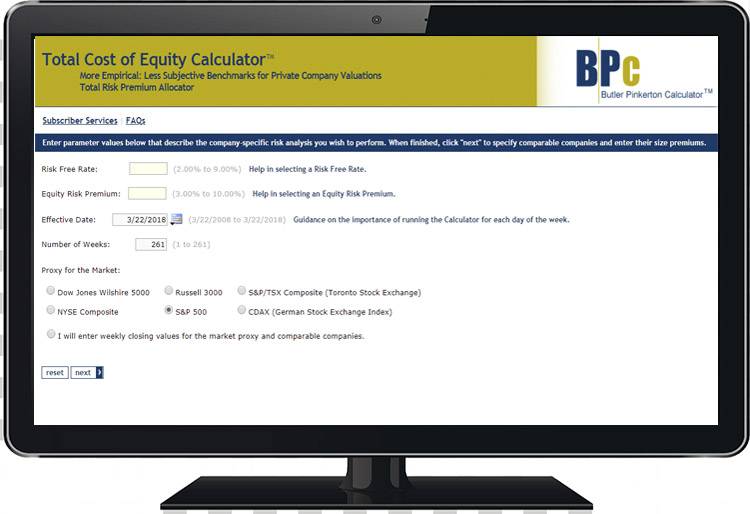

Butler Pinkerton Calculator - Total Risk Allocator

The Butler Pinkerton Calculator (BPC) offers empirical data for total cost of equity (TCOE) and company-specific risk premiums (CSRP) – a first for the business valuation profession. This cutting-edge, web-based tool produces real time beta calculations based on your choice of five different market proxies and allows you to use the empirically-derived results to support and defend your subject company’s cost of capital. Excel with the Butler Pinkerton Calculator while your competition relies on subjective guesses devoid of empirical evidence.

“I use the tremendous Butler Pinkerton Calculator in all of my valuations.”

– Charles Grigsby CPA/ABV/CFF, CVA, ABAR, MAFF, CFE, CPCM

Additional Product Details

Objectively quantify total risk using real-time market observations with the Butler Pinkerton Model.

- Save time and money – the Butler Pinkerton Calculator performs in minutes the work that would otherwise take hours to complete

- Have the most current data – The BPC is updated daily. Quantify TCOEs, CSRPs, and market betas for your exact date of value

- Access the empirical, market-based support for U.S. and German stocks with just a few clicks. The model quantifies TCOEs and CSRPs for up to 12 publicly traded stocks at any one time – and delivers objective answers in seconds • Quickly confirm cost of equity conclusions calculated from other sources or other methods

Video Tutorial

TESTIMONIALS

-

“I use the tremendous Butler Pinkerton Calculator in all of my valuations”. -- Charles Grigsby CPA/ABV/CFF, CVA, ABAR, MAFF, CFE, CPCM

- “I believe that the Butler-Pinkerton Calculator is a valuable tool for business appraisers who want an objective methodology to assess the maximum CSRP. Total Beta allows us to compute the maximum or upper bound for the CSRP. While a good appraisal should include some subjective techniques and judgment to determine the appropriate CSRP, if we exclude Total Beta from our analysis, business appraisers have no inductive or deductive tools to deal with CSR/uncorrelated risk. The problems created by a continued lack of TB use by most appraisers in favor of 'estimating' the CSRP with complete subjectivity is now so acute, an important court had the following pointed comment:" -- Bob Dohmeyer, ASA

NOTE: This court has also explained that we have been understandably . . . suspicious of expert valuations offered at trial that incorporate subjective measures of company-specific risk premia, as subjective measures may easily be employed as a means to smuggle improper risk assumptions into the discount rate so as to affect dramatically the expert’s ultimate opinion on value.

