This month’s brand value snapshot from Markables covers a sector with truly high brand values: over-the-counter drugs. The data include brand valuations of 18 OTC drug businesses between 2004 and 2014 in 11 countries. These firms supply non-prescriptive pharmaceutical products, such as for cough and cold, sore throat, pain relief, sleep aids, oral care, itch, antifungal, and others. Some prominent brands in the peer group are Wartner, Listerine, and Nicorette. These are certainly not “love brands” like some brands in sports, fashion, watches, cars, or electronics. But consumers trust and respect them as reliable remedies for minor but annoying health problems.

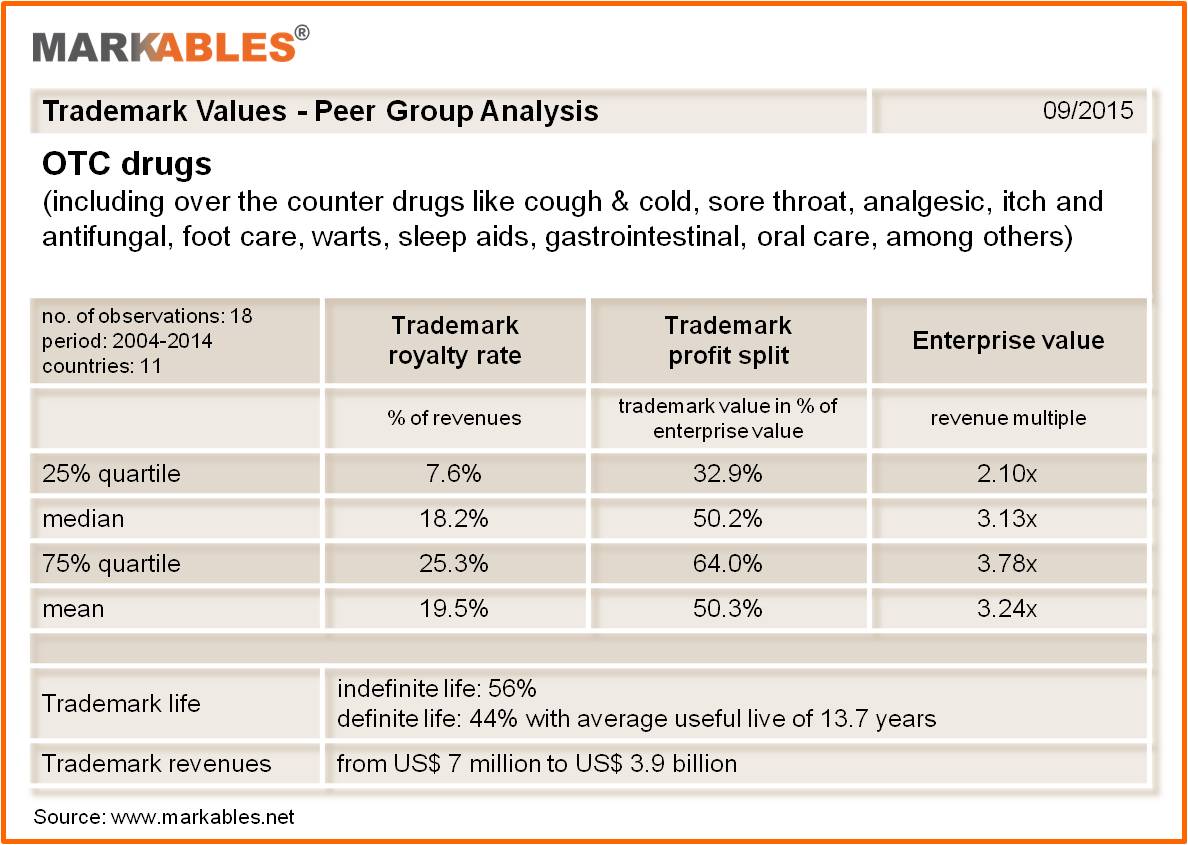

The interquartile range analysis shows a mean trademark royalty rate on revenues of nearly 20%(!), and a mean trademark value of 50% of enterprise value, for sales multiples of 3x revenues and higher. The OTC drug sector is an impressive example of brand-centric asset structure and high brand margins. It is also conclusive evidence that business appraisers are not overly conservative regarding the valuation of brands, as some people in the profession believe.

Markables has a database of over 6,500 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).