage Acquisition. Part of the agreement also provided for a three-year noncompete agreement following the two-year employment agreement. So, in effect, Ross was tied up for five years. Ross was issued a 25% interest in Black Sage Acquisition.

As the divorce progressed, magistrate court issued an order for equitable distribution of the community property. That order included a valuation of the 25% Black Sage Acquisition interest that included a value of Ross’ personal goodwill in that interest. The personal goodwill value, determined by Ross’ expert and accepted by the magistrate court, the district court, and the Idaho Supreme Court, was excluded from the marital estate and determined to be separate property of Ross. The amount excluded as personal goodwill was a material amount.

Since the entire case revolved around determinations of value that related in one way or the other to the transaction, the question became whether this was a case where there was a transaction and therefore there should not be any personal goodwill included. The Supreme Court stated clearly that, under Idaho case law, personal goodwill was not transferrable. There was a transaction that can determine a value—maybe. But the Supreme Court also said that the value of the transaction and the value for divorce purposes were two different dates, with the divorce value being the later date.

Despite the value dates being different, Ross’ expert used the transaction data for his determination of the value of personal goodwill. And the Supreme Court, affirming the lower courts, went along with his value. The result was that the Idaho courts looked at Black Sage Acquisition as a de novo startup company and not the result of a transaction. As such, they proceeded to look at the assets of Black Sage Acquisition and to determine whether there were assets within that were of the nature of personal goodwill. The conclusion of the Idaho courts was that there were such assets and the value of those personal goodwill assets should be excluded from the value of the 25% Black Sage Acquisition value.

There was support for separating the value of Black Sage Acquisition from the transaction since the transaction occurred during the divorce process and not at the divorce valuation date. However, the question left begging was how does this square with the Idaho case law that said personal goodwill was not transferrable. As we have noted, some personal goodwill is, in the view of the author, transferrable. And certainly these personal goodwill assets did indeed transfer from Black Sage Technology to Black Sage Acquisition. Notwithstanding the employment contract and subsequent covenant not to compete in Black Sage Acquisition, those personal assets moved from Black Sage Technology to Black Sage Acquisition.

The result here was not unusual from the standpoint of divorce litigation. Such litigation was often filled with confounding incongruities. This appeared to be one of those cases.

1 Copyright R. James Alerding, CPA/ABV.

2 McReath v. McReath; 2011 WI 66; 335 Wis. 2d 643; 800 N.W.2d 399; 2011 Wisc. LEXIS 354.

3 Noted as professional in the case.

4 Lamm v. Preston, 2023 Ida. LEXIS 4.

5 As opposed to community property.