- “Ever since I first learned about the CAPM formula, I've been convinced that it is the right framework for developing the cost of equity capital. When it appeared that Beta in that formula did not adequately describe risk in the public markets - and especially in the private company market - I knew that there was some number in its place that would and began using an adjusted Beta based on my subjective judgment of a summary of all the factors which comprise risk for a specific company. To my knowledge, there is no better number currently available for this purpose than Total Beta as described in the Butler Pinkerton method and calculator. Not that it's the final answer - but it's far better than anything else out there and a major step forward in seeking out that elusive Beta substitute.” -- Don Tubb, ASA

- “Years ago, when I first attended a BPC session at a NACVA conference, I immediately recognized the BPC as a great step forward for the business valuation profession. Total Beta and the BPC made so much sense and represented such an improvement over the totally subjective methods that I wondered why I had not thought of it myself. Failure to utilize the BPC in the litigation environment could well be fatal to a Valuation Analyst’s expert career.” -- Paul C. French, III CPA/ABV, CVA, BVAL, ABAR, CDBV, CM&AA, CM&EA, CFFA, CFE, FCPA, CrFA, CPIM, CDFA (Past Chairman of the NACVA Executive Advisory Board)

- “Total Beta is simply the CAPM Beta minus the benefits of diversification and is appropriate in situations where investors are not diversified or only partially so. The Total Beta concept gives the appraiser an empirical measurement of company-specific risk that can augment or replace measurements based on intuition and subjective judgment. The Butler Pinkerton Calculator is a great tool for estimating cost of capital for privately-held companies.” -- Gary Schurman CFA, CPA/ABV

- “The Butler Pinkerton Calculator has become one of our favorite tools used by our valuation team in determining a reasonable total cost of equity (TCOE) for small, medium, and large companies. We made a decision to look at as many sources as we could reasonably find. There are difficulties with, or differences to reconcile, with each of the sources. The calculator does not claim to be some sort of panacea, nor represent itself as being the beginning and end to the TCOE discussion. We have found that while the Butler Pinkerton Calculator does not eliminate the subjectivity of the TCOE, it does however, represent a simple tool that, when combined with other data, provides us with useful information in support of our opinion for this critical valuation element.” -- Michael Henrickson CBA, AVA, ASA, BVAL and Anthony Duffy, CPA, ABV, CVA

- “I use the BPC as a baseline in my analysis of specific company risk. The Calculator is easy to use, easy to understand, and easy to explain.” -- Stuart Weiss, CPA/ABV, MBA, MS, CVA, ABAR

- “The Butler Pinkerton CalculatorTM (“BPC”) is a great tool for valuation analysts to use when conducting an income approach and/or a guideline company method of valuation. The BPC presents a way to utilize market information from guideline companies to objectively calculate the systematic and unsystematic risk to an investor in a privately-held investment who is not well-diversified, as opposed to subjectively trying to determine that risk. Through the use of total beta, we have found the calculation of the stand-alone, required equity rates of return of the publicly-traded guideline companies to be a great benchmark and useful tool in determining the required equity rate of return of the subject company.” -- Andrew M. Malec, Ph.D.

- “They may have created a tool for valuation professionals that is … possibly better than anything else out there for the determination of a discount rate. The Butler-Pinkerton Calculator™ is a tool that every valuation analyst must have in his or her toolbox. I believe it is a tool that is a must have for all of us. This is perhaps one of the best contributions to our profession in a long time.” -- Gary Trugman, CPA/ABV, MCBA, ASA

- “Having examined the BPC extensively (and I mean extensively), I am convinced that valuation analysts should consider its application in every valuation where an income approach and/or a guideline publicly traded company (GPTC) method is considered. The specific risk premiums (SRPs) of publicly held companies residing in the same industry of the subject company can now be determined through the use of “total beta” which is based upon hard market evidence. In my mind, this process significantly narrows the “judgment gap” of the subject company SRP. If using the market approach, the market multiples can be adjusted not only for size and growth, but also for the SRP. Again, the judgment gap is narrowed. Finally, I have found that the variance between the values determined by the income and GPTC methods has been significantly reduced.” -- Donald P. Wisehart, ASA, CPA/ABV/CFF, CVA, MST

- “When I started my business appraisal career in the mid 1980s, and as I went through the IBA and ASA certification processes, I became painfully aware that the two biggest technical challenges of almost every appraisal are estimating and supporting the cost of equity capital (particularly the company-specific equity risk premium) and the discount for lack of marketability. At that time, all we had to work with was benchmarking (proxy) data like the Ibbotson and restricted stock / pre-IPO studies (none of them perfect) plus a huge dollop of subjective, but professional, judgment to determine what was reasonable in a specific case.Recently, Keith Pinkerton and Peter Butler developed the Butler-Pinkerton Calculator (BPC), an empirical, logical model of the cost of equity capital and the company-specific equity risk premium. I am a strong proponent of the BPC and have started to use it to reinforce my benchmarking plus subjective judgment methodology. You can purchase and download the model and extensive documentation at bvresources.com.” -- Rand M. Curtiss, ASA, FIBA, MCBA

