Survey reveals favored BV research sources

An exclusive BVR survey collected data concerning research sources valuation experts rely on most when preparing a defensible valuation report. Experts indicated their preferences for sources of transaction data, risk premiums, discounts (marketability, control, and liquidity), guideline public company analyses, compensation, valuation-related case law, and other information required to support a valuation.

The survey results chronicle the changing scene in research sources. In some cases, favored sources of data have fluctuated, with one source gaining favor over another. An example of this can be found in industry-specific data.

Industry data: Sources for industry-specific data and risk have increased over the years as appraisers recognize how important—and conclusive—a thorough analysis can be. While RMA continues to be a widely used industry research source (used by 48% of respondents), IBISWorld has emerged as the most cited source in this year’s survey. Used by 57% of respondents, the service is pricey, but it gives you an assessment of three dimensions of risk: industry (structural), performance (growth), and economic forces (sensitivity) risk. IBIS uses a measuring system that assigns weights and comes up with a mathematical computation to determine whether the company has low, medium, or high risk.

The survey finds, however, that a good number of appraisers do not use commercially available industry research databases. Instead, they rely on materials from trade associations, their own experience, or other sources, such as 10-K filings, analysts' reports, and academic studies.

About 170 BV firms, sole practitioners, CPA firms, and other entities with business valuation practices responded to BVR’s Firm Economics Survey conducted this past summer. The survey examines BV firm performance, compensation, billing rates, marketing and practice development, and more. Responses are being analyzed, and a full report will be available soon.

More survey results will be available in the October issue of Business Valuation Update.

back to top

ASA issues talking points to help

fight 2704 regs

The American Society of Appraisers has issued some talking points and a letter template to use to help communicate opposition to the proposed IRS Section 2704 regulations, particularly to members of Congress. The controversial regs have sparked a firestorm of protest from valuation experts, attorneys, wealth planners, and family business owners (most recent BVWire coverage is here).

Comments matter: The ASA’s talking points are designed to be used when speaking with members of Congress, especially those on the Senate Finance Committee or House Ways & Means, which have oversight of the IRS. To access the talking points document, click here. The letter template raises the most critical points against the proposed regulations, and it’s available if you click here. In a news release, the ASA says: “Feel free to augment any arguments with your own experience as it relates to valuing these kinds of interests and the businesses typically involved.”

So far, the IRS has received over 80 written comments (due November 2), many from family business owners. This is important because it should not just be the valuation community or wealth planners making comments. Observers agree that the impact to family businesses could be devastating, forcing them to take on debt or delay capital investments or hiring in order to pay the increased tax bill.

Support is growing in Congress to quash the proposed regs, but this momentum needs to gain more steam. In the House, Republicans have introduced two bills, H.R. 6042 and H.R. 6100, to nullify the proposed regs. In the Senate, members of the Senate Finance Committee (which has oversight authority over the Treasury and IRS) are among those who have sent a letter to Treasury Secretary Jacob Lew requesting that the proposed regs be withdrawn. There is also a Senate companion bill (S. 3436).

back to top

Know the difference between proving fact of damage and amount

An economic damages case sets out the different standard of proof that applies in tort actions for showing there were lost profits as opposed to quantifying the loss. Knowledge of the applicable burden of proof is a cornerstone of a successful damages analysis.

Certainty vs. approximation: The plaintiff, a national transportation company, sued the defendant, which owned websites that advertised open driver positions, after it found out the defendant kept using the plaintiff’s information without the plaintiff’s authorization. Drivers who were unaware of the broken down relationship between the parties kept applying, but the defendant discarded their applications.

The plaintiff claimed trademark infringement, unfair competition, unauthorized use of identifying information, and tortious interference with prospective contractual relationships. Its damages theory was that, by withholding over 5,000 applications from drivers, the defendant deprived the plaintiff of knowledge about drivers seeking work at a time of driver shortage. Historically, the plaintiff hired a certain percentage of applicants. Instead, it ended up turning down jobs that additional hires could have performed. It suffered some $4 million in lost profits.

The jury awarded $1.25 million in actual damages, which the court reduced to $500,000. In post-trial motions, the defendant argued the award was based on speculation. In tort actions, case law distinguishes “between proving the fact of damage and the amount,” the court explained. The fact of damage must be proved to a certainty, whereas the amount need only be a “reasonable approximation.” Here, the defendant seemed unclear about the difference, but the court read its briefs to argue the plaintiff did not show the defendant’s conduct caused any losses. The court disagreed.

Even if it “is not necessarily believable” that all 5,000-plus applicants to the defendant’s websites would have applied to the plaintiff directly or through some other job board had they been aware of the defendant’s misconduct, some of them would have, the court said. Given the plaintiff’s hiring record and the driver shortage, it was reasonable for the jury to infer some applicants would have been hired. Drivers meant jobs meant profit, the court said.

The case is Marten Transp., Ltd. v. Plattform Adver., Inc., 2016 U.S. Dist. LEXIS 97754 (July 26, 2016). A case digest and the court’s opinion will be available at BVLaw.

back to top

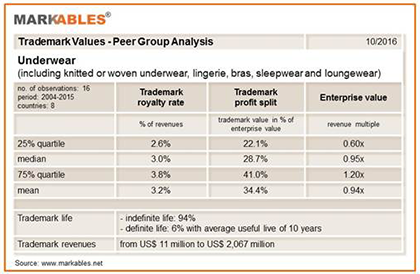

Insights into valuation of underwear brands

The underwear sector is a perfect example of market-based third-party royalty rates for trademarks often not fitting into a valuation for long-term ownership. Although often nonpublished, typical trademark royalty rates for underwear (includes woven bras, lingerie, and sleepwear) range between 5% and 12% depending on the brand. However, such royalty rates are often too high to pass the profit split test in business combinations. Underwear is a mature industry showing rather low profitability, growth prospects, and purchase price multiples.

