Business valuers trying to provide an economic overview (as required by IVS, RICS, ASA, and most international valuation standards) can be forgiven if they struggle describing 2020 and forecasting 2021.

Three sources of summary data on the deal market and prices were published in the last two weeks. The overall conclusion of these four courses comes from a KPMG report:

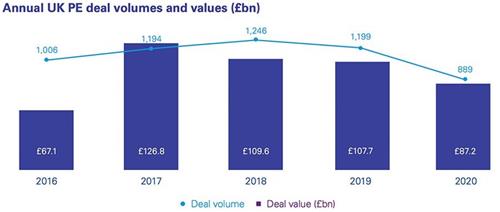

UK private equity deal activity bounced back in the second half of 2020, although a profound slump in transactions in Q2 as lockdown gripped the M&A market meant that total annual deal volumes hit their lowest levels in more than seven years.

KPMG’s latest study of UK transactions involving private equity investors indicates that a total of 889 deals were completed over the course of 2020, with a combined value of GBP87.2 billion. This was the fewest number of private equity transactions seen in the UK since before 2014 and a fall of 26% from the previous year. KPMG concludes that midmarket PE deals were particularly impacted. Jonathan Boyers, head of M&A for KPMG in the UK, says: ‘Once the initial shock of lockdown had worn off, and after a number of years of hesitancy caused by issues such as Brexit, general elections and broader international uncertainty, we saw a renewed urgency amongst private equity investors to get deals done. They had plenty of cash ready to be deployed, and with a similar appetite for transactions in the debt markets, it wasn’t long before the M&A tap was turned back on.’

The KPMG forecast remains upbeat: Boyers says: ‘We’re certainly not seeing any signs that the latest lockdown is quelling momentum. Rather, there seems to be a mindset that nobody wants 2021 to be another “lost year” after such a prolonged period of economic and geo-political uncertainty.’

Another subsector of the large-deal marketplace also, somewhat surprisingly, thrived in 2020, according to BDO’s annual analysis of listed companies taken private. John Stephan, partner and head of global M&A at BDO, says: ‘Private equity houses are taking UK listed companies private at an ever-increasing rate.… PE funds have dominated deal activity whilst corporate buyers have been generally more cautious.’ Stephen believes these conditions will continue into the future. ‘The combination of UK listed companies at attractive multiples and PE funds with large amounts of unspent cash that they need to invest means that the public to private trend is likely to continue at pace,’ he says.

As 2020 came to a close, UK-listed company prices were attractive. At the end of November, valuers will recall, the FTSE 100 had fallen 16% from its value at the start of the year (compared to falls of 9% for the French CAC 40 index and 2% for the German DAX—and a 9% increase for the big-tech company-dominated S&P 500 index in the US).

The three most recent UK-listed companies to have been taken over by PE firms are HML Holdings (property management), HWSI Realisation Fund (fund manager), and Be Heard Group (marketing agency).

To support these conclusions further, Julian Stanier and Adam Cain of Pinsent Masons highlighted how the UK public M&A market recovered in the second half of last year after a sharp reduction in deal activity in the first six months (H1) in their analysis for Out-Law News. They report that, across the whole of 2020, there were 100 transactions involving businesses listed on the London Stock Exchange’s Main Market or AIM that were subject to the UK’s Takeover Code.

‘Market conditions still appear fertile for prospective private equity purchasers and we see take-private bids backed by investment funds and infrastructure funds being particularly prevalent,’ Stanier says.