The “2Q 2021 Control Premium Study” report is now available from BVR. Despite well-reported deals in the UK, EU, and US with depressed sale prices and control premiums (the sale of Grubhub, at a very low 9.8% premium, is one prime example), the reported UK transactions stayed very close to the historic averages of about 30%.

The study provides analysis on equity control premiums, minority discounts on equity, and the invested capital control premium by industry sector, percentage acquired, deal size, whether there was a strategic or financial buyer, method of payment, transaction multiples, and many more.

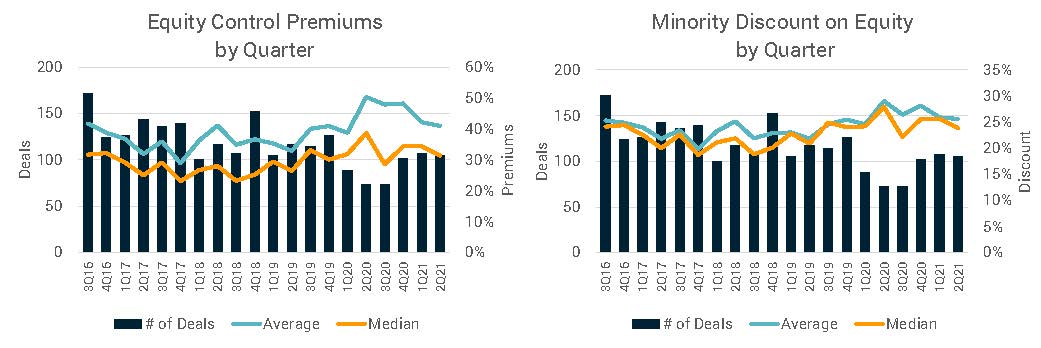

Below is the global summary of control premium analytics, which include the number of completed deals, as well as the average and median control premiums, from 3Q 2016 through 2Q 2021. A second table summarising average minority discounts on equity is also included.