Mentionables: A peer group analysis by MARKABLES for underwear finds average sales to enterprise value ratios of little less than 1.0x (see chart below). Underwear trademarks account for approximately 30% of enterprise value. This translates into average royalty rates for underwear trademarks of about 3% on revenues, considerably lower than typical royalty rates signed in license agreements. Valuing underwear trademarks at market-based royalty rates and indefinite lives would throw a purchase price allocation way out of whack.

There are two key findings here. First, a licensee of a brand or trademark may pay a high price (royalty rate) in a low-risk (short-term, ancillary business) setting that the licensee could not afford and would not accept in the long run. In other words, arm’s-length royalty rates tend to overstate the long-term value of an asset calculated at full cost and risk. And second, the relief-from-royalty method based on comparable uncontrolled transactions must pass a profitability (or profit split) check to avoid overstatement of value.

MARKABLES (Switzerland) has a database of over 8,200 global trademark valuations published in financial reporting documents of listed companies.

(Click image to view full size)

back to top

Global BV News

Bright outlook for BV in Malaysia

Over 160 valuation practitioners from six continents shared valuation developments in their countries during the IACVA 2016 Malaysia International Business Valuation Conference in Kuala Lampur. BVR was happy to be involved with this conference, which brought together appraisers from Africa, Asia, Australia/Oceania, Europe, North America, and South America to present insights on business valuation theories and practices in today’s global economy.

Significant growth: The conference opened with remarks by Malaysia’s deputy minister of finance, Dato’ Othman Bin Aziz, who discussed the importance of business valuation to the Malaysian economy. He said that the Malaysian Ministry of Finance wants to increase the number of ICVS professionals from the current 39 to 1,500 over the next 10 years. He discussed how business valuation skills have become indispensable in the economic crossroads of Malaysia, and his bright outlook for the future of BV in Malaysia drew an enthusiastic response from the attendees.

For more on the conference, click here. Next year’s International IACVA Conference will be in Shenzhen China during September 2017 or October 2017.

back to top

|

Want to make an impact on worldwide BV education?

BVR is now taking applications for its new Training Council. These select individuals will help shape BVR’s educational training program for valuation experts around the world. As a member of the council, you will help determine the topics, people, and controversies that are most important to the profession. Council members will serve a one-year term, during which time you will participate in regular planning calls and help select top-tier experts as well as up-and-coming thought leaders. Council members will be expected to be current with new regulations, court cases, and new methods and will be required to engage in one speaking engagement (as expert or moderator) during their term. Also, during your term, you will have complimentary access to all BVR training events via a Training Passport Pro (a $1,799 value).

If you would like to join BVR’s Training Council, please complete this short application.

back to top

BVWire heading to AICPA FVS conference

BVWire looks forward to attending the AICPA Forensic & Valuation Services Conference 2016 in Nashville, Tenn., on November 6-8. Reflecting the current trends in the valuation profession, the AICPA has added several new tracks to this year’s event: (1) Fair Value Measurements; (2) Trending Now FVS; and (3) Specialized Skills. There will also be a Family Law learning path and a special educational program for up-and-comers called the NextGen FVS Professionals Program, tailored to individuals with fewer than five years of BV or forensic accounting experience. The NextGen program is designed to help junior members of a firm develop core competencies, such as professional development, steps to building credibility, fostering relationships, case management, communications, and more.

Please stop by the BVR booth and say hello! For details and to register, click here.

back to top

BV movers . . .

People: Jim Anderson, principal at the Phoenix firm James R. Anderson, CPA, PC Business Valuation & Litigation Support Services, has been appointed to a four-year term as a public member of the Board of Legal Specialization of the State Bar of Arizona … Kari Ritz Thiessen, who leads the transfer pricing practice area for the Denver-based EKS&H, was admitted as partner.

Firms: In a move to gain some traction in the California market, Dixon Hughes Goodman is adding Parke, Guptill & Co., an Ontario-based firm that provides assurance, tax, and advisory services in Southern California to automobile dealerships … The Fargo, N.D.-based Eide Bailly is growing its Arizona presence with the acquisition of the Scottsdale firm Rauch, Hermanson, Everroad & Rentschler on Oct. 31, 2016 … The Kansas firms Hiebert & Decker, CPAs and Adams, Brown, Beran & Ball are merging effective Nov. 1, 2016.

Please send your professional and firm news to us at editor@bvresources.com.

back to top

Upcoming CPE events

Valuing Trained and Assembled Workforces in Healthcare Provider Entities: A Deep Dive (October 13), with Timothy Smith and Angie Smith. This is Part 6 of BVR's Special Series presented by the BVR/AHLA Guide to Healthcare Industry Finance and Valuation.

Premiums: Are You In or Out of Control? (October 18), with James Ewart (Dixon Hughes Goodman) and R. James Alerding (Alerding Consulting LLC).

Projecting But-For Profits (October 20), with Stacey Udell (Gold Gerstein Group). Part 6 of BVR's Special Series presented by The Comprehensive Guide to Economic Damages.

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden (Executive Legal Editor) at:

info@bvresources.com. |