Most valuers sense that small and medium-sized enterprises are less marketable, and less valuable, than they were at the beginning of the year. Multiple new studies appeared since the last issue of BVWire—UK to help quantify current M&A conditions.

- The May 2020 issue of the FactSet Mergerstat Monthly Review shows a dramatic 36.4% decline in M&A activity in the U.S. market, with similar declines suggested in the UK. Industry sectors that have seen the biggest declines include tech services, manufacturing, and finance.

- The quarterly Argos Index, prepared by Epsilon Research, measures midmarket valuations in the eurozone. The latest study finds a 10% decrease compared to CYE2019, but Epsilon CEO Grégoire Buisson cautions users of the study to recognise that the index is prepared on a six-month rolling basis, so the impact of COVID-19 only began to be felt mid-March. Until then, eurozone midmarket deal volume was actually up 15%, driven largely by deals in Germany. The new Argos Index includes two interviews on values and the market, from Professor Reiner Braun (Technical University of Munich) and Éric de Montgolfier, CEO of Invest Europe. They note that private companies retained value better than small listed stocks, since the EURO STOXX TMI Small Index fell 26.1% between 1 January 2020 and 31 March 2020 (though, of course, like all the major indices, it’s enjoyed a record April and May). The Argos Index is calculated based on the information contained in the Epsilon Multiple Analysis Tool.

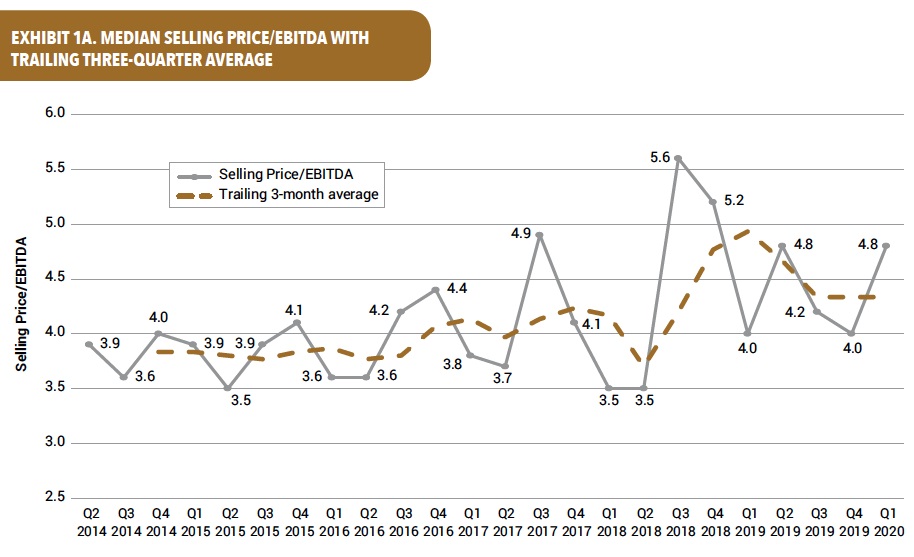

- Meanwhile, the DealStats Value Index confirms that small-company values outperformed the public markets in the first quarter. DVI reflects values for smaller transactions and generally reports lower multiples since most of the transactions reflected in the index do not involve financial buyers. DVI found an increased EBITDA multiple of 4.8x, up from 4.0x in the preceding quarter, and the trailing average leveled out after nine months of decline, as shown in the table.

Other leading sources of private equity and small-company M&A, such as PERDa and M&A Monitor, have not released studies reflecting the impact of COVID-19 as yet.

Please let us know if you have any comments about this article or enhancements you would like to see.