Many business valuers struggle to make sense of financial statement data from listed companies—never mind The Companies House. The lack of clarity in financial statements—particularly the sections business valuations influence—has been a common topic at ICAEW sessions and elsewhere. One can only wonder whether these statements are of any use to your clients or investors lacking extensive training in financial analysis.

Calcbench, the New York City-based market data and research firm, released a new report analysing how firms in the S&P 500 reported their adjusted earnings—and which adjustments accounted for the largest gaps between GAAP and non-GAAP statements. The differences can lead to opposing interpretation of results at a fundamental level, no matter whether you’re analysing statements from a small enterprise or an FTSE large cap.

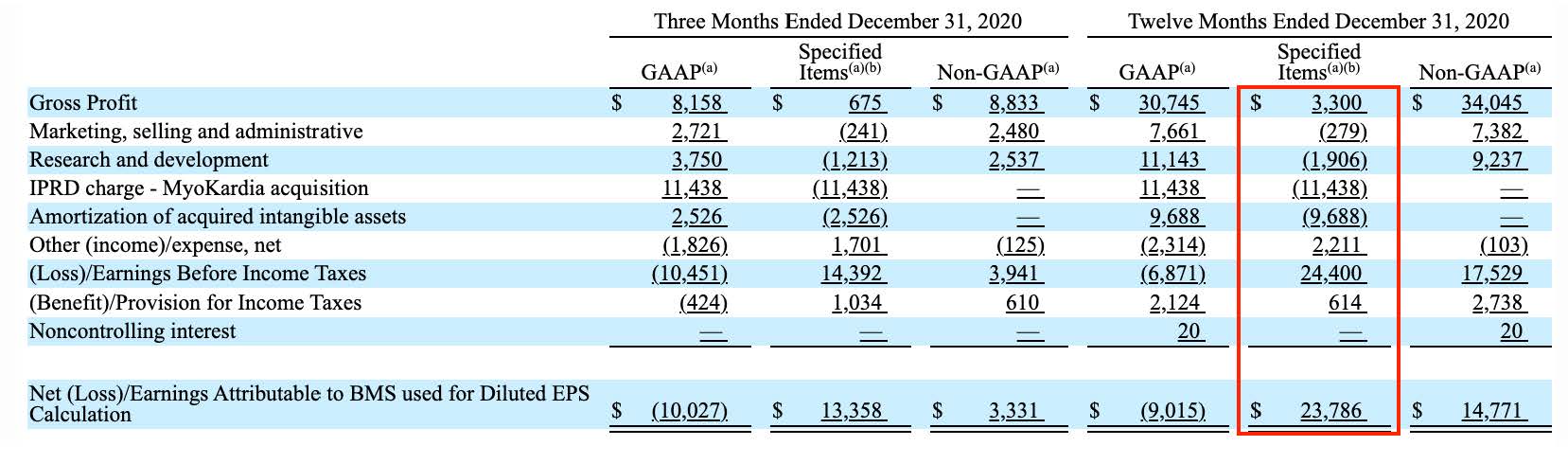

The CalcBench report offers a spectacular 2020 example of the problem: Bristol Myers Squibb. The company reported a $9 billion loss for 2020 and then added back another $23.78 billion in various adjustments—for a non-GAAP adjusted net income of $14.77 billion, as shown in the analysis below. While there are small adjustments to operating expenses, nearly all these changes have to do with the treatment and valuation of intangibles.

No small matter: BMS is not alone among the large S&P 500 firms but the highlights of the CalcBench study (download the complete report from the Calcbench Research Page) include:

- The non-GAAP net income the CalcBench sample group reported exceeded GAAP net income by $132.3 billion. This is more than double the total reported GAAP net income of $130.7 billion.

- The sample group made more than 240 adjustments to GAAP net income.

- Amortisation of intangibles was the single biggest category of specified adjustments, accounting for 30% of all adjustments.

Traditional investors can turn to the London Stock Exchange to see market pricing of listed company assets, but the sheer volume and degree of assumption built into many family business financial statements remains a critical challenge for the trustworthiness and skill of the business valuation profession. The regulators are not helping.