With all of the irresistible holiday goodies surrounding us, we’ll all be in need of a good workout soon, most likely using some of the strongly branded sports products and gear available. December’s brand value snapshot from Markables covers this very sector and compares the brand valuations of 24 sport hardgoods brands between 1999 and 2013 in five countries. Some prominent brands in the peer group are Adams, Cobra and Top Flite (golf gear), Salomon and Rossignol (skis), or Spalding and Rawlings (ball sports), among others.

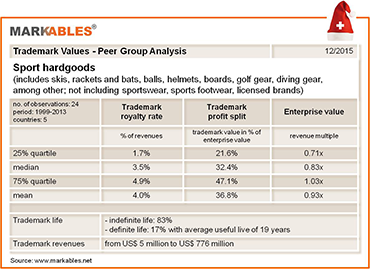

Down to earth multiples: Trademark royalty rates for the sector range between 2% and 5%, with mean royalties from 3.5% to 4.0% (see table below). Trademark profit split is at around 35%. Thus, brand value multiples for the sector are more down to earth than what could have been expected from typical royalty rates charged by the large sports property licensors (8% to 10%). The reasons could be stagnating revenues and weak profitability for sporting goods; average enterprise value multiples for the sector are 0.83x revenues only. For sportswear, average brand value multiples are roughly 50% higher than for hardgoods. The analysis illustrates that sports league and event-based royalty rates cannot simply be transferred into long-term ownership valuations, without reasonable adjustments. An 8% rate on revenues applied into perpetuity may easily result in brand value exceeding enterprise value.

Markables, based in Switzerland, has a database of over 6,500 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).