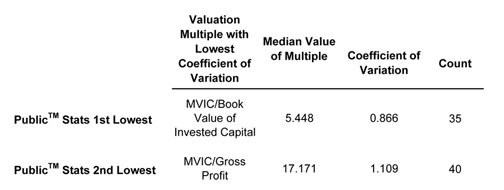

Court of Appeals overturns McCord Last week, the Fifth Circuit Court of Appeals overturned McCord v. Commissioner (2003), easily one of the most controversial tax court cases in valuation lore. Most analysts cite the 117-page McCord for its determination of lack of marketability discounts, where—in a splintered majority, with dissents by Judge Laro among others—the Tax Court rejected the taxpayer’s restricted stock analysis, conducted by William Frazier, ASA (HFBE, Houston), and endorsed the criticism of pre-IPO studies by Dr. Mukesh Bajaj. Immediately after the issuance of the original opinion, the Business Valuation Update™ critiqued the Tax Court’s calculation and conclusions regarding marketability discounts; in an editorial opinion, Shannon Pratt (Shannon Pratt Valuations, Portland, OR) hoped that the appeal would set the record straight. Pratt also recognized that the legal issues generated as much or more controversy as the valuation issues—and indeed, the 5th Circuit focuses more on public policy and other arguments to uphold the “defined value gift clause.” The legal pundits and BV professionals have yet to register the full impact of the McCord overturn; their reactions are just starting to come in. To formulate your own, read the full-text of the 5th Circuit opinion here. Everything the courts have ever said about marketability discountsThe McCord case highlights why it’s so critical to remain current on all court decisions regarding discounts for lack of marketability (DLOM). Given the legal basis for McCord’s overthrow, the Tax Court will still continue to question the validity of published stock data; and the IRS continues its aggressive campaign against marketability discounts. Experts agree that to successfully defend a DLOM calculation these days, you’ve got to know your DLOM law. That’s where this latest resource becomes indispensable: BVR’s Guide to DLOM Case Law, 2006 Edition contains abstracts of nearly 200 court cases, including such landmark decisions as Mandelbaum v. Commissioner (1995)—in which the Tax Court listed nine discrete factors for determining DLOM—and subsequent cases where the courts (and attorneys and analysts) attempted to apply the factors to specific companies. For a free copy of the Mandelbaum abstract, click here. “Because lack of marketability discounts are determined on a case-by-case basis,” says Shannon Pratt, “I recommend this current, one-stop resource whenever you have to calculate a DLOM.” For your copy, plus a searchable CD and annual updates, click here. U.S. pharmaceuticals offer case study in benchmarking value For the past several financial quarters, European drug companies have posted higher profit margins than their U.S. Counterparts—until now. Second quarter 2006 financial results (from a Chemical & Engineering News survey) show that U.S. pharmaceutical companies have finally pulled ahead, improving their profit margins to 22.4% compared with 22.0% for European companies. That got us thinking: What valuation multiples for public pharmaceutical companies (SIC code 2834) have the lowest coefficient of variation, and thus, might be better predictors of value? We analyzed the Public Stats™ database for valuation multiples from sales of public pharmaceutical companies. The results appear below. To learn more about these databases, visit www.BVMarketData.com.

Tremendous advances have taken place in the area of adjusting multiples from public company comparables for use in the guideline company method. As reported in the latest (September) issue of the Business Valuation Update™, the ASA has recently incorporated these modifications into its ASA Standards Guidance as well as its BV201N and BV203N course materials. New research has led to improvements in the Mercer Methodology as well as the more traditional models in the BV “Bible”: Valuing a Business, by Pratt, Reilly, and Schweihs (fifth edition to be released early next year). To stay on top of all the changes, register for Adjusting Multiples from Guideline Public Companies, BVR’s next telephone conference on August 31, 2006, moderated by Shannon Pratt and featuring “real life” case studies by Alina Niculita, CFA (Shannon Pratt Valuations); and Tim Lee (Mercer Capital). To register, click here. Billionaire muckraker bashes BV Mark Cuban—who became a billionaire by selling his Broadcast.com to Yahoo!—has now dedicated a new website, Sharesleuth.com, to “exposing securities fraud and corporate chicanery.” Cuban, also the owner of the NBA’s Dallas Mavericks, partnered with a seasoned business reporter to “[dig] through the muck and rot in the lower trenches of the stock market.” Their stated goal: to root out the investment opportunities that are “not what they seem,” and reveal the companies that are the “creation of predators and pretenders.” In the post-Enron and -Worldcom era, perhaps the business world could use a new watchdog. But, “unlike some investment sites,” say the corporate sleuths, “we won’t base our reports on intensive financial and technical analysis,” such as trailing EBITDA and discounted cash flows. Instead, in a recent MSN.com article, Cuban actively encourages investors to ignore valuation analysis, saying that the process of trying to figure out what a company’s really worth is no more than “laughable filler.” (Click here for the full article.) Cuban’s muckraking may also be mercenary, as he admittedly plans to short the stocks that Sharesleuth.com exposes. Does the end justify the means? Contrast Cuban’s latest venture to those of another billionaire business mogul, Warren Buffett, who—as the MSN.com piece points out, “looks at valuation exclusively and has done extraordinarily well.” FASB ‘fair value champion’ announces early retirement Edward Trott officially gave notice last week that he will be cutting short his second term on FASB’s board, planning to retire in June of next year rather than in 2009, as his five-year stint would otherwise dictate. The former KPMG partner turned “fair value champion” according to CFO.com, will dedicate the remainder of his time on FASB’s board to issuing a fair-value measurement document “that will solidify a single definition of fair value and provide a general framework for making fair-value measurements.” For the full-text article, go to CFO.com. Value enhancement: Opportunities in the private equity market “Facing high valuations, growing competition and mounting pressure from limited partners, private equity firms are seeking non-traditional strategies to achieve more predictable returns,” according to a recent article at Bank of America’s Business Capital site. In addition to partnering with established companies, “many private equity firms are also looking to operational-oriented strategies as a way to enhance” portfolio returns. For example, powerhouse Kohlberg Kravis Roberts & Co. recently hired a former chief executive officer of a major electronics manufacturer to provide “hands-on” operational expertise. But smaller PE firms are now turning to outside professional advisors to ask questions that get at the heart of company operations, such as: Are systems and controls working optimally? What are the strengths/weaknesses of middle management? Do service delivery and production capabilities support financial projections? Sounds like a job for seasoned business appraisers, for whom value enhancement is still perhaps the greatest under-appreciated aspect of valuation knowledge. To ensure this email is delivered to your inbox, Copyright © 2006 by Business Valuation Resources, LLC Business

Valuation Resources, LLC | 7412 SW Beaverton Hillsdale Hwy., Ste. 106 |

Portland, OR 97225 | (503) 291-7963

|