- “The Butler Pinkerton Model can be a useful procedure for the valuation analyst when estimating the company-specific equity risk premium to use in the valuation of a privately held company. In general, market-derived empirical data, as opposed to subjective judgment, typically adds to the credibility of a valuation analysis prepared for family law purposes.” -- Eric Hamm, Willamette Management Associates in article titled, A New Procedure to Estimate the Company-Specific Equity Risk Premium when Valuing a Closely Held Business Included in the Marital Estate: The Butler Pinkerton Model, published in Willamette Management Associates’ Insights (Special 2008 edition).

- “The basic premise underlying the BPM model is not controversial. When public guideline companies exist, the model provides a good framework from which to analyze and place in context the specific-company risk premium. Access to the model (i.e., the calculator) is priced such that it is affordable to use as appropriate.” -- Bob Duffy, CFA, ASA, Grant Thornton during VPS webinar

- “Using this method poses an important question: how does the analyst determine the appropriate company-specific risk premium to apply? Many practitioners rely solely on intuition and judgment, which is subjective. Some analysts may utilize a factor analysis, which provides a frame-work for thinking about the subject company’s risks, but it is still subjective and does little to provide analytical framework to deal with large, unique risk factors such as the risk of contract termination for Company B. Other analysts may even employ the Butler-Pinkerton model, which is more objective…. “Accounting for Significant Risk in Discounted Cash Flow (DCF) Analyses” -- published in the June/July 2008 edition of the Financial Valuation and Litigation Expert written by -- Todd C. Fries, CFA and J. R. Radcliffe

- “Frankly, it was this analysis (reviewing Forms 10-K, etc.) that gave me the best insight into the characteristics that affect risk in this industry. I don’t believe that you can reasonably assess company specific risk factors without an understanding and analysis of the benchmarks derived from the BPC. I much prefer BPC because it forces me to examine public company data about industry risk factors and value drivers which is available through public filings, press releases, analyst reports, etc. The data is much more comprehensive in nature than the limited data available for private companies. When my damages were presented to the opposing party the case promptly settled in our client’s favor. The model just feels right and is “esthetically pleasing” so to speak to the target audience because it is so market driven.” -- James M. Skorheim, JD, CPA/ABV/CFF, CFE, CVA, CrFA

- “First, we do a significant amount of Fair Value compliance work, and the BPC is a great tool for developing capital costs for hypothetical market participants. We've had general acceptance of this method in audit review, and it's a great time saver. Second, in documenting a decision regarding discounts for lack of marketability, we regularly use QMDM as one of the methods considered. The BPC enables us to develop actual market equity returns for smaller publicly traded companies, providing a lower limit for the expected return input in QMDM.” -- James B. Lurie, CPA/ABV, ASA, CBA, CVA, BVAL, CIR

- “Total beta is a widely accepted measure of risk in situations where investors are not well diversified. The Butler-Pinkerton Calculator is a convenient and flexible tool for quickly arriving at an objective estimate of total beta and the company specific risk premium for a privately held company.” -- Keith Harvey, Ph.D., CFA

- “We believe that the Butler-Pinkerton Calculator is a useful tool for appraisers who want a quantitative way to assess the maximum CSRP. What the Total Beta and calculator computes is the maximum or upper bound for the CSRP. A good appraisal should also use subjective techniques and judgment to determine the appropriate CSRP for the subject company.” -- Vicentiu M. Covrig, Ph.D., CFA andDaniel McConaughy, ASA, Ph.D.

- “The Butler Pinkerton Calculator (BPC) has become an extremely useful tool in our valuation practice. While we primarily use traditional methods for determining the cost of capital, we find BPC’s “total beta concept” to be a very effective means for assessing the reasonableness of cost of equity and company-specific risk estimates of a private company. The BPC’s use of empirical market data from public companies is invaluable when dealing with auditors and triers of fact. -- Lindon A. Greene, CPA/ABV, ASA

- “Whether you use BPC as an integral part of your valuation or as a sanity check, it is a very powerful tool to develop a market-based cost of equity capital.” -- Greg Tesone, ASA