How do marketing intangibles drive the value of medical device businesses? This is a question addressed in this month’s industry sector snapshot from MARKABLES. An important aspect about the medical device sector is that it is quite heterogeneous. For example, there are durable technical devices, which are used many times on different patients, or there are single-use devices and consumables, which need to be replenished every week. By the same token, there are long-lasting devices, which are used on one individual patient only, such as implants. It is obvious that purchase behavior, purchase decision, and brand preference are fundamentally different. To account for this, the analysis looks deeper into three different subsectors: measurement and monitoring equipment, orthopedic implants, and single-use devices and consumables. All in all, the peer group in these three subsectors consists of 83 businesses in 17 countries that were acquired between 2004 and 2015.

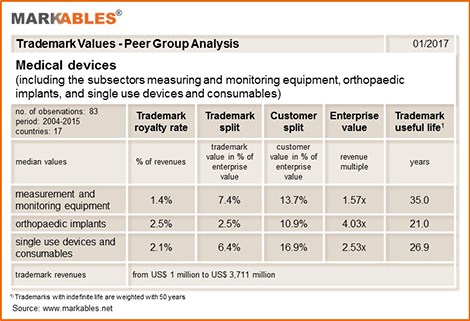

The table below illustrates the median ratios for various valuation parameters by the three subsectors. Surprisingly, enterprise values differ largely in the three subsectors. Implant businesses are valued at 4x revenues, consumable and single-use businesses at 2.5x revenues, and measurement businesses at 1.6x revenues only. There is impressive evidence for the profit split theory of intangible assets, whereby a royalty rate paid for an intangible asset is a result of splitting the profit between licensor and licensee. Accordingly, average trademark royalty rates on revenues are highest for the most profitable businesses (implants) and lowest for the least profitable (measurement). Similarly, the average useful lives of trademarks show the same differences. Moreover, in single-use and consumables—which is the lowest tech of our three subsectors—the total of trademark plus customer value is highest, although, with 23.3% of enterprise value, it is still relatively low. Other intangibles (i.e., technology) as well as the value of the skills to cope with future challenges (innovation, organizational improvements, new market strategies) have their shares as well. This analysis illustrates the importance of a thorough composition of homogenous peer groups at the product/sector level.

(click to view full size)